Manchester United Intrinsic Stock Value – Manchester United Clinches European Spot, Takeover Talks Underway

June 2, 2023

☀️Trending News

Meanwhile, takeover talks of Manchester United ($NYSE:MANU) stock have been gaining traction as of late. Manchester United is one of the most iconic and successful football clubs in the world, with a rich history stretching back over a century. The club has also achieved significant success in other competitions, such as the FIFA Club World Cup, Intercontinental Cup, European Super Cup and FA Community Shield. Manchester United’s fanbase is among the largest in global football and the team plays its home games at the iconic Old Trafford Stadium.

Price History

On Wednesday, Manchester United achieved a major milestone when their stock opened at $18.6 and closed at $19.3, up 3.4% from the previous close of 18.7. This jump in their stock price has secured them a spot in the European Football League for the upcoming season.

Additionally, there are rumors of a potential takeover of the club by a new owner, though no official announcement has been made. Manchester United is one of the most well-known football clubs in the world, with a rich history of success and an incredibly passionate fan base. While the team has been through some difficult times in recent years, Wednesday’s milestone shows that they are on the road to recovery and greater success. With potential new ownership on the horizon, it will be interesting to see what direction Manchester United takes in the coming season. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manchester United. More…

| Total Revenues | Net Income | Net Margin |

| 582.32 | -118.78 | -14.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manchester United. More…

| Operations | Investing | Financing |

| -3.25 | -133.29 | 75.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manchester United. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.43k | 1.32k | 0.62 |

Key Ratios Snapshot

Some of the financial key ratios for Manchester United are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | -18.3% | -22.0% |

| FCF Margin | ROE | ROA |

| -28.8% | -75.8% | -5.6% |

Analysis – Manchester United Intrinsic Stock Value

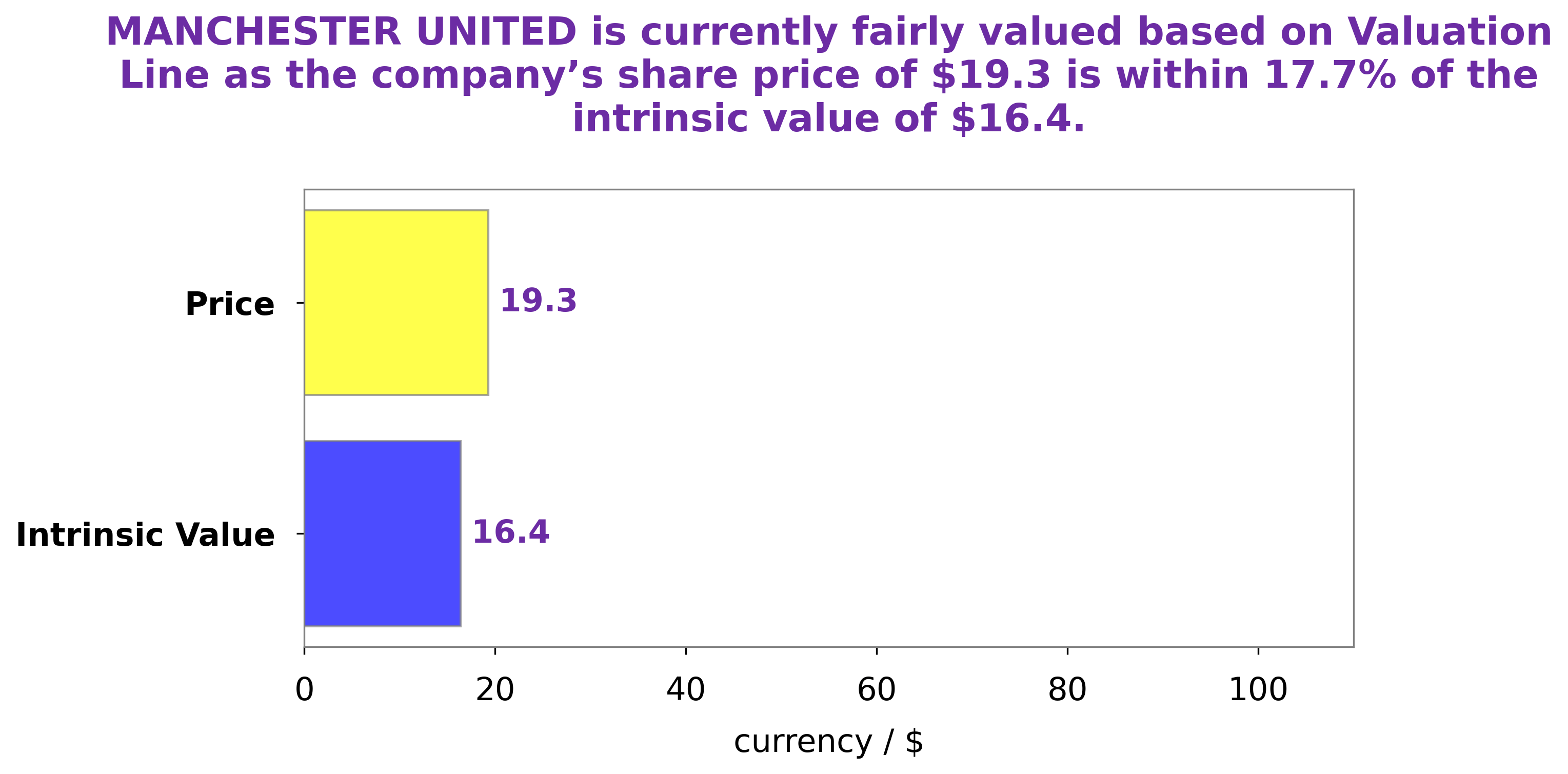

At GoodWhale, we have conducted an analysis of Manchester United‘s financials. Our proprietary Valuation Line yields a fair value of $16.4 for Manchester United’s shares. However, the market is currently trading the stock at $19.3, representing a price overvaluation of 17.5%. This implies that the stock is currently overvalued, and investors should be cautious before investing at this price level. More…

Peers

Since its establishment in 1902, Manchester United PLC has been one of the most successful soccer clubs in the world. The English club has won 20 league titles, 12 FA Cups, five League Cups, and three European Cups. In recent years, Manchester United PLC has been competing with Futebol Clube do Porto – Futebol SAD, Bonhill Group PLC, Live Co Group PLC, and other companies for the title of most successful soccer club.

– Futebol Clube do Porto – Futebol SAD ($LTS:0MSQ)

Futebol Clube do Porto – Futebol SAD is a professional football club in Portugal. The club is based in the city of Porto and plays in the Primeira Liga, the top flight of Portuguese football. The club was founded in 1893 and has won the Primeira Liga title a record 27 times, the Taça de Portugal a record 25 times, the Taça da Liga a record 7 times, and the UEFA Champions League twice. The club has also won the UEFA Cup twice and the UEFA Super Cup once.

– Bonhill Group PLC ($LSE:BONH)

Bonhill Group PLC is a business intelligence, media, and events company. The company operates in three segments: Business Information, Events, and Media. The Business Information segment provides critical intelligence and analysis on the people, companies, and deals that shape the technology, media, and telecoms markets. The Events segment produces live events that connect and inform technology, media, and telecoms professionals. The Media segment provides news and insight on the technology, media, and telecoms markets.

– Live Co Group PLC ($LSE:LVCG)

Live Co Group PLC is a holding company that owns and operates businesses in the live entertainment industry. The company has a market cap of 6.74M as of 2022 and a Return on Equity of -28.65%. The company’s businesses include live music venues, ticketing platforms, and artist management. The company’s mission is to provide live entertainment experiences that inspire, connect, and entertain people around the world.

Summary

Investors interested in Manchester United stocks should take note of the recent news that Europe secured a takeover pending. The stock price has since moved up, which indicates that the market is positive on the potential outcome of the takeover. Investors should assess the company’s financial statement for potential risks and rewards associated with owning the stock. They should also take into consideration the overall economic environment in order to make an informed decision.

Analyzing the competitive landscape and company strategy is also important. Lastly, investors should monitor news and events closely to determine if the takeover is likely to be approved. Ultimately, Manchester United stocks offer an opportunity for investors to potentially benefit from an increase in price but must be approached with caution.

Recent Posts