Cinemark Holdings Sees Significant Decline in Equity and Unsecured Bonds in 2022

January 30, 2023

Trending News 🌧️

Cinemark Holdings ($NYSE:CNK), Inc. is one of the largest and most influential movie theater chain in the world.

However, in 2022, Cinemark’s capital structure has seen a significant decline, with the equity dropping 36% and the unsecured bond declining from $105 to well below $90. There are several factors that have contributed to this decline. The pandemic also caused many people to stay home and watch movies online, resulting in a sharp decrease in box-office revenues.

In addition, Cinemark’s debt-to-equity ratio has been increasing steadily over the past few years, making it more difficult for the company to acquire necessary capital for expansion and growth. The decrease in unsecured bonds could also be attributed to increased competition from streaming services such as Netflix and Hulu. These services have gained tremendous popularity over the past few years and have become an attractive alternative to traditional movie theaters. This competition has put a strain on Cinemark’s ability to attract customers and generate profits. Finally, investors may have been discouraged by the company’s lack of transparency when it comes to its financial performance. This lack of transparency could have caused investors to be wary of investing in Cinemark stock, leading to a decrease in equity and unsecured bonds. It remains to be seen whether Cinemark can turn things around or if this decline will continue into the future.

Share Price

Cinemark Holdings is currently experiencing a significant decline in equity and unsecured bonds in the 2022 fiscal year. At the time of writing, most media exposure has been negative in regards to the struggling company. Despite this, on Tuesday, Cinemark Holdings stock opened at $10.9 and closed at $11.1, showing a 2.6% increase from the prior closing price of $10.8. Cinemark Holdings is no exception, as its share price has dropped significantly over the past year. Despite the recent increase in stock price, investors are still wary of the company’s future prospects.

This ratio is a measure of a company’s financial stability and indicates that Cinemark Holdings is highly leveraged with debt and not in a very healthy financial position. The company’s directors have noted that their current financial situation is not sustainable and that they are working to improve their liquidity position by reducing costs and increasing revenue. The company’s future depends on its ability to navigate the turbulent waters of the current economic climate and make the necessary changes to ensure its long-term success. Until then, investors will likely remain cautious when it comes to investing in Cinemark Holdings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cinemark Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.52k | -171.38 | -3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cinemark Holdings. More…

| Operations | Investing | Financing |

| 236.12 | -87.6 | -39.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cinemark Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.85k | 4.65k | 1.62 |

Key Ratios Snapshot

Some of the financial key ratios for Cinemark Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.5% | -33.9% | 0.7% |

| FCF Margin | ROE | ROA |

| 5.3% | 5.7% | 0.2% |

VI Analysis

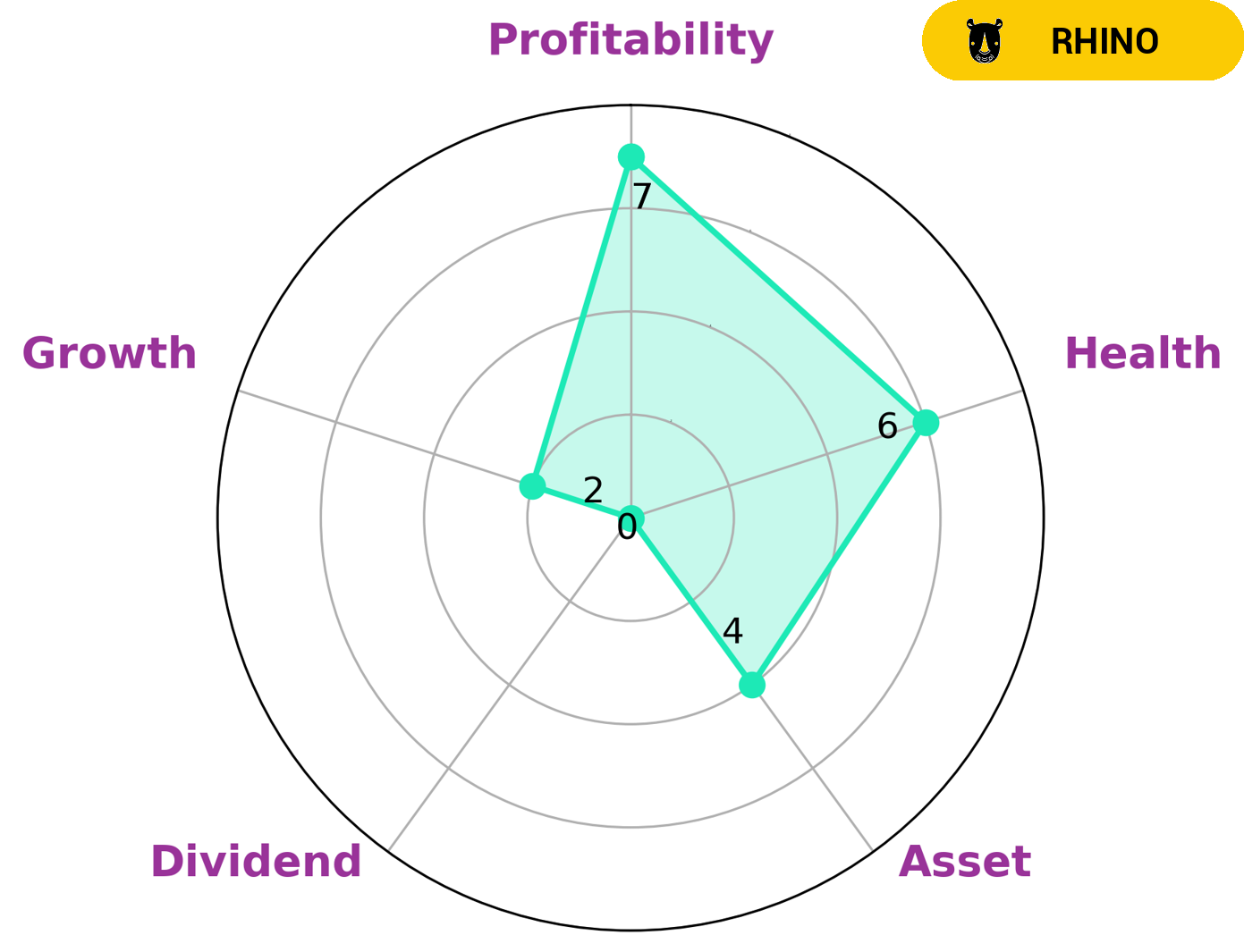

CINEMARK HOLDINGS, as seen by the VI Star Chart, has an intermediate health score of 6/10, meaning that the company has solid fundamentals and should be able to safely ride out any crisis without the risk of bankruptcy. As a ‘rhino’, CINEMARK HOLDINGS has achieved moderate revenue or earnings growth, but has not yet made a strong impression on investors. The company is strong in profitability, but weak in dividend growth and assets. This type of company may attract investors looking for a reliable source of steady income, as well as those seeking moderate capital appreciation. Investors who are looking for higher returns may not find the company attractive, due to its low growth. In summary, CINEMARK HOLDINGS has solid fundamentals and is more suited for investors seeking a reliable source of steady income than those seeking higher returns and capital appreciation. Its moderate revenue and earnings growth also make it an attractive option for investors. More…

VI Peers

Cinemark Holdings Inc. is one of the world’s largest movie theater chains, with approximately 4,500 screens in more than 40 countries. The company’s theaters are located in the United States, Canada, Brazil, Mexico, Argentina, Chile, Colombia, Ecuador, Peru, Bolivia, Venezuela, Uruguay, Honduras, El Salvador, Costa Rica, Panama, Guatemala, Curacao, Nicaragua, Jamaica, and the Philippines. Cinemark Holdings Inc. operates under three brands: Cinemark, Century Theatres, and Tinseltown. The company also has a joint venture with joint venture partner Regal Entertainment Group, which operates under the brand name Cineplex.

– American Community Newspapers Inc ($OTCPK:ACNI)

The company’s market cap is 29.25k as of 2022 and its ROE is 1.84%. The company is a provider of news and information for the African-American community.

– Major League Football Inc ($OTCPK:MLFB)

Major League Football Inc is a professional American football league that was founded in 2014. The league has a market cap of 825.65k as of 2022 and a Return on Equity of 51.36%. The company is based in New York City and has eight teams. The league’s aim is to be a premier development league for players and coaches to develop their skills before moving on to the NFL.

– Tech Central Inc ($OTCPK:TCHC)

Tech Central Inc is a tech company with a focus on developing innovative products and services. The company has a market cap of 6.69k as of 2022 and a ROE of 144.23%. The company’s products and services are designed to improve the efficiency and productivity of its customers. Tech Central Inc’s mission is to provide its customers with the best possible technology solutions. The company’s products and services include software, hardware, and support services.

Summary

Cinemark Holdings, a leading movie theatre chain, has experienced a significant decline in its equity and unsecured bonds in 2022. This has caused a decrease in investor sentiment and confidence, as media outlets have predominantly reported on the negative financial news.

However, investors should analyze the fundamentals of the company such as its revenue, cash flow, and debt levels before making an investment decision. Cinemark remains one of the largest movie theatre chains, and its stock may present an opportunity for value investing.

Additionally, the company has taken steps to reduce costs and maximize profitability. Investors should monitor the stock price and financial statements of Cinemark Holdings to evaluate if it is an attractive investment.

Recent Posts