Warner Music Intrinsic Value Calculation – Warner Music Group Corp. Stock Prices Drop 0.71% in Last 52 Weeks Closing at $25.21

May 28, 2023

Trending News 🌧️

The Warner Music ($NASDAQ:WMG) Group Corp. experienced a slight downtick in stock prices over the past 52 weeks as their closing price of $25.21 on this day represented a -0.71% change from $25.39 the previous week. This drop in prices has slightly impacted investors as Warner Music Group Corp. is an immensely popular American entertainment and record label company that operates through a global network of affiliates and subsidiaries. It encompasses some of the most prolific and beloved record labels, artists, and songwriters in the music business, making it a reliable source for quality music. As such, there is still confidence in its future prospects.

Analysis – Warner Music Intrinsic Value Calculation

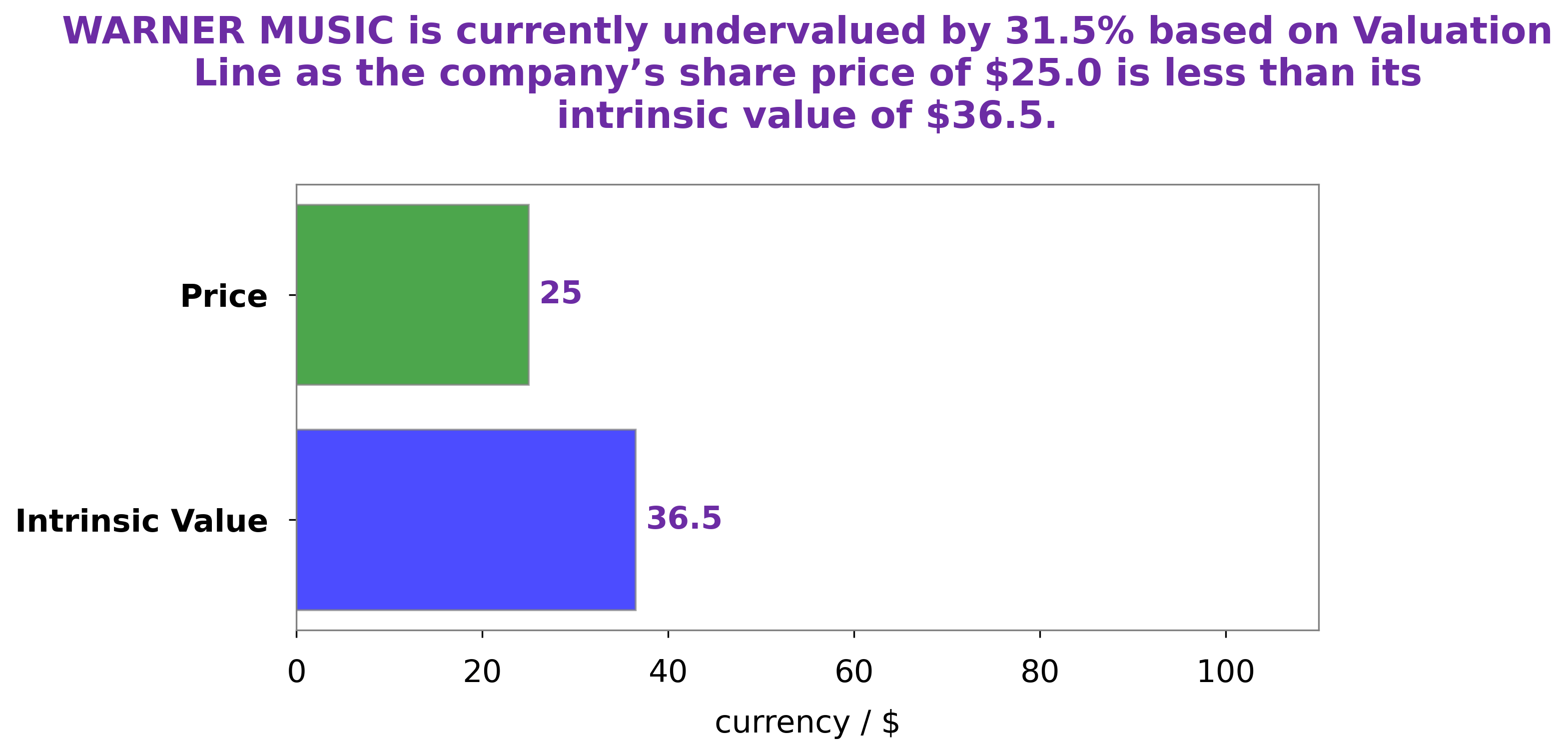

GoodWhale recently conducted an analysis of WARNER MUSIC‘s fundamentals in order to determine the intrinsic value of the company’s shares. After extensive research, our proprietary Valuation Line determined that the intrinsic value of each WARNER MUSIC share is around $36.5. Given that WARNER MUSIC shares are currently trading at $25.0, we conclude that they are undervalued by 31.5%. We believe this presents a great opportunity for investors to acquire WARNER MUSIC shares at a discount, as the company has strong fundamentals and potential for growth. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Warner Music. More…

| Total Revenues | Net Income | Net Margin |

| 5.82k | 428 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Warner Music. More…

| Operations | Investing | Financing |

| 772 | -226 | -318 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Warner Music. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.01k | 7.74k | 0.49 |

Key Ratios Snapshot

Some of the financial key ratios for Warner Music are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.9% | 50.9% | 12.2% |

| FCF Margin | ROE | ROA |

| 10.0% | 170.3% | 5.5% |

Peers

The company operates through three segments: Recorded Music, Music Publishing, and Live Entertainment. The Recorded Music segment consists of recorded music labels and distribution companies. The Music Publishing segment consists of music publishing companies. The Live Entertainment segment consists of live music promoters, artist management companies, and e-commerce businesses. The company’s competitors include Universal Music Group NV, Live Nation Entertainment Inc, Boat Rocker Media Inc.

– Universal Music Group NV ($OTCPK:UMGNF)

As of 2022, Universal Music Group has a market capitalization of 33.37 billion dollars and a return on equity of 23.73%. Universal Music Group is a French-owned multinational music corporation that is the largest of the “big three” record companies in the world. The company produces and distributes recorded music through a network of subsidiaries and affiliates, and also engages in music publishing and merchandising. Universal Music Group owns the world’s largest music catalogue, which includes the works of some of the most popular and influential artists of all time. The company’s artists include Drake, Taylor Swift, Kendrick Lamar, and Lady Gaga.

– Live Nation Entertainment Inc ($NYSE:LYV)

Live Nation Entertainment Inc is a global entertainment company that operates in the concert, ticketing, and artist management businesses. The company has a market cap of 18.14B as of 2022 and a Return on Equity of -55.8%. Live Nation is the largest concert promoter in the world and also owns and operates Ticketmaster, the largest ticketing company in the world. The company also owns a number of music festivals, including Lollapalooza and Bonnaroo.

– Boat Rocker Media Inc ($TSX:BRMI)

Boat Rocker Media Inc is a Canadian entertainment company with a market cap of 151.91M as of 2022. The company focuses on the production and distribution of television, film, digital content, and live entertainment. Some of its notable productions include Orphan Black, The Amazing Race Canada, and Lost in Space. The company has a ROE of 1.14%.

Summary

Investing in Warner Music Group Corp. can prove to be a good decision for investors looking to diversify their portfolio. Investors should also take into consideration the company’s strong presence in both the physical and digital music markets, as well as its strategic investments in Sync and Master recordings. Given its financial strength and potential for long-term growth, Warner Music Group Corp. is a good option for investors looking for a reliable stock.

Recent Posts