Walt Disney Stock Fair Value Calculator – Florida Gov. DeSantis’ Board Takes on Disney in Legal Dispute Over Oversight

May 2, 2023

Trending News 🌧️

Walt Disney ($NYSE:DIS) Company is an American multinational entertainment and media conglomerate headquartered in Burbank, California. It is one of the world’s largest media conglomerates, as well as the largest entertainment company in terms of revenue. The company is best known for its film production studios, its theme parks, and its many television and retail properties. Recently, Florida Gov. Ron DeSantis’ board has taken on the Walt Disney Company in a legal dispute over oversight. The board is planning to file a counter-suit against Disney, which alleges that the company is violating state oversight laws by refusing to turn over documents to state inspectors. The dispute began when Florida’s Department of Business and Professional Regulation (DBPR) sent a letter to Disney demanding detailed information about its operations. Disney has refused to provide the necessary information, citing concerns about its proprietary business secrets.

The conflict between Disney and the state has been escalating ever since. Disney has argued that it should be exempt from certain oversight regulations due to its size and influence. The state has countered by saying that Disney is not exempt from regulations and must produce the required documents. The board of Gov. DeSantis is now preparing to take legal action in response to Disney’s continued refusal to comply with the state’s requests. It remains to be seen how this dispute will ultimately be resolved.

Market Price

The Board had sued the company over its failure to disclose political contributions and executive compensation. At the end of Monday’s trading session, Walt Disney‘s stock opened at $102.4 and closed at $102.2, down by 0.3% from the previous closing price of $102.5. The Board alleges that Disney failed to adequately disclose key information to shareholders, which possibly affected the company’s stock price. The legal dispute could have ramifications for other large companies in Florida and beyond, as it sets a precedent for how companies must transparently report on their finances and political contributions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walt Disney. More…

| Total Revenues | Net Income | Net Margin |

| 84.42k | 3.32k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walt Disney. More…

| Operations | Investing | Financing |

| 5.24k | -5.31k | -5.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walt Disney. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 202.12k | 93.25k | 52.63 |

Key Ratios Snapshot

Some of the financial key ratios for Walt Disney are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -16.5% | 8.3% |

| FCF Margin | ROE | ROA |

| 0.1% | 4.6% | 2.2% |

Analysis – Walt Disney Stock Fair Value Calculator

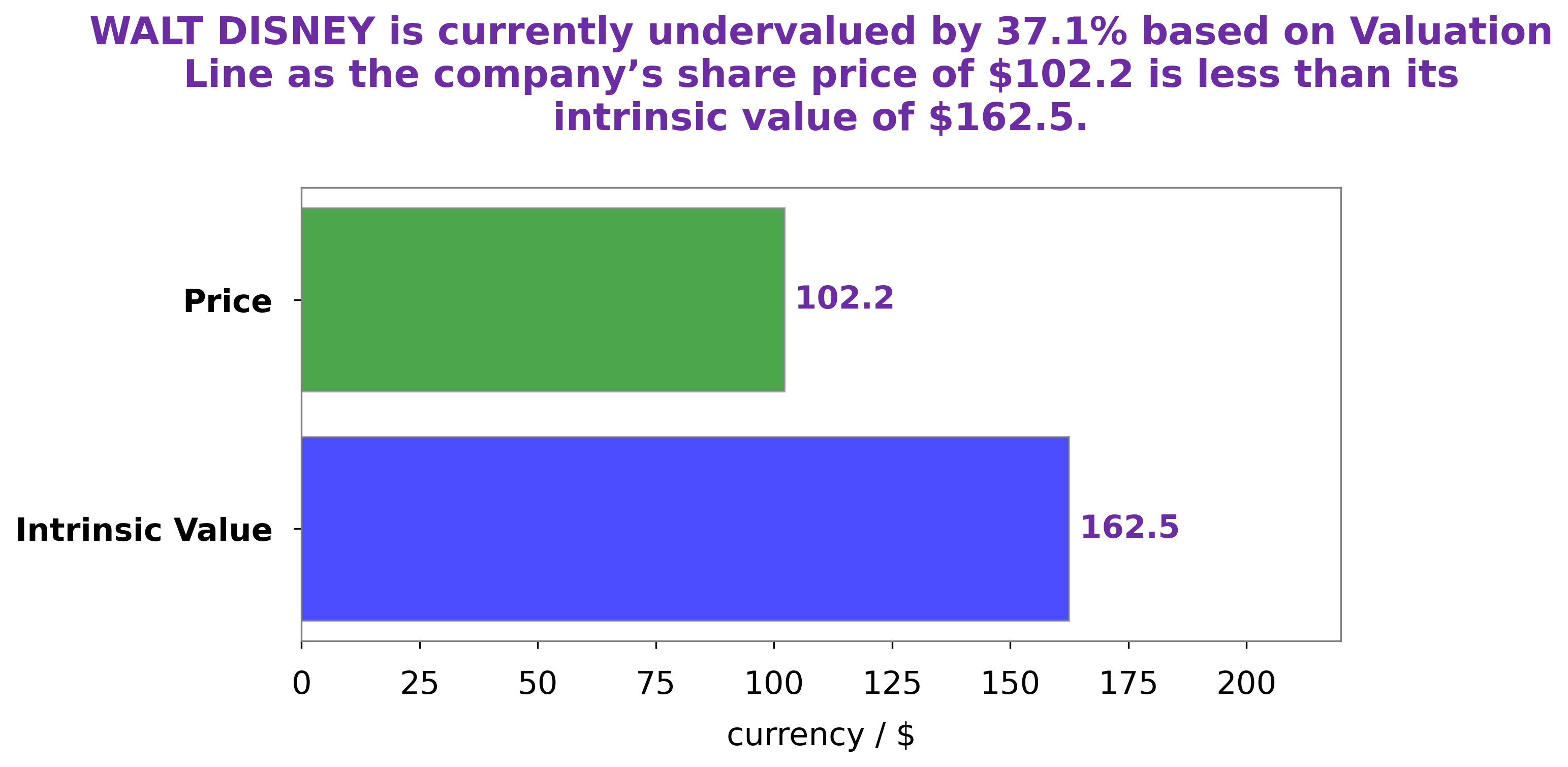

After careful analysis of WALT DISNEY‘s fundamentals, our proprietary Valuation Line has calculated the intrinsic value of WALT DISNEY’s share to be around $162.5. However, currently it is traded at a much lower price of $102.2. This indicates the stock is undervalued by 37.1%. As an investor, this presents an attractive opportunity to purchase the stock at a great value. More…

Peers

The Walt Disney Co is the largest entertainment company in the world. It operates in four business segments: media networks, parks and resorts, studio entertainment, and consumer products. The company has a wide array of competitors, including Netflix Inc, Paramount Global, Warner Bros.Discovery Inc, and many others.

– Netflix Inc ($NASDAQ:NFLX)

Netflix is a streaming service for movies and TV shows. It has a market cap of 109B as of 2022 and a Return on Equity of 22.38%. The company was founded in 1997 and is headquartered in Los Gatos, California.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 12.64B as of 2022, a Return on Equity of 18.54%. The company is a leading provider of global insurance and reinsurance solutions. It offers a broad range of products and services to meet the needs of its clients.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery, Inc. is a global media and entertainment company that operates a portfolio of cable television networks and produces original content for a variety of platforms. The company operates in over 220 countries and territories and reaches nearly 3 billion people around the world. Discovery’s primary businesses include Discovery Channel, Animal Planet, Science Channel, Investigation Discovery, TLC, OWN: Oprah Winfrey Network, Velocity, Travel Channel, Food Network, Cooking Channel, and HGTV. The company also operates Eurosport, Discovery Kids, Discovery Family, and Discovery Turbo. In addition to its cable networks, Discovery also owns and operates digital media properties, including Discovery Digital Networks, Seeker Network, and TestTube.

Summary

Investing in Walt Disney provides a unique opportunity for potential investors. The company boasts a long history of successful business operations and a wide variety of products and services that appeal to a large customer base. As the media and entertainment industries rapidly evolve, Disney has grown to become a major player in the space. It owns a number of entertainment brands, including ABC, ESPN, Marvel and Star Wars.

The company also has a strong presence in the theme park and cruise line industries. Disney has seen mixed financial performance in recent years, but is currently making moves to strengthen its competitive positions and increase shareholder value. Florida Gov. DeSantis’ board recently announced plans to countersue Disney in an oversight battle, potentially providing an additional layer of long-term stability for investors.

Recent Posts