Amc Networks Intrinsic Value – AMC Networks Shares Plummet -142.58%; What’s in Store for Investors?

April 12, 2023

Trending News ☀️

The last session saw AMC ($NASDAQ:AMCX) Networks Inc.’s traded shares amounting to 0.25 million, with its beta value reaching 1.20. Given the company’s share price has fallen -142.58% from its highs, what can be expected for the future? AMC Networks Inc. is a media company that operates the AMC, BBC AMERICA, IFC, SundanceTV and WE tv cable networks, as well as the video streaming service, AMC+. The company also produces content for its networks and other platforms, and owns the independent film distributor IFC Films. As a result of the coronavirus pandemic, AMC Networks has been severely impacted due to its reliance on advertising and subscription revenue from cable and satellite companies. As more consumers have shifted to streaming services, such as Netflix and Hulu, the company has seen its subscriber base decline significantly in recent months. Furthermore, AMC is also facing challenges due to rising production costs, as costs of production have increased due to the pandemic. Given its current challenges, investors are left wondering what the future holds for this media giant. With the share price being down -142.58%, AMC Networks may be facing significant losses in the near future. It is likely that the company will need to focus on cutting costs and increasing its online presence in order to remain competitive in the media industry.

Additionally, investors should also carefully consider how much risk they are willing to take in order to invest in the company. Ultimately, it is up to individual investors to make that decision for themselves.

Share Price

The steep decline of the stock price has many investors asking what is in store for them in the future. As the pandemic continues to affect the entertainment industry, AMC Networks Inc. has seen its revenues decrease as well as its stock prices. The company has taken steps to reduce costs, such as cutting executive salaries and furloughing employees, but with the uncertain nature of the pandemic, it is difficult to predict how this will affect their long-term outlook.

As a result, investors are uncertain about AMC Networks Inc.’s future prospects and it is unclear how they will fare in the coming months and years. While it is possible that the stock could rebound and see an increase in its share value, this is far from certain and investors should be aware of the risks associated with AMC Networks Inc. shares before investing. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amc Networks. More…

| Total Revenues | Net Income | Net Margin |

| 3.1k | 7.59 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amc Networks. More…

| Operations | Investing | Financing |

| 181.83 | -39.38 | -97.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amc Networks. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.63k | 4.53k | 18.76 |

Key Ratios Snapshot

Some of the financial key ratios for Amc Networks are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | -9.3% | 3.4% |

| FCF Margin | ROE | ROA |

| 4.4% | 7.2% | 1.2% |

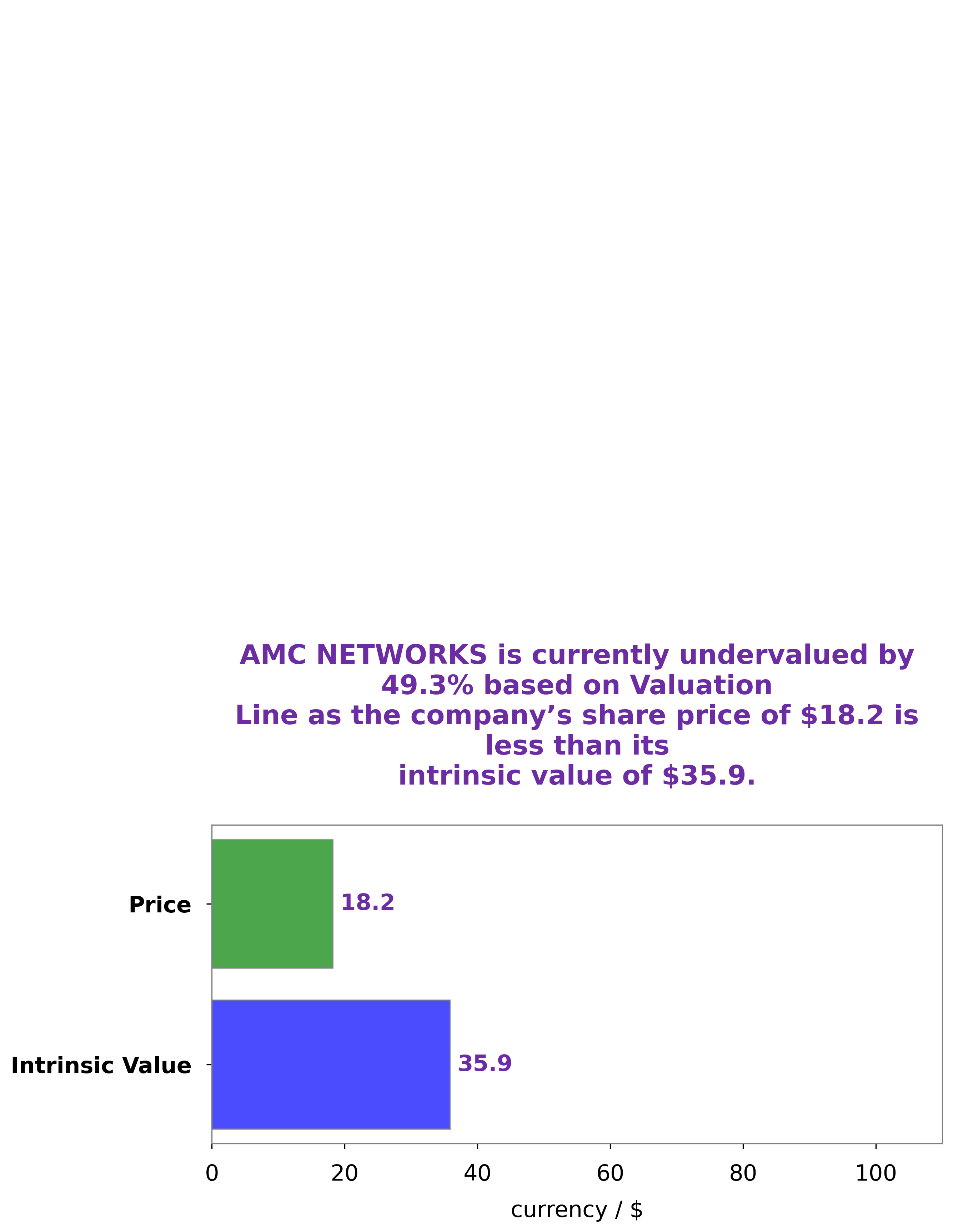

Analysis – Amc Networks Intrinsic Value

At GoodWhale, we have conducted an analysis of AMC NETWORKS‘s wellbeing. Our proprietary Valuation Line has determined that the intrinsic value of their stock is around $35.9. This means that the current trading price of $18.2 is undervalued by 49.4%. This presents a great opportunity for investors looking to buy undervalued stocks. We believe that AMC NETWORKS could be a great addition to any portfolio and is one of the few stocks that is currently undervalued in the market. More…

Peers

AMC Networks Inc is an American entertainment company that owns and operates several cable television channels. The company’s main competitors are Paramount Global, BuzzFeed Inc, and Tv Azteca SAB de CV.

– Paramount Global ($NASDAQ:PARA)

Paramount Global has a market cap of 10.21B as of 2022, a Return on Equity of 12.85%. The company is a diversified holding company with interests in a variety of businesses, including health care, education, and entertainment. Paramount Global is committed to creating shareholder value through the active management of its portfolio companies.

– BuzzFeed Inc ($NASDAQ:BZFD)

BuzzFeed, Inc. is an American internet media and news company based in New York City. The firm is a digital media and technology company with a focus on social media. BuzzFeed was founded in 2006 by Jonah Peretti and John S. Johnson III. The company has raised $496.3 million in venture funding to date.

– Tv Azteca SAB de CV ($OTCPK:AZTEF)

Tv Azteca SAB de CV is a Mexican multimedia company with operations in both the television and radio industries. The company’s market cap as of 2022 is 223.95M, and its Return on Equity is 91.59%. Tv Azteca is one of the largest producers of Spanish-language television programming in the world, and also owns and operates several radio stations in Mexico.

Summary

Investing in AMC Networks Inc. is risky due to the stock’s fall of 142.58% from its highs. However, the stock has recently seen an increase in price with a trading volume of 0.25 million and a beta value of 1.20. Investors should carefully consider the company’s stock price movements and its overall financial performance before making any investments. Additionally, investors should conduct further research into the company’s operations, competitors, and industry in order to better understand the company and make an informed investment decision.

Recent Posts