AMC Entertainment Stock Price Predicted to Test $10 by End of 2023 After 18% Drop in Previous Week and 47% Loss in Market Capitalization Over 6 Months

March 14, 2023

Trending News 🌧️

AMC ($NYSE:AMC) Entertainment has been struggling for the past several months, having seen its stock price drop 18% in the last week and a 47% loss in its market capitalization over the last 6 months. This downward trend in the stock price has been getting investors worried but some have suggested that the company may yet hit its benchmark of $10.00 by the end of 2023. The last time AMC stock tested this benchmark was on 15 September 2022. It is important to note that the decrease in AMC’s stock price is primarily attributed to the pandemic and its resulting pressures on the entertainment industry. With people stuck at home, movie theaters have been forced to close their doors, leading to reduced ticket sales and thus a decrease in revenue for AMC.

Additionally, the company has had to cut costs and lay off workers to remain afloat during the pandemic, further reducing their profits. Despite the pessimism surrounding AMC Entertainment’s stock prices, there is still hope that it could reach its benchmark of $10.00 by the end of 2023. Furthermore, as restrictions begin to ease and people start to return to movie theaters, AMC could capitalize on increased ticket sales and revenue. Therefore, although AMC’s stock price has taken a considerable hit, it is still possible that it could reach its benchmark of $10.00 by the end of 2023.

Market Price

AMC Entertainment’s stock price has been on a significant decline recently. On Monday, the stock price opened at $5.4 and closed at $5.5, up by 1.5% from its prior closing price. As AMC Entertainment continues to experience financial struggles, investors should remain cautious in the near future. While there is potential for the stock to rebound, the consensus is that the stock price will continue to decline in the coming months and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amc Entertainment. More…

| Total Revenues | Net Income | Net Margin |

| 3.91k | -973.6 | -22.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amc Entertainment. More…

| Operations | Investing | Financing |

| -548.7 | -68.2 | 1.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amc Entertainment. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.14k | 11.76k | -4.94 |

Key Ratios Snapshot

Some of the financial key ratios for Amc Entertainment are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.6% | -4.0% | -15.1% |

| FCF Margin | ROE | ROA |

| -18.8% | 14.4% | -4.1% |

Analysis

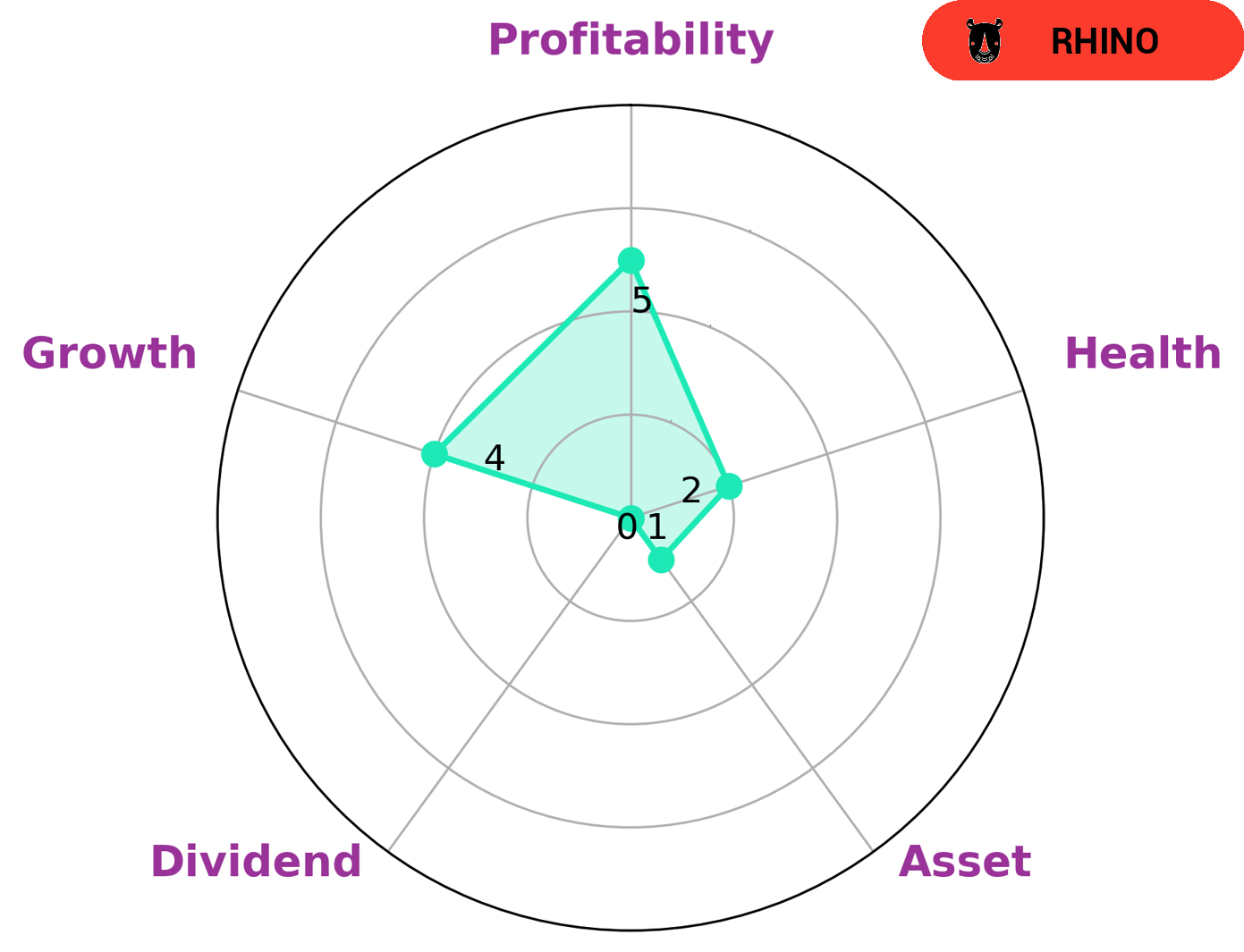

As GoodWhale, we conducted an analysis of AMC ENTERTAINMENT‘s wellbeing. Using our Star Chart analysis tool, we determined that AMC ENTERTAINMENT is strong in one category, medium in three and weak in two categories – growth, profitability and asset, dividend. Our health score for AMC ENTERTAINMENT was 2/10, reflecting its low cashflows and debt. This indicates that this company is less likely to sustain future operations in times of crisis. AMC ENTERTAINMENT is classified as a ‘rhino’, meaning it has achieved moderate revenue or earnings growth. Such companies are likely to be attractive to investors who appreciate long-term stability and reliable returns. Moreover, investors looking to diversify their portfolio may find rhinos attractive due to their low volatility and limited downside risk. More…

Peers

AMC Entertainment Holdings Inc is one of the world’s largest movie theater chains. It has several competitors, including Shine Trend International Multimedia Tec, Bonhill Group PLC, and DEAG Deutsche Entertainment AG.

– Shine Trend International Multimedia Tec ($TPEX:6856)

Shine Trend International Multimedia Tec is a global technology company that provides innovative solutions for the communications, media, and entertainment industries. The company has a market cap of 1.93B as of 2022 and a return on equity of 18.8%. Shine Trend International Multimedia Tec is a leading provider of innovative communications and media solutions that enable its customers to connect, interact, and collaborate. The company’s products and services include: broadband and IPTV solutions, cloud-based solutions, content management and delivery solutions, and enterprise communications solutions. Shine Trend International Multimedia Tec is headquartered in Shenzhen, China.

– Bonhill Group PLC ($LSE:BONH)

Bonhill Group PLC is a United Kingdom-based company, which provides business-to-business media and events services. The company operates through four segments: Vitesse Media, Information Media, Investment Media and Events. Vitesse Media segment comprises of online and print publications, which provide news and information for small and medium-sized enterprises (SMEs) in the United Kingdom. Information Media segment provides market intelligence, news and analysis on the technology, media and telecom sectors. Investment Media segment focuses on the private equity and venture capital markets. Events segment consists of conferences, exhibitions and awards.

Summary

Investors in AMC Entertainment are taking a cautious approach after the stock price dropped 18% in the past week and the company’s market capitalization lost 47% over 6 months. Following this steep decline, investors are advised to research further before considering an investment, as the future of the company still remains uncertain.

Recent Posts