Live Nation Entertainment Shares Sink 0.54% on Poor Trading Session

June 23, 2023

☀️Trending News

Live Nation Entertainment ($NYSE:LYV) Inc., a live events and ticketing company, experienced a dismal day on the stock market Wednesday. Shares of Live Nation dropped 0.54% to $88.65, a significant decline from its opening price. Live Nation is a global entertainment company that promotes live events and produces concerts, festivals, and theatrical performances. It operates through its two divisions – concert and Ticketing division and sponsorship division.

It also provides its customers with access to tickets through its ticketing platform and provides sponsorship opportunities to brands. Its strategic partnerships with artist managers, entertainment venues, and technology platforms enable it to create unique event experiences for its customers.

Analysis

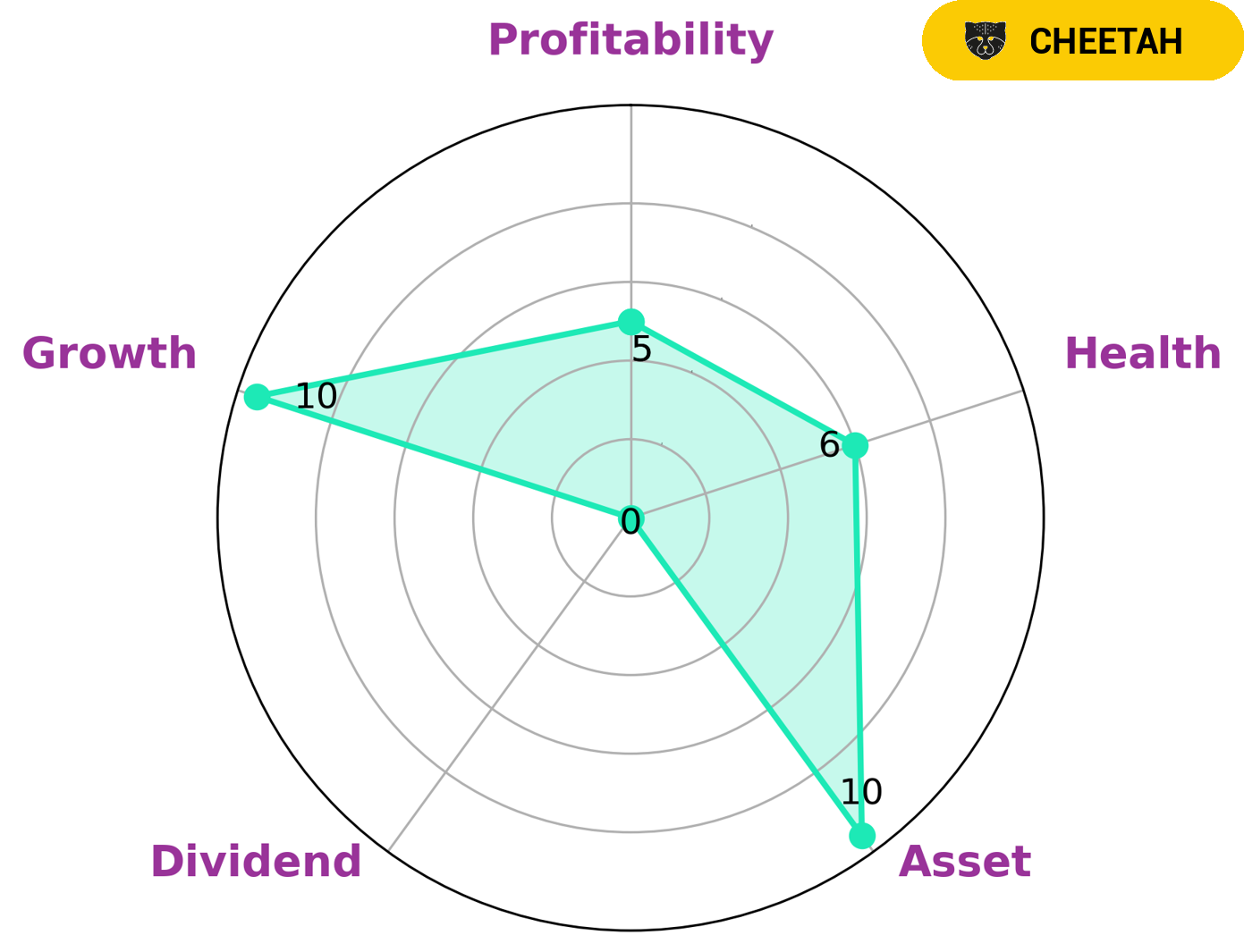

GoodWhale conducted an analysis of LIVE NATION ENTERTAINMENT’s wellbeing. According to our Star Chart, LIVE NATION ENTERTAINMENT is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This may be of interest to investors who are willing to take on a higher risk in exchange for potentially higher returns. LIVE NATION ENTERTAINMENT is strong in terms of assets and growth, medium in profitability, and weak in dividend. Despite this, our analysis reveals that the company has a high health score of 7/10 with regard to its cashflows and debt, making it more capable of sustaining future operations in times of crisis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LYV. More…

| Total Revenues | Net Income | Net Margin |

| 18.01k | 177.01 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LYV. More…

| Operations | Investing | Financing |

| 1.79k | -729.53 | 157.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LYV. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.87k | 18.08k | -2 |

Key Ratios Snapshot

Some of the financial key ratios for LYV are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 67.3% | 5.1% |

| FCF Margin | ROE | ROA |

| 7.7% | -137.6% | 3.0% |

Peers

Its competitors include Warner Bros. Discovery Inc, SD Entertainment Inc, Imagination TV Inc.

– Warner Bros.Discovery Inc ($NASDAQ:WBD)

Discovery Inc. is an American global mass media and entertainment company. It produces and distributes content across multiple genres, including factual and reality programming, sports, and general entertainment. The company has a market cap of 32.75B and a ROE of -5.76%. Discovery Inc. was founded in 1985 and is headquartered in Silver Spring, Maryland.

– SD Entertainment Inc ($TSE:4650)

S2 Games is a publicly traded American video game developer and publisher headquartered in Boston, Massachusetts. The company was founded in 2003 by James Green and Marc DeForest. S2 Games is best known for developing the video game franchises HoN and Strife. As of 2022, S2 Games has a market cap of 2.46B and a return on equity of 14.92%. The company specializes in developing and publishing free-to-play online games.

– Imagination TV Inc ($OTCPK:IMTV)

Imagination TV Inc is a publicly traded company with a market cap of 1.22k as of 2022. The company has a Return on Equity of 143.46%. Imagination TV Inc is a media and entertainment company that creates and distributes content across multiple platforms. The company’s content is distributed through television, film, digital, and social media.

Summary

Live Nation Entertainment Inc. had a weak trading session on Wednesday as its shares fell by 0.54% to $88.65. The overall stock market had a poor day as well, pointing to a general decline in investor confidence. Investors should be aware that the current market conditions could affect the price of Live Nation Entertainment shares.

It is important to monitor the company’s performance and to perform due diligence before investing in its stock. Analysts should consider various factors such as the company’s financial situation, industry trends, and competitive landscape before making an investment decision.

Recent Posts