Cinemark Holdings Intrinsic Value Calculator – .

April 28, 2023

CNK

CINEMARK ($NYSE:CNK): Stock Trading at $16.52 with Heavy Volume of Trades: What’s Next?

Trending News 🌥️

Cinemark Holdings Inc. NYSE: CNK is one of the largest movie theatre operators in the United States and Latin America. On Wednesday, CNK closed the trading day at $16.52, marking a 0.30% decrease or 0.05 points from the previous closing price. Trading volume for the day was 3,126,553 shares. Given the current market conditions and the heavy volume of trades for CNK, investors want to know what is next for the stock.

However, as more and more states are allowing theatres to open, there is hope that the stock will recover soon. In addition to this, Cinemark has taken steps to make sure that their theatres are as safe as possible, by implementing social distancing, sanitation protocols, contactless ticketing and limited capacity. These measures may help in getting people back to the theatres, thus boosting the stock’s performance. Investors should note that Cinemark is also working on expanding its offerings by creating virtual cinemas with premium content, which may also attract customers. Overall, with the reopening of movie theatres and Cinemark’s efforts to innovate its offerings, it is likely that the stock will start recovering soon and reach higher levels. Investors should closely monitor the market trends and the company’s performance before taking any investment decisions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cinemark Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.45k | -267.4 | -6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cinemark Holdings. More…

| Operations | Investing | Financing |

| 136 | -96.3 | -52.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cinemark Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.82k | 4.7k | 0.92 |

Key Ratios Snapshot

Some of the financial key ratios for Cinemark Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.2% | -42.6% | -3.5% |

| FCF Margin | ROE | ROA |

| 1.0% | -35.5% | -1.1% |

Stock Price

Cinemark Holdings Inc. CNK is trading at $16.52 with heavy volume of trades on Monday. The stock opened at $16.4 and closed at $16.5, down by 0.1% from the last closing price of 16.5. This slight decline in the stock’s price is indicative of investors’ watchful approach, as they remain uncertain of what lies ahead for the company’s stock. Given the volatile nature of the stock market in recent times, it is difficult to predict what will happen next for Cinemark Holdings Inc. CNK stock.

In the face of uncertainty, investors may opt to take a wait-and-see approach and refrain from making investments in the company’s stock until more information is available. Moreover, any new developments or news related to the company could have a significant impact on its share price, either positively or negatively. Therefore, investors should pay close attention to the latest developments and news related to Cinemark Holdings Inc. in order to make informed decisions about investing in its stock. Live Quote…

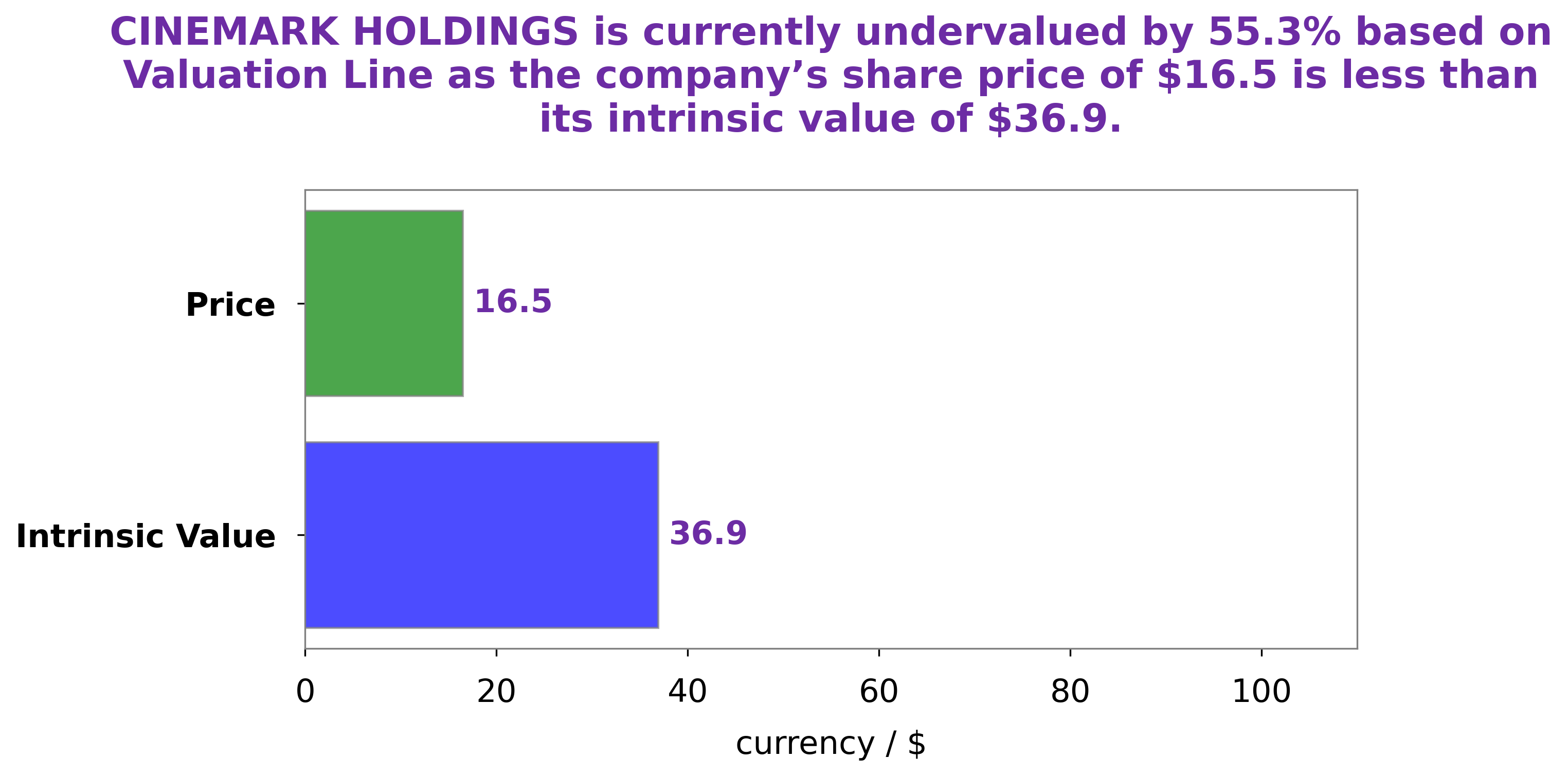

Analysis – Cinemark Holdings Intrinsic Value Calculator

At GoodWhale, we have conducted an analysis of CINEMARK HOLDINGS‘s financials and arrived at a fair value of $36.9 for its shares. This value is derived from our proprietary Valuation Line and takes into account the company’s financial performance, industry trends, and other factors. Currently, CINEMARK HOLDINGS stock is traded at $16.5, which is significantly lower than our calculated fair value. This indicates that the stock is undervalued by 55.3%. We believe that this presents a good opportunity to investors looking to purchase the stock at a discounted rate. More…

Peers

Cinemark Holdings Inc. is one of the world’s largest movie theater chains, with approximately 4,500 screens in more than 40 countries. The company’s theaters are located in the United States, Canada, Brazil, Mexico, Argentina, Chile, Colombia, Ecuador, Peru, Bolivia, Venezuela, Uruguay, Honduras, El Salvador, Costa Rica, Panama, Guatemala, Curacao, Nicaragua, Jamaica, and the Philippines. Cinemark Holdings Inc. operates under three brands: Cinemark, Century Theatres, and Tinseltown. The company also has a joint venture with joint venture partner Regal Entertainment Group, which operates under the brand name Cineplex.

– American Community Newspapers Inc ($OTCPK:ACNI)

The company’s market cap is 29.25k as of 2022 and its ROE is 1.84%. The company is a provider of news and information for the African-American community.

– Major League Football Inc ($OTCPK:MLFB)

Major League Football Inc is a professional American football league that was founded in 2014. The league has a market cap of 825.65k as of 2022 and a Return on Equity of 51.36%. The company is based in New York City and has eight teams. The league’s aim is to be a premier development league for players and coaches to develop their skills before moving on to the NFL.

– Tech Central Inc ($OTCPK:TCHC)

Tech Central Inc is a tech company with a focus on developing innovative products and services. The company has a market cap of 6.69k as of 2022 and a ROE of 144.23%. The company’s products and services are designed to improve the efficiency and productivity of its customers. Tech Central Inc’s mission is to provide its customers with the best possible technology solutions. The company’s products and services include software, hardware, and support services.

Summary

Cinemark Holdings Inc CNK has been trading around $16.52 per share, closing at -0.30% or -0.05 points for the day. Analysts suggest investors look for the company’s next earnings release for more insight into the stock’s performance and outlook. Investors should also take into consideration Cinemark’s financials, management strategy and competitive landscape to better understand whether investing in the stock is a wise choice.

Additionally, analysts suggest closely monitoring the company’s balance sheet to ensure the debt-to-equity ratio remains low. Furthermore, investors should consider what other stocks they may want to buy to create a diversified portfolio with CNK. With these factors in mind, investors can make an informed decision when investing in CNK.

Recent Posts