UBS Group AG Significantly Cuts Stake in EMCOR Group, Inc

June 12, 2023

🌧️Trending News

The drastic reduction in UBS Group AG’s stake in EMCOR ($NYSE:EME) Group, Inc. could be seen as a sign of a potential shift in strategy for the company. It is unclear what impact this move may have on the company’s stock performance in the near future, but it is likely that investors will be paying close attention to the stock’s performance over the coming months.

Share Price

On Wednesday, EMCOR GROUP, Inc. saw its stock open at $175.0 and close at $176.7, up by 1.2% from its prior closing price of 174.6. The surge in stock price was a result of UBS Group AG significantly decreasing its stake in the company. The impact of the reduction in stake on EMCOR GROUP, Inc. remains to be seen as the market digests this news. However, it is likely that the stock price of the company will remain relatively stable in the short-term as investors assess the impact of this news and decide how to proceed. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Emcor Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.37k | 444.21 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Emcor Group. More…

| Operations | Investing | Financing |

| 509.16 | -152.25 | -445.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Emcor Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.64k | 3.57k | 41.4 |

Key Ratios Snapshot

Some of the financial key ratios for Emcor Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 10.0% | 5.5% |

| FCF Margin | ROE | ROA |

| 3.9% | 19.4% | 6.9% |

Analysis

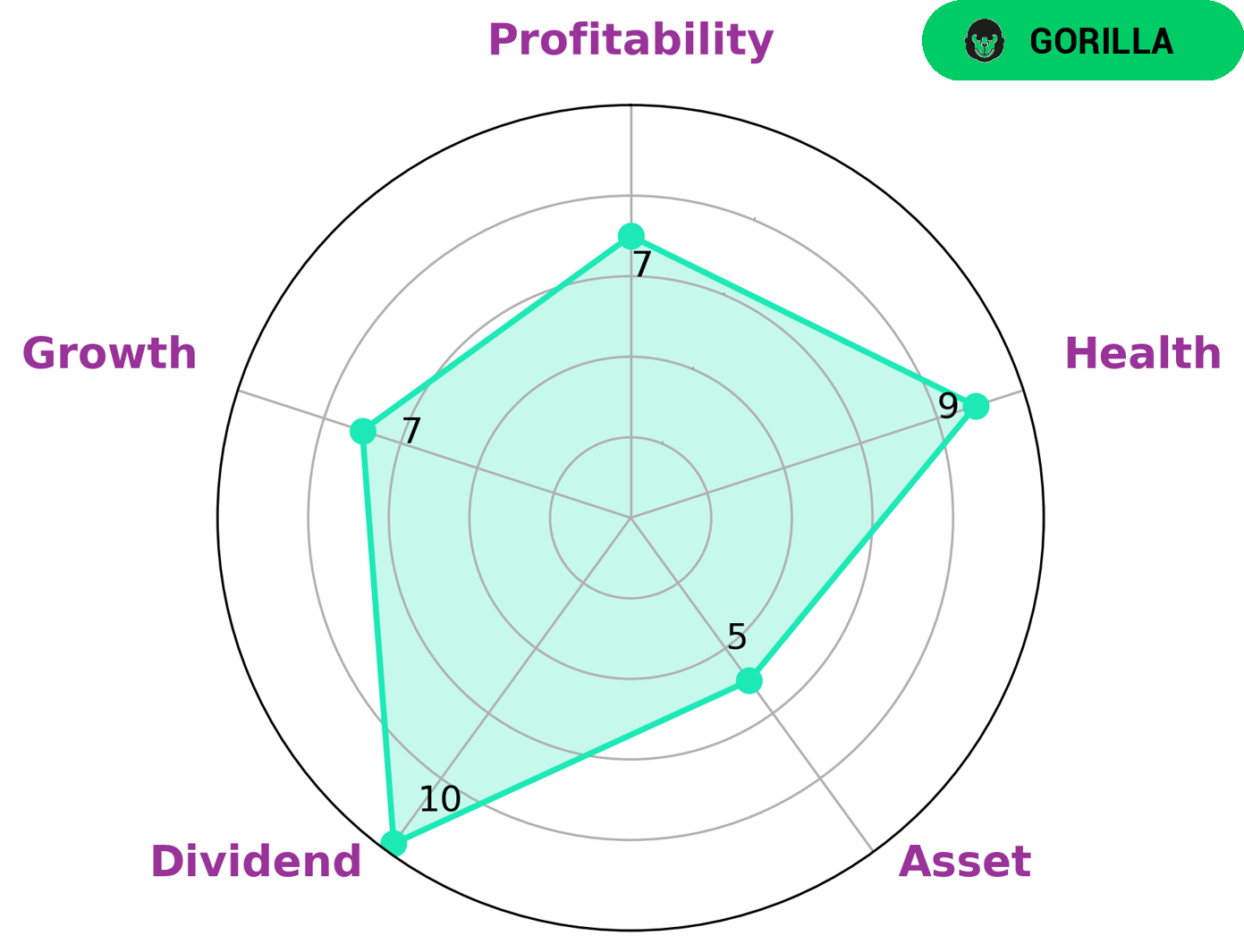

GoodWhale recently conducted an analysis of EMCOR GROUP‘s financials and our Star Chart showed that the company is strong in the areas of dividend, growth, and profitability as well as medium in asset. We also found that the company has a high health score of 9/10, which indicates that it is capable of paying off debt and funding future operations. Investors who are looking for a reliable and stable source of returns with potential for growth may be interested in investing in EMCOR GROUP. More…

Peers

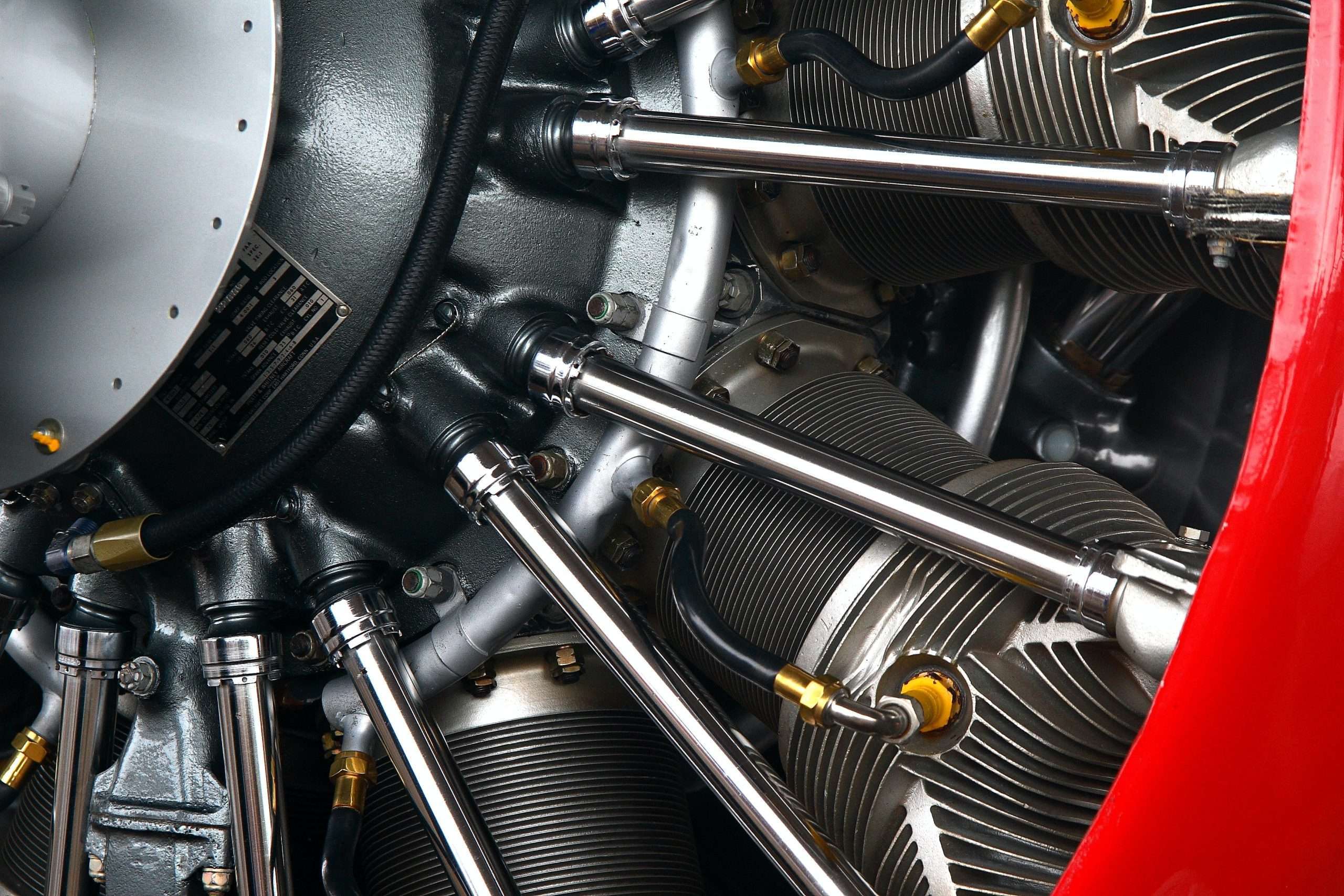

EMCOR Group Inc. is in the business of providing electrical and mechanical construction and facilities services. The company operates in three segments: Commercial & Industrial, Utilities & Power, and Federal. EMCOR Group Inc. has a market capitalization of $8.3 billion and its competitors include Comfort Systems USA Inc, Sterling Construction Co Inc, and NV5 Global Inc.

– Comfort Systems USA Inc ($NYSE:FIX)

Comfort Systems USA Inc is a leading provider of mechanical and electrical installation, maintenance, and repair services in the United States. The company has a market cap of 3.81 billion and a return on equity of 14.84%. Comfort Systems USA Inc provides a wide range of services to a diversified customer base, including commercial, industrial, and institutional clients. The company’s services include heating, ventilation, and air conditioning (HVAC), plumbing, piping, controls, and metalwork. Comfort Systems USA Inc has a strong commitment to safety, quality, and customer satisfaction. The company has a workforce of over 4,000 employees and operates in over 100 locations across the United States.

– Sterling Construction Co Inc ($NASDAQ:STRL)

Sterling Construction Company, Inc. engages in the construction of infrastructure for the development and maintenance of transportation and water infrastructure in the United States. The company operates through two segments, Transportation Infrastructure Construction, and Commercial and Industrial Construction. The Transportation Infrastructure Construction segment includes the construction of highways, roads, bridges, airfields, ports, light rail, and heavy rail systems. The Commercial and Industrial Construction segment comprises the construction of parking structures, office buildings, healthcare facilities, educational facilities, retail centers, and other commercial/industrial projects. Sterling Construction Company, Inc. was founded in 1956 and is headquartered in The Woodlands, Texas.

As of 2022, Sterling Construction Company’s market cap is 755.09 million dollars and its ROE is 23.39%. Sterling Construction Company is a construction company that operates in the United States, constructing various infrastructure projects such as highways, bridges, and office buildings.

– NV5 Global Inc ($NASDAQ:NVEE)

NV5 Global Inc. is a provider of professional and technical engineering and consulting solutions to public and private sector clients in the infrastructure, energy, construction, real estate, and environmental markets. The company has a market cap of $2.11 billion and a return on equity of 8.78%. NV5’s services include program management, project management, construction management, and general consulting. The company serves a variety of clients, including government agencies, municipalities, utilities, developers, and commercial and industrial businesses.

Summary

This is a notable development as the company’s stock has seen strong performance over the past year. Analysts are taking a closer look at EMCOR’s financials, and evaluating its potential for long-term gains. Factors such as revenue growth, profitability, and debt levels are being scrutinized, along with expected returns from future investments. Investors should keep an eye on the market to see if this trend continues and opportunities arise.

Recent Posts