Walt Disney Stock Fair Value – Disney Fights Back Against DeSantis with Expansion of Legal Suit

May 10, 2023

Trending News 🌧️

The Walt Disney ($NYSE:DIS) Company is a media and entertainment conglomerate known across the world for its beloved films, TV shows, theme parks, and merchandise. Recently, the company has been in the news for its legal battle against Florida Governor Ron DeSantis. Disney has taken legal action against DeSantis following his decision to sign a bill that invalidates its agreements which required Disney to pay its employees a higher minimum wage. Disney argued that the new law unfairly strips workers of the wages and benefits that were agreed upon in their contracts. In response to Disney’s lawsuit, the governor said the company was attempting to “strong-arm” Florida lawmakers into providing special treatment.

The company is seeking an injunction to block the law from taking effect and has accused DeSantis of interfering with its collective bargaining rights. Disney’s legal challenge comes at a precarious time for both the company and the state of Florida. With tensions rising between Disney and the state, it remains to be seen how this legal battle will be resolved.

Price History

On Monday, WALT DISNEY stock opened at $101.7 and closed at $103.0, up by 2.4% from previous closing price of 100.5. The company has responded by expanding its legal suit against the Governor, citing concerns that the executive order limits the ability of employers to protect their employees and workplaces from the virus. WALT DISNEY has cited the health and safety of its employees and patrons as a top priority and expressed its commitment to following the scientific advice of medical experts in order to protect the community. The company’s stock closing price of $103.0 is reflective of its determination to pursue justice and ensure its workers are safe. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walt Disney. More…

| Total Revenues | Net Income | Net Margin |

| 84.42k | 3.32k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walt Disney. More…

| Operations | Investing | Financing |

| 5.24k | -5.31k | -5.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walt Disney. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 202.12k | 93.25k | 52.63 |

Key Ratios Snapshot

Some of the financial key ratios for Walt Disney are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -16.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 0.1% | 4.6% | 2.2% |

Analysis – Walt Disney Stock Fair Value

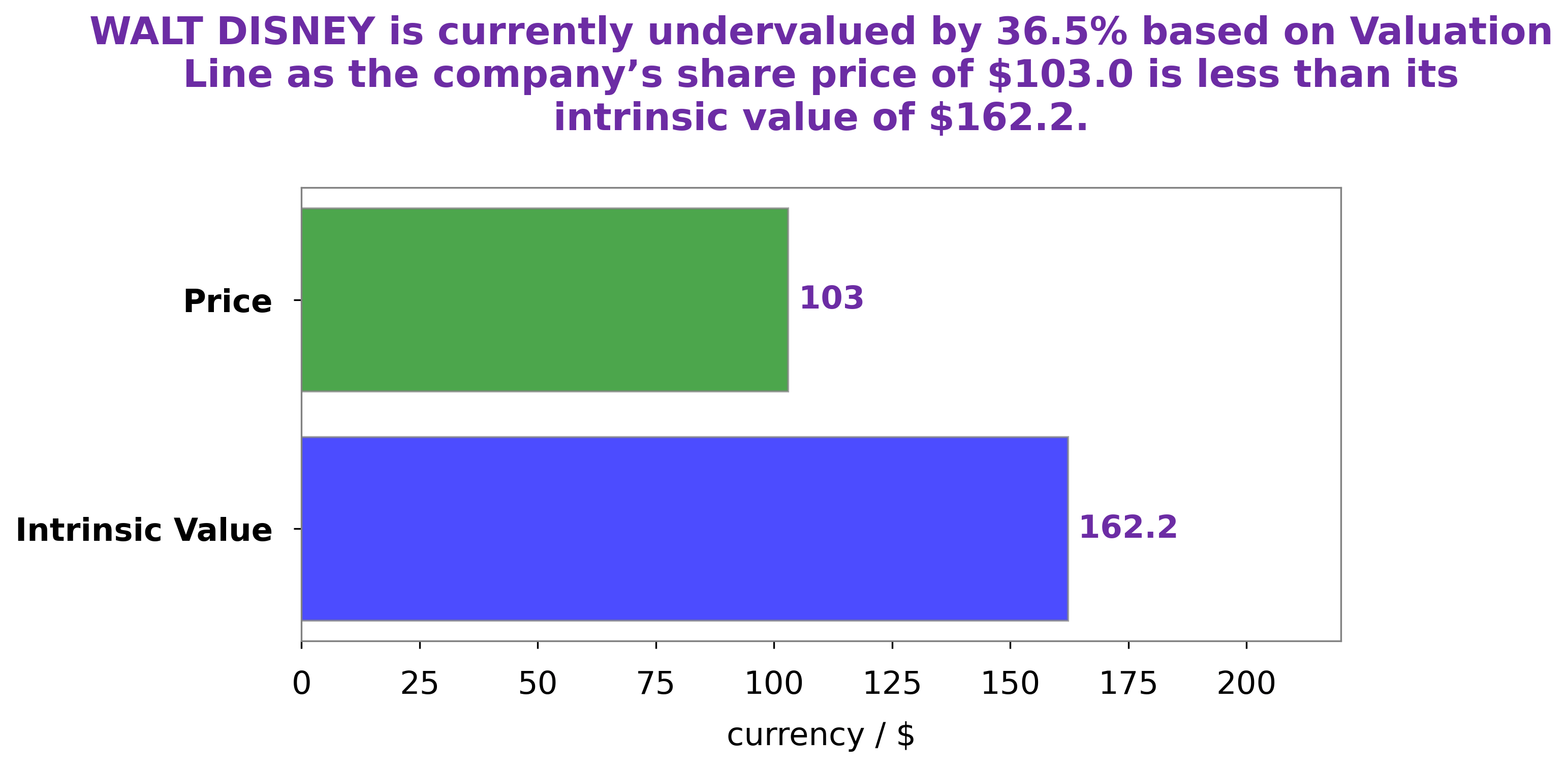

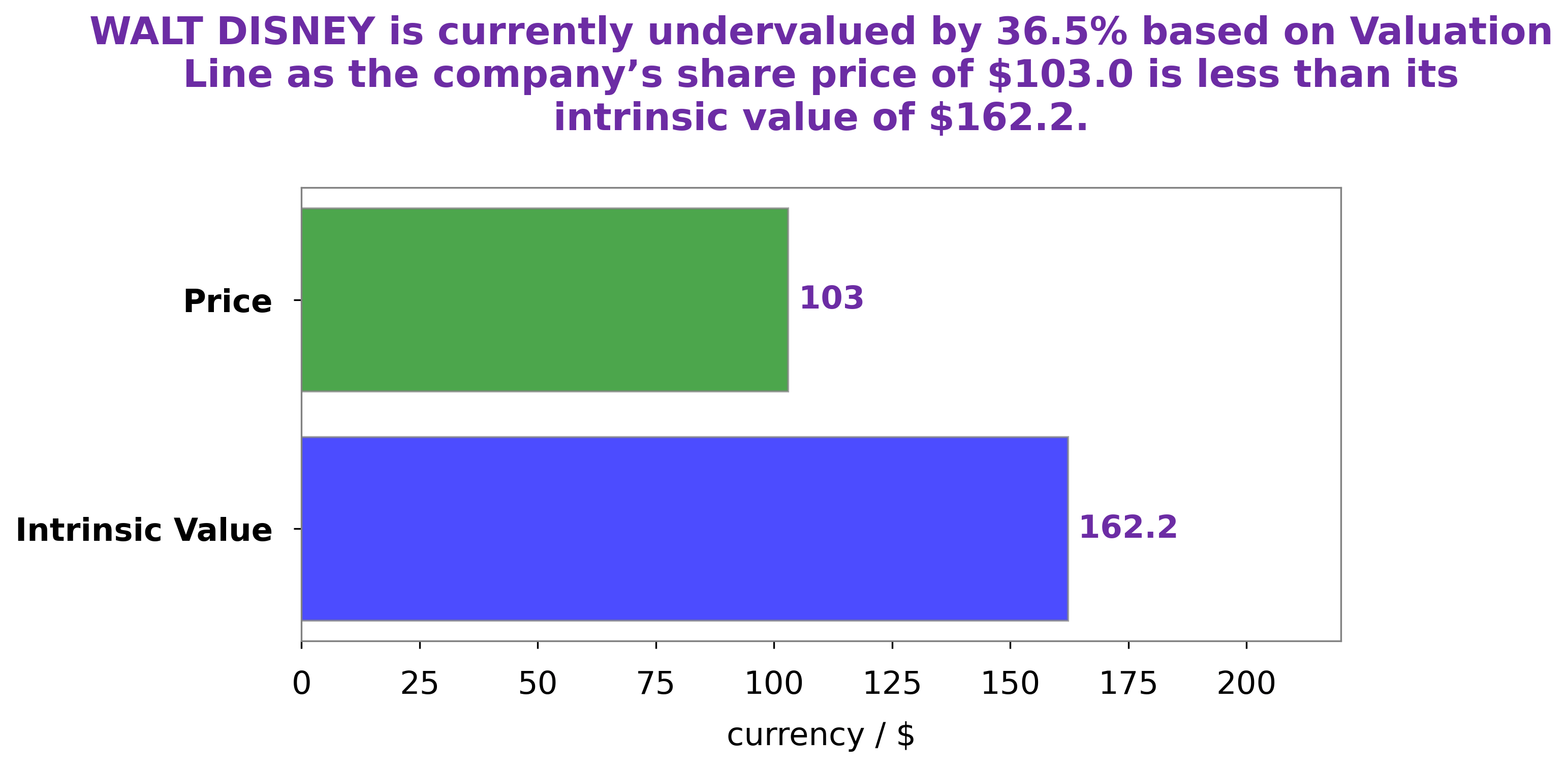

We at GoodWhale recently conducted an analysis of WALT DISNEY‘s wellbeing. After carefully studying their financials and using our proprietary Valuation Line, we determined that the intrinsic value of WALT DISNEY share is around $162.2. This means that right now, WALT DISNEY stock is being traded at $103.0, which indicates that it is undervalued by 36.5%. We believe that this could be a great opportunity for potential investors to take advantage of the current market situation. More…

Peers

The Walt Disney Co is the largest entertainment company in the world. It operates in four business segments: media networks, parks and resorts, studio entertainment, and consumer products. The company has a wide array of competitors, including Netflix Inc, Paramount Global, Warner Bros.Discovery Inc, and many others.

– Netflix Inc ($NASDAQ:NFLX)

Netflix is a streaming service for movies and TV shows. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.64B as of 2022, a Return on Equity of 18.54%. The company is a leading provider of global insurance and reinsurance solutions. It offers a broad range of products and services to meet the needs of its clients.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery, Inc. is a global media and entertainment company that operates a portfolio of cable television networks and produces original content for a variety of platforms. The company operates in over 220 countries and territories and reaches nearly 3 billion people around the world. Discovery’s primary businesses include Discovery Channel, Animal Planet, Science Channel, Investigation Discovery, TLC, OWN: Oprah Winfrey Network, Velocity, Travel Channel, Food Network, Cooking Channel, and HGTV. The company also operates Eurosport, Discovery Kids, Discovery Family, and Discovery Turbo. In addition to its cable networks, Discovery also owns and operates digital media properties, including Discovery Digital Networks, Seeker Network, and TestTube.

Summary

Walt Disney has been investing in various projects recently. The company filed a lawsuit against Florida Governor Ron DeSantis after he signed a bill that would void its existing deals with the state. Disney is said to be seeking damages for the losses it has incurred, which could potentially affect its share price. Analysts are closely monitoring the situation and investors should be aware of any developments that could impact Disney’s stock performance.

In addition, investors should be mindful of any changes in the company’s overall strategy, as well as its competitive position in the industry. It is important to stay up-to-date on the latest news and developments concerning Disney and its investments.

Recent Posts

Walt Disney Stock Fair Value – Disney Fights Back Against DeSantis with Expansion of Legal Suit

May 10, 2023

Trending News 🌧️

The Walt Disney ($NYSE:DIS) Company is a media and entertainment conglomerate known across the world for its beloved films, TV shows, theme parks, and merchandise. Recently, the company has been in the news for its legal battle against Florida Governor Ron DeSantis. Disney has taken legal action against DeSantis following his decision to sign a bill that invalidates its agreements which required Disney to pay its employees a higher minimum wage. Disney argued that the new law unfairly strips workers of the wages and benefits that were agreed upon in their contracts. In response to Disney’s lawsuit, the governor said the company was attempting to “strong-arm” Florida lawmakers into providing special treatment.

The company is seeking an injunction to block the law from taking effect and has accused DeSantis of interfering with its collective bargaining rights. Disney’s legal challenge comes at a precarious time for both the company and the state of Florida. With tensions rising between Disney and the state, it remains to be seen how this legal battle will be resolved.

Price History

On Monday, WALT DISNEY stock opened at $101.7 and closed at $103.0, up by 2.4% from previous closing price of 100.5. The company has responded by expanding its legal suit against the Governor, citing concerns that the executive order limits the ability of employers to protect their employees and workplaces from the virus. WALT DISNEY has cited the health and safety of its employees and patrons as a top priority and expressed its commitment to following the scientific advice of medical experts in order to protect the community. The company’s stock closing price of $103.0 is reflective of its determination to pursue justice and ensure its workers are safe. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walt Disney. More…

| Total Revenues | Net Income | Net Margin |

| 84.42k | 3.32k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walt Disney. More…

| Operations | Investing | Financing |

| 5.24k | -5.31k | -5.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walt Disney. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 202.12k | 93.25k | 52.63 |

Key Ratios Snapshot

Some of the financial key ratios for Walt Disney are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -16.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 0.1% | 4.6% | 2.2% |

Analysis – Walt Disney Stock Fair Value

We at GoodWhale recently conducted an analysis of WALT DISNEY‘s wellbeing. After carefully studying their financials and using our proprietary Valuation Line, we determined that the intrinsic value of WALT DISNEY share is around $162.2. This means that right now, WALT DISNEY stock is being traded at $103.0, which indicates that it is undervalued by 36.5%. We believe that this could be a great opportunity for potential investors to take advantage of the current market situation. More…

Peers

The Walt Disney Co is the largest entertainment company in the world. It operates in four business segments: media networks, parks and resorts, studio entertainment, and consumer products. The company has a wide array of competitors, including Netflix Inc, Paramount Global, Warner Bros.Discovery Inc, and many others.

– Netflix Inc ($NASDAQ:NFLX)

Netflix is a streaming service for movies and TV shows. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.64B as of 2022, a Return on Equity of 18.54%. The company is a leading provider of global insurance and reinsurance solutions. It offers a broad range of products and services to meet the needs of its clients.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery, Inc. is a global media and entertainment company that operates a portfolio of cable television networks and produces original content for a variety of platforms. The company operates in over 220 countries and territories and reaches nearly 3 billion people around the world. Discovery’s primary businesses include Discovery Channel, Animal Planet, Science Channel, Investigation Discovery, TLC, OWN: Oprah Winfrey Network, Velocity, Travel Channel, Food Network, Cooking Channel, and HGTV. The company also operates Eurosport, Discovery Kids, Discovery Family, and Discovery Turbo. In addition to its cable networks, Discovery also owns and operates digital media properties, including Discovery Digital Networks, Seeker Network, and TestTube.

Summary

Walt Disney has been investing in various projects recently. The company filed a lawsuit against Florida Governor Ron DeSantis after he signed a bill that would void its existing deals with the state. Disney is said to be seeking damages for the losses it has incurred, which could potentially affect its share price. Analysts are closely monitoring the situation and investors should be aware of any developments that could impact Disney’s stock performance.

In addition, investors should be mindful of any changes in the company’s overall strategy, as well as its competitive position in the industry. It is important to stay up-to-date on the latest news and developments concerning Disney and its investments.

Recent Posts