News Corporation Reports Non-GAAP EPS of $0.09, Revenue of $2.45B Beats Estimates.

May 12, 2023

Trending News 🌥️

The company reported a Non-GAAP earnings per share (EPS) of $0.09, exceeding the forecast of $0.04.

In addition, the revenue for the quarter was $2.45 billion, also beating the estimated $2.38 billion. News Corporation ($NASDAQ:NWSA) is an American multinational mass media company with dual-headquarters in New York City and Los Angeles. It is one of the world’s largest diversified media and entertainment conglomerates, operating across a wide variety of industries, including tv and film production, cable network programming, publishing, and digital media. News Corporation’s stock is listed on the New York Stock Exchange (NYSE) and NASDAQ under the symbol “NWSA”. The strong financial results in the first quarter were driven primarily by increased subscription revenue from Fox News and Fox Sports. Moreover, the company reported higher advertising revenues, as well as gains in its film and television businesses. In addition, News Corporation’s cost-saving measures also contributed to its higher-than-expected profits. This will likely bode well for the company’s future performance as it continues to expand its business.

Share Price

The company reported non-GAAP earnings per share (EPS) of $0.09 and revenue of $2.45 billion which beat analysts’ estimates. There was a 0.5% increase in the company’s stock price, with the opening price at $16.6 and closing price at $16.7 from the previous day’s closing of $16.7. The revenue beat was driven by a strong performance in the company’s digital real estate services, cable network programming and book publishing segments.

Additionally, the company’s advertising revenue saw a slight year-over-year increase due to increased demand from social media platforms. The company also announced that it had repurchased $1 billion of its common stock for the fiscal fourth quarter. Overall, the financial results reflect strong performance across the board and were above market expectations, suggesting a positive outlook for the company going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for News Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 10.16k | 299 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for News Corporation. More…

| Operations | Investing | Financing |

| 1.08k | -2.16k | 290 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for News Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.89k | 7.83k | 14.1 |

Key Ratios Snapshot

Some of the financial key ratios for News Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.4% | 18.5% | 4.7% |

| FCF Margin | ROE | ROA |

| 5.7% | 3.7% | 1.8% |

Analysis

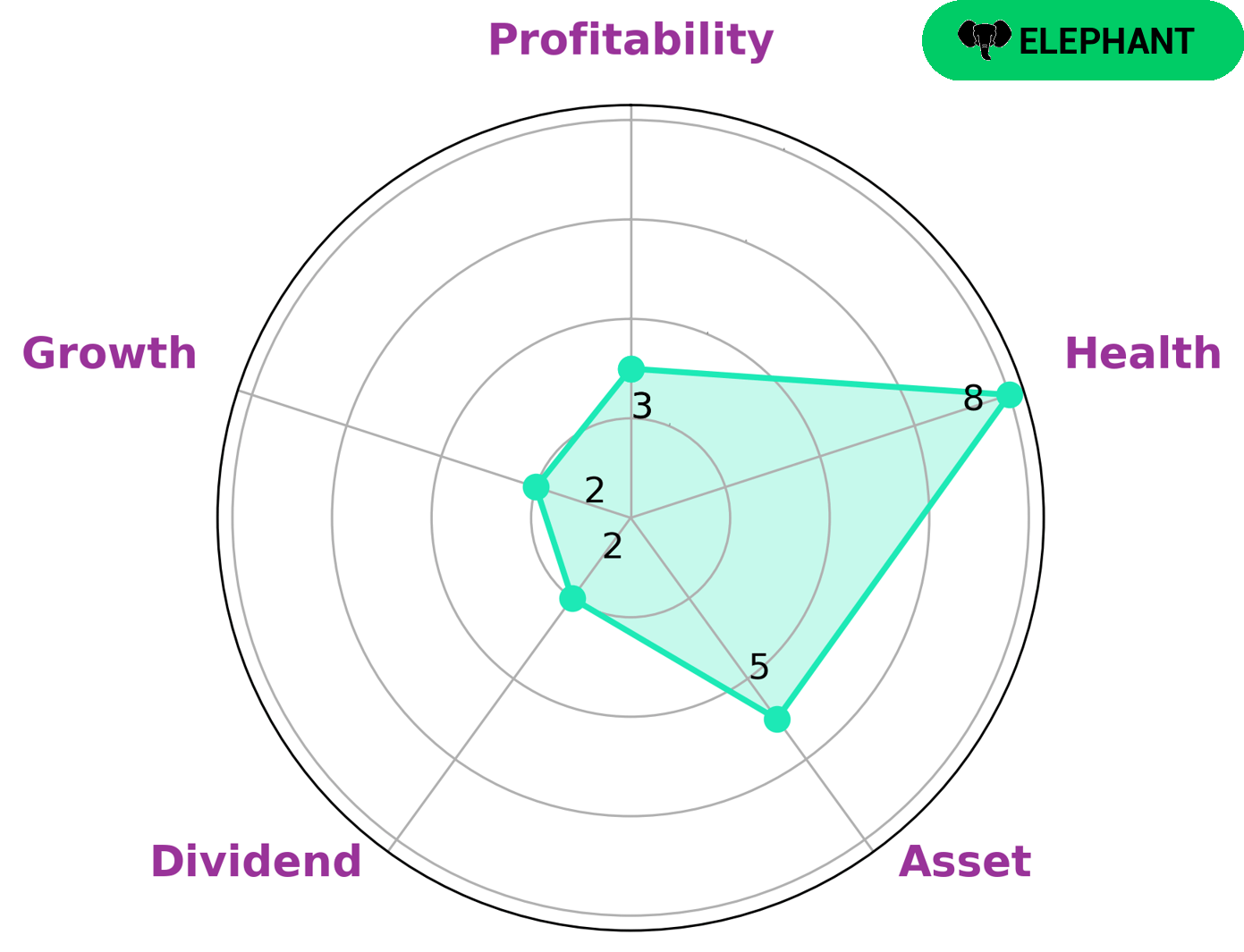

GoodWhale recently conducted an analysis of NEWS CORPORATION‘s wellbeing. According to our Star Chart, NEWS CORPORATION is strong in terms of cashflows, medium in terms of assets, and weak in terms of dividend, growth and profitability. Despite this, NEWS CORPORATION has a high health score of 8/10, indicating that it is capable of sustaining future operations even in times of crisis. In addition to this, it is classified as an ‘elephant’, meaning that it is rich in assets after deducting off liabilities. Given the above, we would expect that NEWS CORPORATION would be of interest to many types of investors, including those looking for strong cashflows and assets, as well as those looking for opportunities to invest in a company which is capable of sustaining itself through periods of crisis. More…

Peers

The company was founded by Rupert Murdoch in 1979. News Corp is headquartered in New York, New York. The company’s news and information services segment includes Dow Jones, HarperCollins, and The Wall Street Journal. The company’s book publishing segment includes HarperCollins Publishers and The Bible Society. The company’s digital real estate services segment includes Move, Inc. and Realtor.com. The company’s other segment includes Foxtel and Sky Deutschland.

– Gannett Co Inc ($NYSE:GCI)

Gannett Co Inc is a publicly traded media holding company headquartered in Tysons, Virginia, United States. It is the largest U.S. newspaper publisher as measured by total daily circulation. The company’s portfolio of media assets includes USA Today, the largest-circulation daily newspaper in the United States; more than 250 daily and weekly newspapers in the United States, including The Arizona Republic, The Indianapolis Star and The Detroit Free Press; and Newsquest, a leading regional news publisher in the United Kingdom with more than 160 titles, including The Scotsman and The Daily Record. Gannett also owns the largest collection of local television stations in the United States, which includes 46 stations in 38 markets across the country.

– New York Times Co ($NYSE:NYT)

The New York Times Company is a leading media organization with a market capitalization of $4.9 billion and a return on equity of 10.7%. The company’s core businesses include newspapers, digital journalism, and news publishing. Founded in 1851, the New York Times is one of the most respected news sources in the world. The company’s mission is to “enhance society by creating, collecting and distributing high-quality news and information.”

– Pearson PLC ($LSE:PSON)

Pearson PLC is a British multinational publishing and education company headquartered in London. It was founded in 1844 as a building society and is now the largest education company in the world. Pearson PLC has a market cap of 6.43B as of 2022 and a Return on Equity of 5.41%. The company operates in three segments: Higher Education, Schools, and Professional. Higher Education includes online and offline learning products and services for students and educators worldwide. Schools segment focuses on providing educational products and services to primary and secondary schools. Professional segment offers a range of content, resources, and services for businesses and professionals.

Summary

This strong financial performance signals potential upside in the stock price and makes it a good investment opportunity for investors. News Corporation has a strong market presence, a diverse portfolio of businesses, and an experienced management team, all of which add to the company’s long-term growth potential. Furthermore, the company is well-positioned to continue to grow and exceed expectations in the coming quarters.

Recent Posts