AFN Stock Fair Value – Raymond James Drops Q3 2023 Earnings Estimates for Ag Growth International

May 22, 2023

Trending News ☀️

Raymond James’ equities researchers recently decreased their Q3 2023 earnings per share estimates for Ag Growth International ($TSX:AFN) Inc. (AGI). AGI is a company that specializes in manufacturing and marketing of grain handling, storage and conditioning equipment. The company has also branched out into othe rproducts such as livestock feeders and auger systems. It is headquartered in Winnipeg, Manitoba, and has operations in the United States and Europe. The Raymond James’ team cited lower-than-expected farm income levels as their primary reason for reducing the estimated earnings of AGI.

This is concerning news for investors as the company heavily relies on the agricultural market for much of its revenue. The company stated that the COVID-19 crisis has had a negative impact on their operations and has caused an overall decrease in demand for their products. The lowered forecast for Q3 2023 could be an indicator of further weak performance. Investors should keep an eye on AGI’s upcoming earnings results to see if the company can overcome this current period of difficulty and return to growth.

Earnings

Raymond James recently dropped their Q3 2023 earnings estimates for Ag Growth International Inc. In their FY2023 Q1 earnings report ending March 31 2023, AG GROWTH INTERNATIONAL earned 347.02M CAD in total revenue and 16.36M CAD in net income indicating an 18.8% increase in total revenue and a 7.8% increase in net income compared to the previous year. This marks the third consecutive year of AG GROWTH INTERNATIONAL’s total revenue growth, as it has risen from 253.7M CAD to 347.02M CAD in the last 3 years.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AFN. More…

| Total Revenues | Net Income | Net Margin |

| 1.51k | -49.4 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AFN. More…

| Operations | Investing | Financing |

| 145.2 | -53.77 | -78.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AFN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.66k | 1.38k | 14.84 |

Key Ratios Snapshot

Some of the financial key ratios for AFN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 31.8% | 1.5% |

| FCF Margin | ROE | ROA |

| 5.8% | 5.2% | 0.9% |

Stock Price

On Tuesday, the stock of Ag Growth International Inc. (AGI) opened at CA$52.9 and closed at CA$51.9, down by 2.4% from its prior closing price of CA$53.2. This drop came after Raymond James lowered its earnings estimates for the company in the third quarter of 2023. Live Quote…

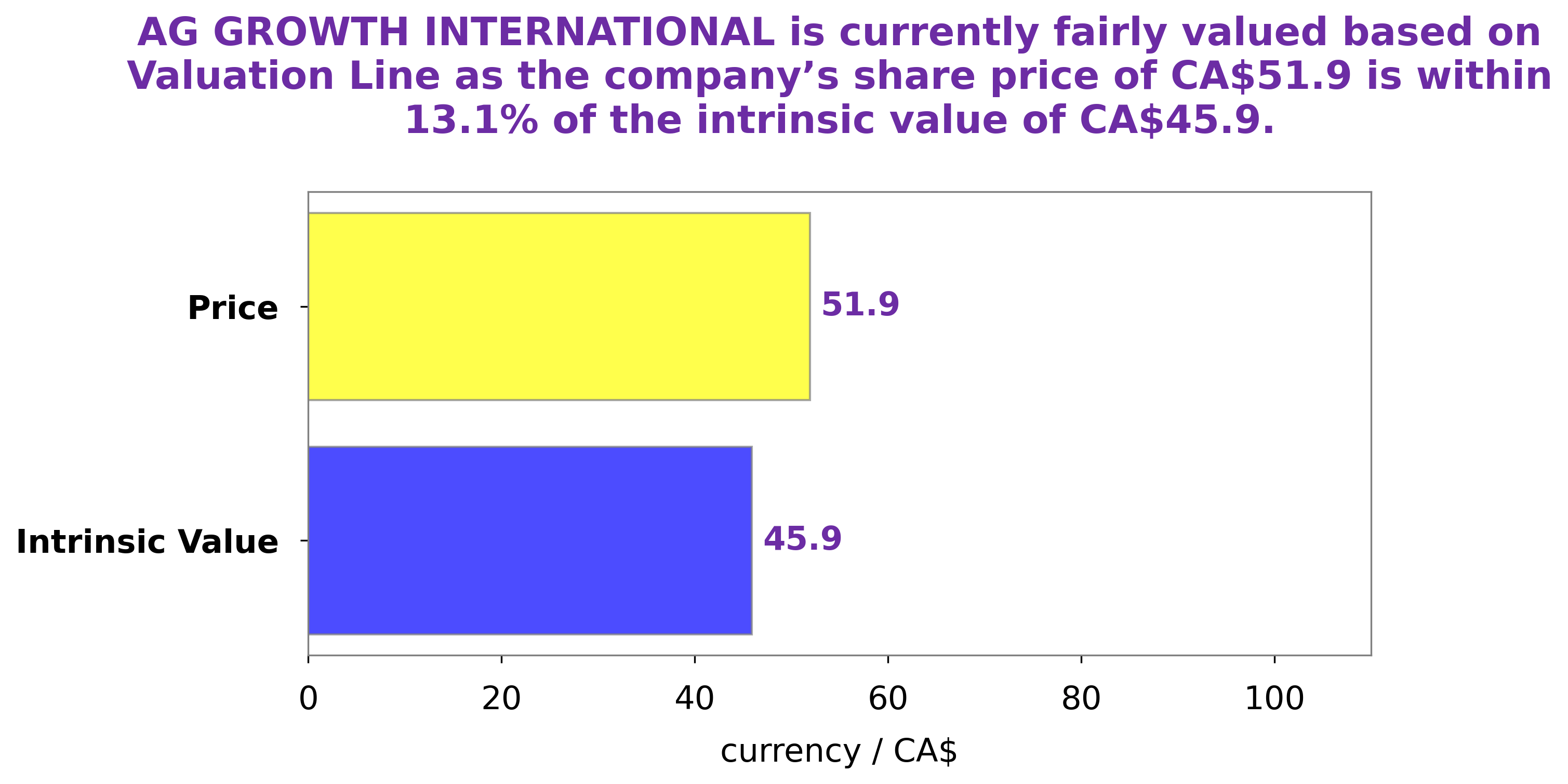

Analysis – AFN Stock Fair Value

At GoodWhale, we have conducted an analysis of AG GROWTH INTERNATIONAL’s wellbeing. The results of this analysis suggest that the fair value of AG GROWTH INTERNATIONAL share is around CA$45.9. This figure has been calculated by our proprietary Valuation Line, which takes into account factors such as the company’s current performance, expected future growth, and overall risk profile. This suggests that investors may not be properly accounting for the company’s risk profile. As such, it is possible that the current stock price may be unsustainable in the long-term. More…

Peers

Its main competitors are Buhler Industries Inc, Titan International Inc, Hammond Power Solutions Inc.

– Buhler Industries Inc ($TSX:BUI)

Buhler Industries Inc is a Canadian company that manufactures and distributes agricultural equipment. The company has a market cap of 42.75 million as of 2022 and a return on equity of 12.01%. The company’s products include tractors, combines, and other farm equipment.

– Titan International Inc ($NYSE:TWI)

Titan International, Inc. is a holding company, which engages in the manufacture and sale of wheels, tires, and undercarriage systems and components for off-highway vehicles used in agricultural, earthmoving/construction, and consumer applications. It operates through the following segments: Agricultural, Earthmoving/Construction, and Consumer. The Agricultural segment manufactures and sells products for agricultural equipment applications. The Earthmoving/Construction segment manufactures and sells products for construction equipment applications. The Consumer segment manufactures and sells products for all-terrain vehicles, motorcycles, and other consumer applications. The company was founded by Maurice J. Taylor, Sr. in 1900 and is headquartered in Quincy, IL.

– Hammond Power Solutions Inc ($TSX:HPS.A)

Hammond Power Solutions Inc is a leading manufacturer of electrical power transformers in North America. The company has a market cap of 202.38M as of 2022 and a Return on Equity of 15.26%. Hammond Power Solutions Inc is a publicly traded company on the Toronto Stock Exchange (TSX: HPS.A). The company was founded in 1917 and is headquartered in Guelph, Ontario, Canada. Hammond Power Solutions Inc designs, manufactures and markets a broad range of standard and specialized electrical transformers, which are used in the generation, transmission, distribution, industrial and utility sectors. The company’s products are sold through a network of independent distributors and representatives, as well as direct to original equipment manufacturers and end-users.

Summary

Ag Growth International Inc. (AGI) is a publicly traded Canadian grain handling and storage company that provides quality products and services to the agricultural industry. Recent investment analysis suggests that there could be some risks for the company in the next quarter. Equities researchers from Raymond James recently dropped their Q3 2023 earnings per share estimates for AGI due to the changing market conditions and volatility. Investors should be aware of these risks and monitor AGI closely in the coming months as they may face further financial challenges.

Analysts recommend that investors should diversify their portfolios to mitigate potential losses and focus on long term growth. It is important to keep in mind that AGI has a strong track record of success, and further research should be conducted in order to make a well-informed investment decision.

Recent Posts