AMC Entertainment Reports Positive Q4 Earnings for 2023 with 8-Cent Beat.

March 7, 2023

Trending News ☀️

On Tuesday, AMC ($NYSE:AMC) Entertainment reported its earnings for Q4 of 2023, showing a positive financial performance with a beat of 8-cents against analysts’ expectations. The positive results were driven by strong sales at the company’s new locations, as well as cost-cutting initiatives such as digital advertising and consolidation of overhead costs.

In addition, the company’s revenue increased due to increased attendance at films such as ‘Jurassic World: Fallen Kingdom’, as well as higher ticket prices and concession sales. “It is gratifying to see our hard work and cost-cutting strategy paying off,” said Aron. “We are confident that these efforts will continue to result in positive earnings for our company in the future.” At the same time, Aron noted that there is still much work to be done in order to ensure the long-term success of AMC Entertainment. “We need to continue to focus on innovation and customer service while continuing to expand our reach internationally,” he said. Overall, the strong Q4 earnings report from AMC Entertainment bodes well for the future of the company, as it demonstrates its ability to remain profitable despite challenging market conditions. The company is well-positioned for future growth, and investors should be encouraged by these positive results.

Stock Price

This news has been mostly positive so far, helping to boost the company’s stock. On Tuesday, the stock opened at $7.8 before dropping 6.2% to close at $7.1. This was a decline from the prior closing price of $7.6, but analysts remain optimistic about the positive performance overall and the future of AMC stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amc Entertainment. More…

| Total Revenues | Net Income | Net Margin |

| 3.91k | -973.6 | -22.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amc Entertainment. More…

| Operations | Investing | Financing |

| -548.7 | -68.2 | 1.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amc Entertainment. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.14k | 11.76k | -4.94 |

Key Ratios Snapshot

Some of the financial key ratios for Amc Entertainment are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.6% | -4.0% | -15.1% |

| FCF Margin | ROE | ROA |

| -18.8% | 14.4% | -4.1% |

Analysis

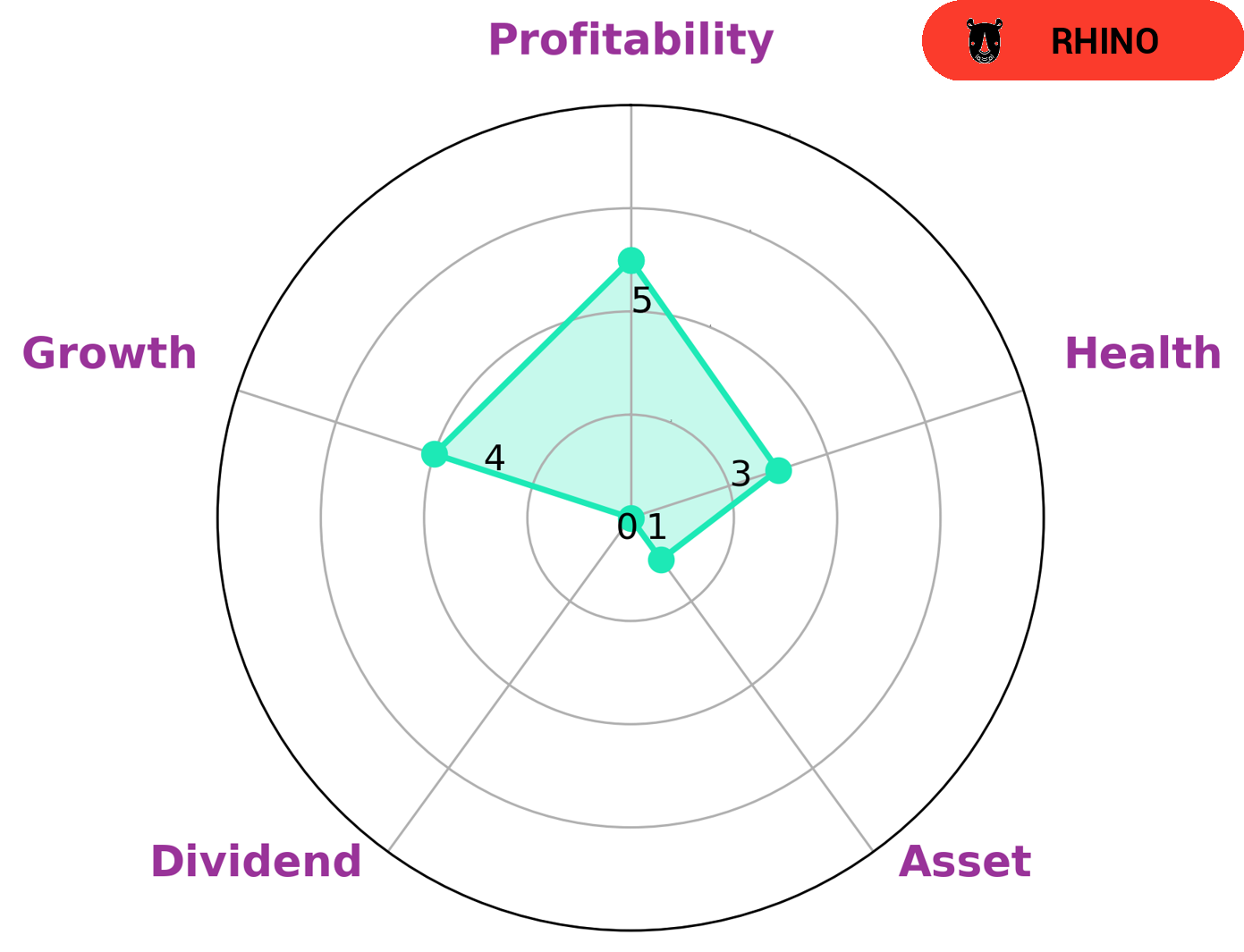

At GoodWhale, we use our Star Chart to give investors a snapshot of how a company has been performing. In the case of AMC ENTERTAINMENT, the company has been classified as a “rhino” – a type of company that has achieved moderate revenue or earnings growth. This means that we predict that investors who are looking for a steady, reliable income stream may be interested in investing in this company. That said, we have given AMC ENTERTAINMENT a health score of 3/10 when considering their cashflows and debt. This means that the company is less likely to be able to pay off debt and fund future operations. On top of this, AMC ENTERTAINMENT is strong in medium in terms of growth, profitability and weak in terms of asset and dividend. This all points to a company that may not be the most attractive investment opportunity. More…

Peers

AMC Entertainment Holdings Inc is one of the world’s largest movie theater chains. It has several competitors, including Shine Trend International Multimedia Tec, Bonhill Group PLC, and DEAG Deutsche Entertainment AG.

– Shine Trend International Multimedia Tec ($TPEX:6856)

Shine Trend International Multimedia Tec is a global technology company that provides innovative solutions for the communications, media, and entertainment industries. The company has a market cap of 1.93B as of 2022 and a return on equity of 18.8%. Shine Trend International Multimedia Tec is a leading provider of innovative communications and media solutions that enable its customers to connect, interact, and collaborate. The company’s products and services include: broadband and IPTV solutions, cloud-based solutions, content management and delivery solutions, and enterprise communications solutions. Shine Trend International Multimedia Tec is headquartered in Shenzhen, China.

– Bonhill Group PLC ($LSE:BONH)

Bonhill Group PLC is a United Kingdom-based company, which provides business-to-business media and events services. The company operates through four segments: Vitesse Media, Information Media, Investment Media and Events. Vitesse Media segment comprises of online and print publications, which provide news and information for small and medium-sized enterprises (SMEs) in the United Kingdom. Information Media segment provides market intelligence, news and analysis on the technology, media and telecom sectors. Investment Media segment focuses on the private equity and venture capital markets. Events segment consists of conferences, exhibitions and awards.

Summary

AMC Entertainment reported a beat for the fourth-quarter of 2023 with 8-cent earnings. While initially this news was met with optimism from investors, the stock price subsequently dipped. This could be an indication that market expectations may have been met and surpassed, yet investors remain uncertain about AMC Entertainment’s future prospects.

Investors should conduct further research before deciding if AMC Entertainment is a worthy investment. Analyzing the company’s financials, competition in the industry, and expected market conditions can help investors decide whether AMC Entertainment is a sound investment.

Recent Posts