Manchester United PLC Near Industry Top Despite 1.44% Fall in a Week: Time to Accumulate?

February 6, 2023

Trending News ☀️

Manchester United ($NYSE:MANU) PLC is one of the world’s most popular football clubs, and its stock is one of the most widely traded in the sports industry. InvestorsObserver recently rated the company near the top of its industry group, despite a 1.44% fall in its share price over the last week. This begs the question: should you accumulate Manchester United PLC stock, despite the recent dip? Manchester United has maintained a place at the top of the football world for over a century. Over the years, Manchester United has established itself as one of the most successful sports franchises in the world. The company is also well-positioned to continue its success through investment in new players, facilities and technology.

They have also been investing heavily in their media presence and content production, which is expected to further increase their global reach and influence. In addition to these investments, Manchester United has been actively pursuing commercial partnerships and sponsorships with some of the biggest companies in the world. Given the strong fundamentals of the company, investors should consider taking advantage of the recent dip in price and accumulate Manchester United PLC stock. InvestorsObserver has rated the company near the top of its industry group, and the company has considerable potential for further growth. Although there is no guarantee that this stock will rise again, it certainly appears to be a good buy at current prices.

Share Price

Manchester United PLC is one of the most recognizable sports and entertainment companies in the world. On Tuesday, Manchester United stock opened at $22.6 and closed at $22.6. Currently, media exposure for Manchester United PLC is mostly positive. This includes both domestic and international news outlets that report on the company’s progress. The company is also increasingly active in social media, providing updates on their activities as well as responding to fans questions, concerns, and opinions. The company has been able to maintain a strong financial position due to its diverse revenue streams. Manchester United derives income from its Premier League matches, sponsorship deals, merchandise sales, and broadcast fees.

The company also has a number of commercial partnerships with well-known brands, which helps to boost their profile. Manchester United has been able to capitalize on its status as a global brand. It has partnerships with organizations like Nike, Pepsi, and Chevrolet, who help to promote the club and its activities. The club also has a strong presence on digital platforms such as Facebook, Twitter, and YouTube. It is an attractive option for investors due to its high profile and diversified revenue streams. With positive media exposure and commercial partnerships, now may be the time to accumulate Manchester United stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manchester United. More…

| Total Revenues | Net Income | Net Margin |

| 600.39 | -126.49 | -16.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manchester United. More…

| Operations | Investing | Financing |

| 26.77 | -121.44 | 15.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manchester United. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.42k | 1.32k | 0.62 |

Key Ratios Snapshot

Some of the financial key ratios for Manchester United are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -18.3% | -17.5% |

| FCF Margin | ROE | ROA |

| -20.9% | -57.3% | -4.6% |

Analysis

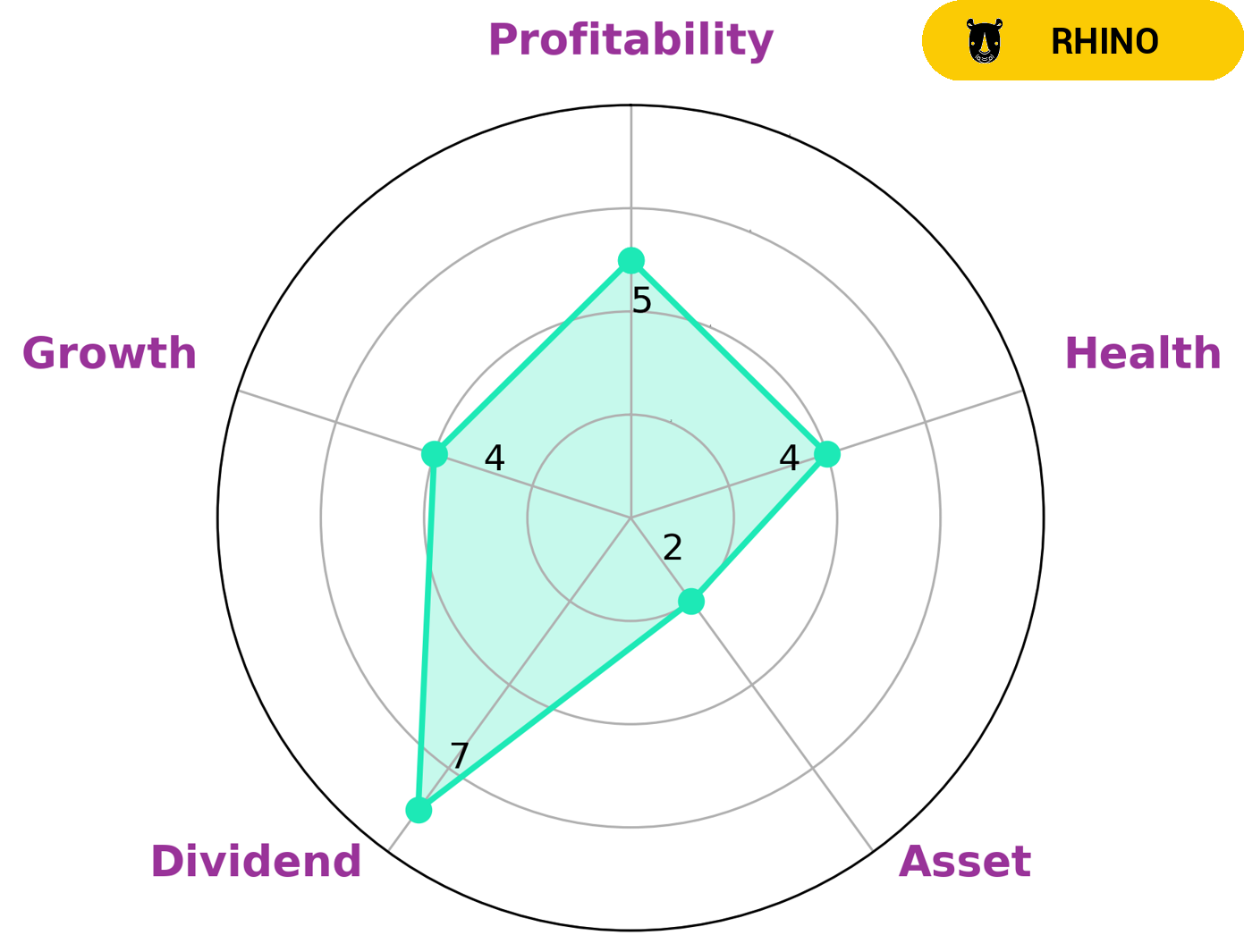

GoodWhale conducted an analysis of Manchester United‘s fundamentals, which showed that the company is strong in dividend, medium in growth, profitability and weak in asset. Manchester United was classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This type of company may be of particular interest to investors looking for a balance of dividend income and potential for growth. Manchester United also has an intermediate health score of 4/10 with regards to its cashflows and debt, which suggests that the company may be able to sustain future operations in times of crisis. However, it is important for investors to remember that past performance is no guarantee of future success, and any investment in Manchester United should be made with caution. Overall, Manchester United’s fundamentals suggest that it is a company with potential for dividend income and moderate growth. Investors should carefully consider the risks involved in investing in this type of company before making any decisions. More…

Peers

Since its establishment in 1902, Manchester United PLC has been one of the most successful soccer clubs in the world. The English club has won 20 league titles, 12 FA Cups, five League Cups, and three European Cups. In recent years, Manchester United PLC has been competing with Futebol Clube do Porto – Futebol SAD, Bonhill Group PLC, Live Co Group PLC, and other companies for the title of most successful soccer club.

– Futebol Clube do Porto – Futebol SAD ($LTS:0MSQ)

Futebol Clube do Porto – Futebol SAD is a professional football club in Portugal. The club is based in the city of Porto and plays in the Primeira Liga, the top flight of Portuguese football. The club was founded in 1893 and has won the Primeira Liga title a record 27 times, the Taça de Portugal a record 25 times, the Taça da Liga a record 7 times, and the UEFA Champions League twice. The club has also won the UEFA Cup twice and the UEFA Super Cup once.

– Bonhill Group PLC ($LSE:BONH)

Bonhill Group PLC is a business intelligence, media, and events company. The company operates in three segments: Business Information, Events, and Media. The Business Information segment provides critical intelligence and analysis on the people, companies, and deals that shape the technology, media, and telecoms markets. The Events segment produces live events that connect and inform technology, media, and telecoms professionals. The Media segment provides news and insight on the technology, media, and telecoms markets.

– Live Co Group PLC ($LSE:LVCG)

Live Co Group PLC is a holding company that owns and operates businesses in the live entertainment industry. The company has a market cap of 6.74M as of 2022 and a Return on Equity of -28.65%. The company’s businesses include live music venues, ticketing platforms, and artist management. The company’s mission is to provide live entertainment experiences that inspire, connect, and entertain people around the world.

Summary

Investing in Manchester United PLC is currently a favorable option, despite a 1.44% drop in its share price over the past week. Media coverage of the company has been generally positive and analysts suggest accumulating their stock in the long run. Manchester United is an established and successful team in the English Premier League, with a large and loyal fan base.

As such, the stock markets have continued to remain bullish on the company despite short-term fluctuations in its value. Analysts believe that Manchester United PLC is well-positioned for continued success and potential growth in both revenue and market capitalization.

Recent Posts