-Side Analyst Says

April 25, 2023

Trending News 🌧️

A Sell-Side Analyst recently reported that CINEMARK HOLDINGS ($NYSE:CNK) is not a good investment at this time. CINEMARK HOLDINGS is a leading motion picture exhibitor with theaters in the U.S., Latin America and the Middle East. Despite its strong portfolio, the company’s stock is not currently a good investment option, according to the analyst. The analyst believes that there is no strong justification for investing in Cinemark’s stock.

This, combined with the company’s relatively high debt levels, has made it a risky investment. Therefore, it would be wise to sell the stock at this time.

Stock Price

The stock opened at $16.4 and closed at $16.5, representing a decline of 0.1% compared to its previous closing price. This decline was seen despite the positive news regarding the launch of the Cinemark XD lineup in select locations. Analysts cite the uncertain economic outlook caused by the coronavirus pandemic and the resulting closure of movie theaters as the primary reasons for their bearish outlook on CINEMARK HOLDINGS stock. Going forward, it may be wise for investors to avoid investing in CINEMARK HOLDINGS until the economic impact of the pandemic is better understood. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cinemark Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.45k | -267.4 | -6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cinemark Holdings. More…

| Operations | Investing | Financing |

| 136 | -96.3 | -52.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cinemark Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.82k | 4.7k | 0.92 |

Key Ratios Snapshot

Some of the financial key ratios for Cinemark Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.2% | -42.6% | -3.5% |

| FCF Margin | ROE | ROA |

| 1.0% | -35.5% | -1.1% |

Analysis

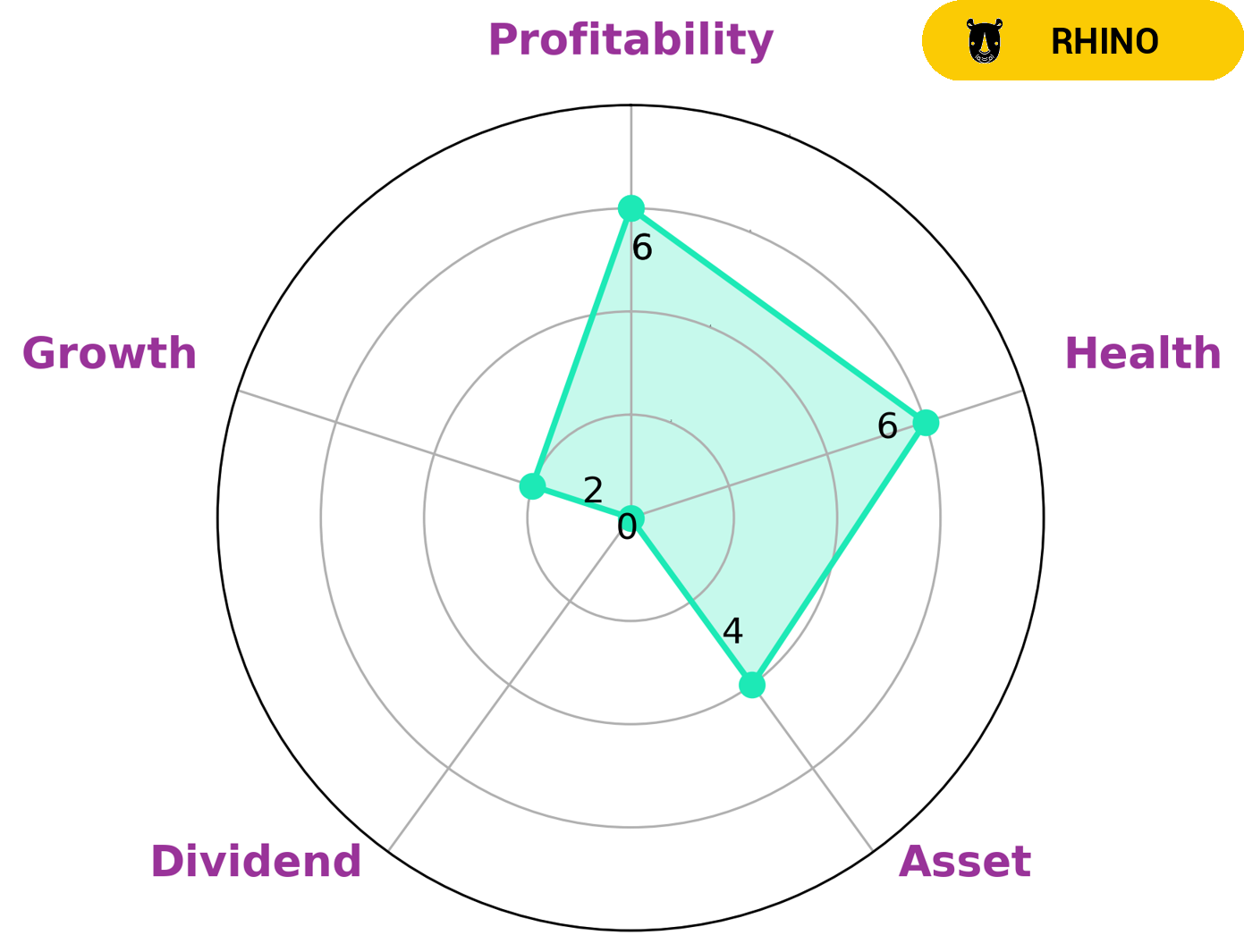

At GoodWhale, we have conducted an analysis of CINEMARK HOLDINGS‘s health. Based on our Star Chart, CINEMARK HOLDINGS is classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Those who may be interested in investing in such a company could be value investors, looking to capitalize on its current assets, or those interested in its potential for medium-term growth. CINEMARK HOLDINGS has an intermediate health score of 6/10, based on our analysis of its cashflows and debt, meaning that it is likely to ride out any economic crisis without the risk of bankruptcy. The company is strong in terms of assets and profitability, but weak on dividend and growth. More…

Peers

Cinemark Holdings Inc. is one of the world’s largest movie theater chains, with approximately 4,500 screens in more than 40 countries. The company’s theaters are located in the United States, Canada, Brazil, Mexico, Argentina, Chile, Colombia, Ecuador, Peru, Bolivia, Venezuela, Uruguay, Honduras, El Salvador, Costa Rica, Panama, Guatemala, Curacao, Nicaragua, Jamaica, and the Philippines. Cinemark Holdings Inc. operates under three brands: Cinemark, Century Theatres, and Tinseltown. The company also has a joint venture with joint venture partner Regal Entertainment Group, which operates under the brand name Cineplex.

– American Community Newspapers Inc ($OTCPK:ACNI)

The company’s market cap is 29.25k as of 2022 and its ROE is 1.84%. The company is a provider of news and information for the African-American community.

– Major League Football Inc ($OTCPK:MLFB)

Major League Football Inc is a professional American football league that was founded in 2014. The league has a market cap of 825.65k as of 2022 and a Return on Equity of 51.36%. The company is based in New York City and has eight teams. The league’s aim is to be a premier development league for players and coaches to develop their skills before moving on to the NFL.

– Tech Central Inc ($OTCPK:TCHC)

Tech Central Inc is a tech company with a focus on developing innovative products and services. The company has a market cap of 6.69k as of 2022 and a ROE of 144.23%. The company’s products and services are designed to improve the efficiency and productivity of its customers. Tech Central Inc’s mission is to provide its customers with the best possible technology solutions. The company’s products and services include software, hardware, and support services.

Summary

Cinemark Holdings, Inc. (NYSE: CNK) is a leading global exhibitor and one of the world’s largest and most geographically diverse movie theater circuits. Despite a strong presence in the market, there is no compelling reason to own the stock here. The company has seen revenue decline due to the coronavirus pandemic and is facing increased competition from streaming services.

The outlook for movie theaters, especially in the near-term, remains uncertain and this could further weigh on Cinemark’s stock price in the coming months. Investors should consider selling their shares of Cinemark at current levels.

Recent Posts