TopBuild Corp. Insider Steven P. Raia Sells 2700 Shares of Stock

June 12, 2023

☀️Trending News

TOPBUILD ($NYSE:BLD): TopBuild Corp. is a leading installer and distributor of insulation products to the United States construction industry. The company provides services for both residential and commercial customers, as well as specialized services for fire protection and roofing systems. Recently, Steven P. Raia, an insider at TopBuild Corp., sold 2700 shares of the company’s stock. The sale was disclosed in a filing with the Securities and Exchange Commission, which is available through this link.

Price History

On Wednesday, TOPBUILD CORP (NYSE: BLD) stock opened at $226.1 and closed at $228.5, representing a 1.6% increase from its previous closing price of $224.8. Given that insiders have access to non-public information regarding the company’s performance and prospects, this sale could be an indication that the company’s stock may not perform as well as it has been doing recently. However, the insider has still retained a sizable amount of shares in the company and may be looking to diversify their portfolio. Either way, investors should remain cautious and monitor the stock price closely to assess how the company is performing in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Topbuild Corp. More…

| Total Revenues | Net Income | Net Margin |

| 5.11k | 577.15 | 11.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Topbuild Corp. More…

| Operations | Investing | Financing |

| 576.12 | -122.75 | -244.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Topbuild Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.7k | 2.64k | 60.77 |

Key Ratios Snapshot

Some of the financial key ratios for Topbuild Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.3% | 40.1% | 16.4% |

| FCF Margin | ROE | ROA |

| 9.8% | 27.1% | 11.1% |

Analysis

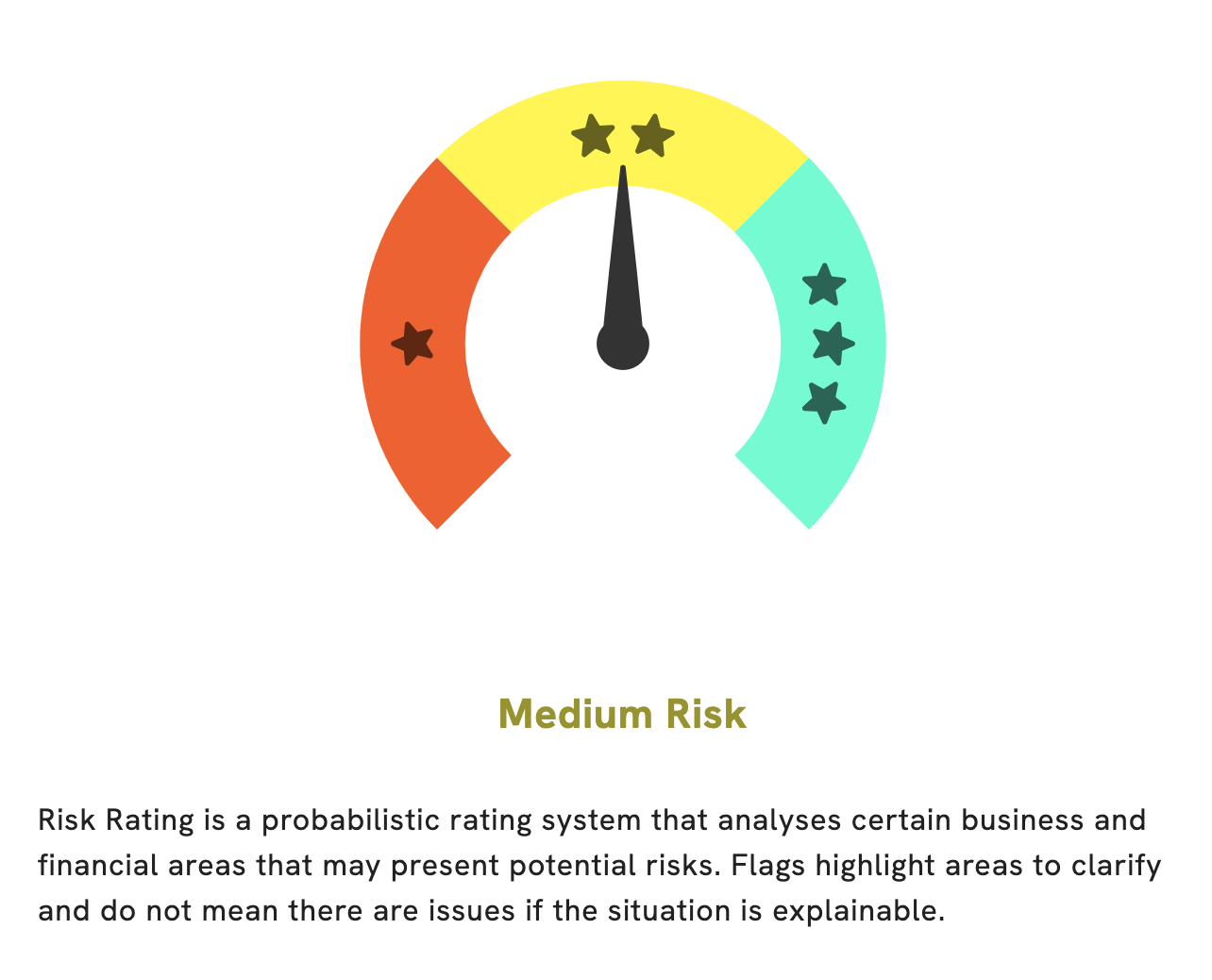

At GoodWhale, we have analyzed the fundamentals of TOPBUILD CORP. Based on our Risk Rating assessment, TOPBUILD CORP is a medium risk investment in terms of its financial and business aspects. We have detected two risk warnings in the balance sheet and cashflow statement of TOPBUILD CORP. If you’d like to know more, register with us at goodwhale.com and see the full risk assessment for yourself. More…

Peers

There is intense competition between TopBuild Corp and its competitors: BlueLinx Holdings Inc, Beacon Roofing Supply Inc, Grafton Group PLC. All of these companies are trying to gain market share in the highly competitive building materials industry. TopBuild Corp has been able to differentiate itself from its competitors by offering a unique combination of products and services that are unmatched in the industry.

– BlueLinx Holdings Inc ($NYSE:BXC)

BlueLinx Holdings Inc is a holding company that engages in the wholesale distribution of building and industrial products in the United States. It operates through the following segments: Engineered Products and Building Products. The Engineered Products segment offers metal components and industrial products. The Building Products segment focuses on lumber and lumber sheet goods, millwork, roofing, siding, decking, fencing, insulation, gypsum, and other specialty building products. The company was founded on January 25, 2002 and is headquartered in Atlanta, GA.

– Beacon Roofing Supply Inc ($NASDAQ:BECN)

Beacon Roofing Supply Inc is a publicly traded company that engages in the distribution of roofing materials and complementary building products in the United States and Canada. It has a market cap of 3.66B as of 2022 and a return on equity of 11.71%. The company was founded in 1928 and is headquartered in Herndon, Virginia.

Summary

Investors should be aware that this could potentially signal a lack of confidence in the company’s future prospects. However, they should also take into account that insiders do not always have accurate insight into performance of the company. Before making any decisions to buy or sell TopBuild Corp’s stock, investors should do their own research, such as reviewing the financial statements and long-term performance of the company. Additionally, they should look at the company’s competitive standing in the industry and consider the quality of its management and products.

Recent Posts