Endeavor Group Holdings Reports Q4 2023 GAAP EPS of -$0.72, Missing Estimates by $0.71.

March 3, 2023

Trending News 🌧️

This earning miss comes at a time when the company had been making strides in the market and investors had been expecting an increase in earnings for the quarter. The company’s quarterly results were $0.71 lower than what was expected, which resulted in an overall EPS of -$0.72. This was extremely disappointing, as Endeavor Group ($NYSE:EDR) Holdings had been making a push to improve their earnings and the overall outlook of the company, however they have fallen short in Q4 2023.

The poor performance of Q4 2023 may have been caused by a number of factors, such as lower consumer spending or a decrease in their production output. Whatever the cause may be, investors are likely to be disappointed with this outcome and will be watching Endeavor Group Holdings closely as they move forward in the coming quarters.

Stock Price

This news resulted in the current media sentiment being largely negative. Despite the negative news, ENDEAVOR GROUP stock opened at $22.2 and closed at $22.3, which is 0.1% higher than its previous closing price of 22.3. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Endeavor Group. More…

| Total Revenues | Net Income | Net Margin |

| 5.27k | 129.13 | 2.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Endeavor Group. More…

| Operations | Investing | Financing |

| 502.93 | -704.53 | -549.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Endeavor Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.5k | 9.2k | 6.88 |

Key Ratios Snapshot

Some of the financial key ratios for Endeavor Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | 39.4% | 3.4% |

| FCF Margin | ROE | ROA |

| 6.7% | 5.8% | 0.9% |

Analysis

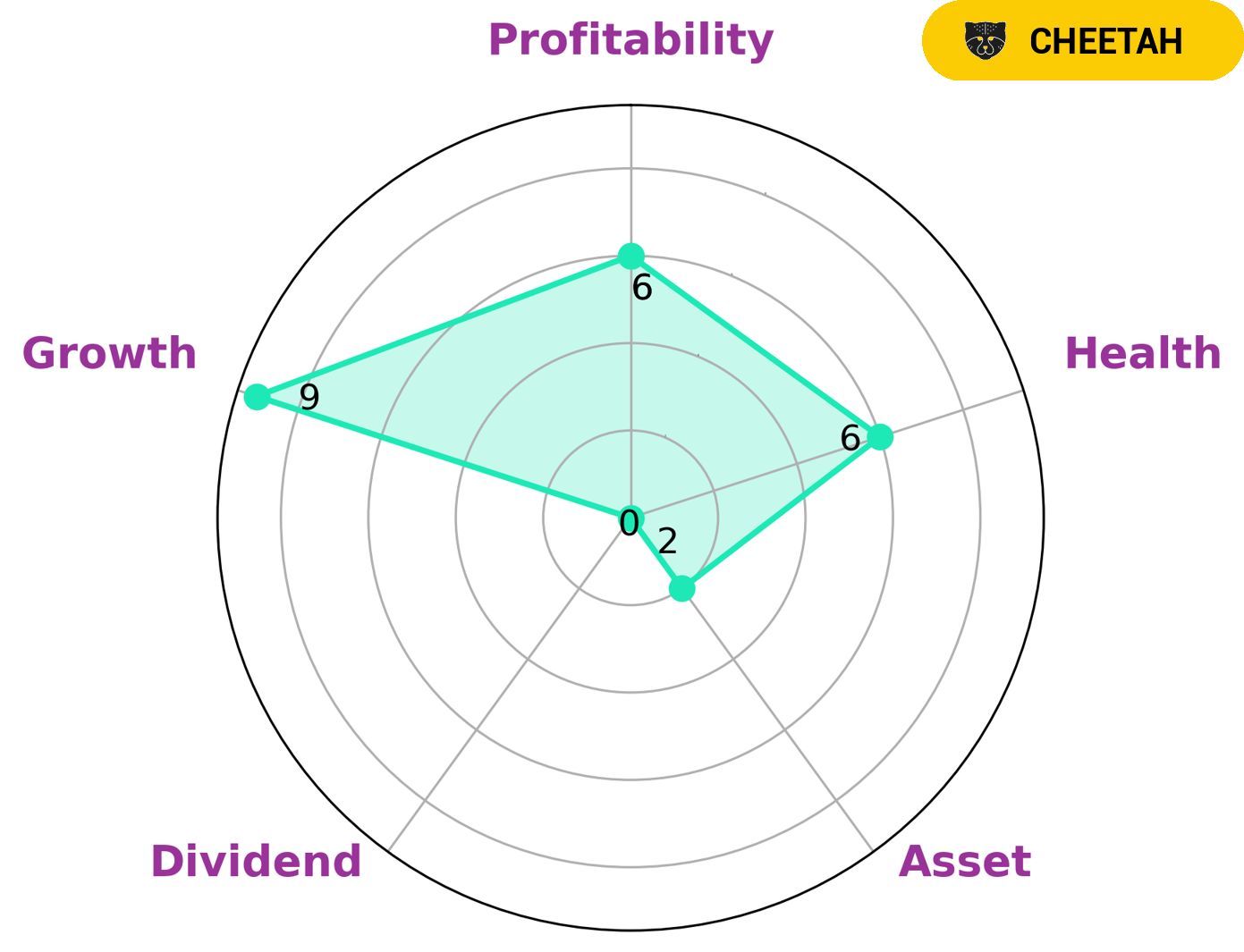

At GoodWhale, we conducted an analysis of ENDEAVOR GROUP‘s wellbeing. The Star Chart we produced showed that ENDEAVOR GROUP has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that the company might be able to sustain future operations in times of crisis. ENDEAVOR GROUP is also classified as a ‘cheetah’, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given these results, active investors with a high appetite for risk may be interested in investing in the company. The company is strong in terms of growth, but only medium in terms of profitability and weak in terms of assets and dividend. The potential returns on investment may be high, but the risk of a significant loss may also be present. More…

Peers

In the entertainment industry, there is always competition between companies to be the best and most successful. This is especially true for Endeavor Group Holdings Inc, which competes with companies such as Eline Entertainment Group Inc, Beijing HualuBaina Film & TV Co Ltd, and Lingerie Fighting Championships Inc. While all of these companies are vying for the top spot, Endeavor Group Holdings Inc has the advantage of experience and a strong track record of success. This, combined with its innovative approach to the entertainment industry, gives Endeavor Group Holdings Inc a strong chance of coming out on top.

– Eline Entertainment Group Inc ($OTCPK:EEGI)

Eline Entertainment Group Inc is a media and entertainment company. The company has a market capitalization of $3.93 billion and a return on equity of -0.04%. The company produces and distributes films, television programs, and other entertainment content. The company’s operations are conducted through its subsidiaries, which include Eline Productions, Eline Studios, and Eline Distribution.

– Beijing HualuBaina Film & TV Co Ltd ($SZSE:300291)

Beijing HualuBaina Film & TV Co Ltd is a film and television production company based in Beijing, China. The company has a market cap of 3.83B as of 2022 and a return on equity of 0.69%. Beijing HualuBaina Film & TV Co Ltd produces a variety of film and television content, including feature films, television series, and documentaries. The company has a long history in the film and television industry, and has produced a number of well-known Chinese films and television series.

– Lingerie Fighting Championships Inc ($OTCPK:BOTY)

Lingerie Fighting Championships Inc is a company that produces mixed martial arts events that feature women in lingerie as the competitors. The company was founded in 2011 and is based in Las Vegas, Nevada.

Lingerie Fighting Championships Inc has a market cap of 2.47M as of 2022. The company has a Return on Equity of -63.67%.

The company produces mixed martial arts events that feature women in lingerie as the competitors. The company was founded in 2011 and is based in Las Vegas, Nevada.

Summary

ENDEAVOR GROUP, a global business organization, recently reported its Q4 2023 earnings results. Unfortunately, the company reported a GAAP EPS of -$0.72, missing analyst estimates by $0.71. This has been met with mostly negative sentiment from the media and investors alike. The shocking loss has led to ENDEAVOR GROUP stock prices dropping sharply.

Analysts are now debating amongst themselves whether or not to invest in the company. While some see the losses as a short-term issue, others are warning investors against investing in ENDEAVOR GROUP for the foreseeable future. Given the current market conditions and ENDEAVOR GROUP’s precarious standing, it is important for investors to weigh their options and make an informed decision before investing in the company.

Recent Posts