Russell Investments Group Ltd. Divests 316 Shares of Arcosa,

May 17, 2023

Trending News ☀️

Arcosa ($NYSE:ACA), Inc. is a publicly traded company in the United States that produces infrastructure-related products and services. The company operates in three segments: Infrastructure Products, Construction Services, and Energy Services. This move follows Russell’s recent decision to divested from a wide range of companies, including Arcosa. The divestment is part of Russell’s strategy to focus on funds with higher growth potential and better returns.

The divestment had a minimal impact on the stock price of Arcosa and the company is still well-positioned to continue growing and providing innovative solutions to its customers. Despite the divestment, Arcosa still has many investors and remains a strong force in the infrastructure industry. The company is well-poised to capitalize on future growth opportunities as the infrastructure industry continues to evolve.

Stock Price

This was evident from the stock market data, where the stock opened at $68.2 and closed at $68.3, a decrease of 0.5% from the previous closing price of 68.6. This divestment is likely to impact the stock of Arcosa and its investors in the short-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcosa. More…

| Total Revenues | Net Income | Net Margin |

| 2.26k | 280.2 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcosa. More…

| Operations | Investing | Financing |

| 177.1 | 61.9 | -178.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcosa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.42k | 1.17k | 46.35 |

Key Ratios Snapshot

Some of the financial key ratios for Arcosa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | 2.4% | 17.3% |

| FCF Margin | ROE | ROA |

| 0.9% | 11.0% | 7.1% |

Analysis

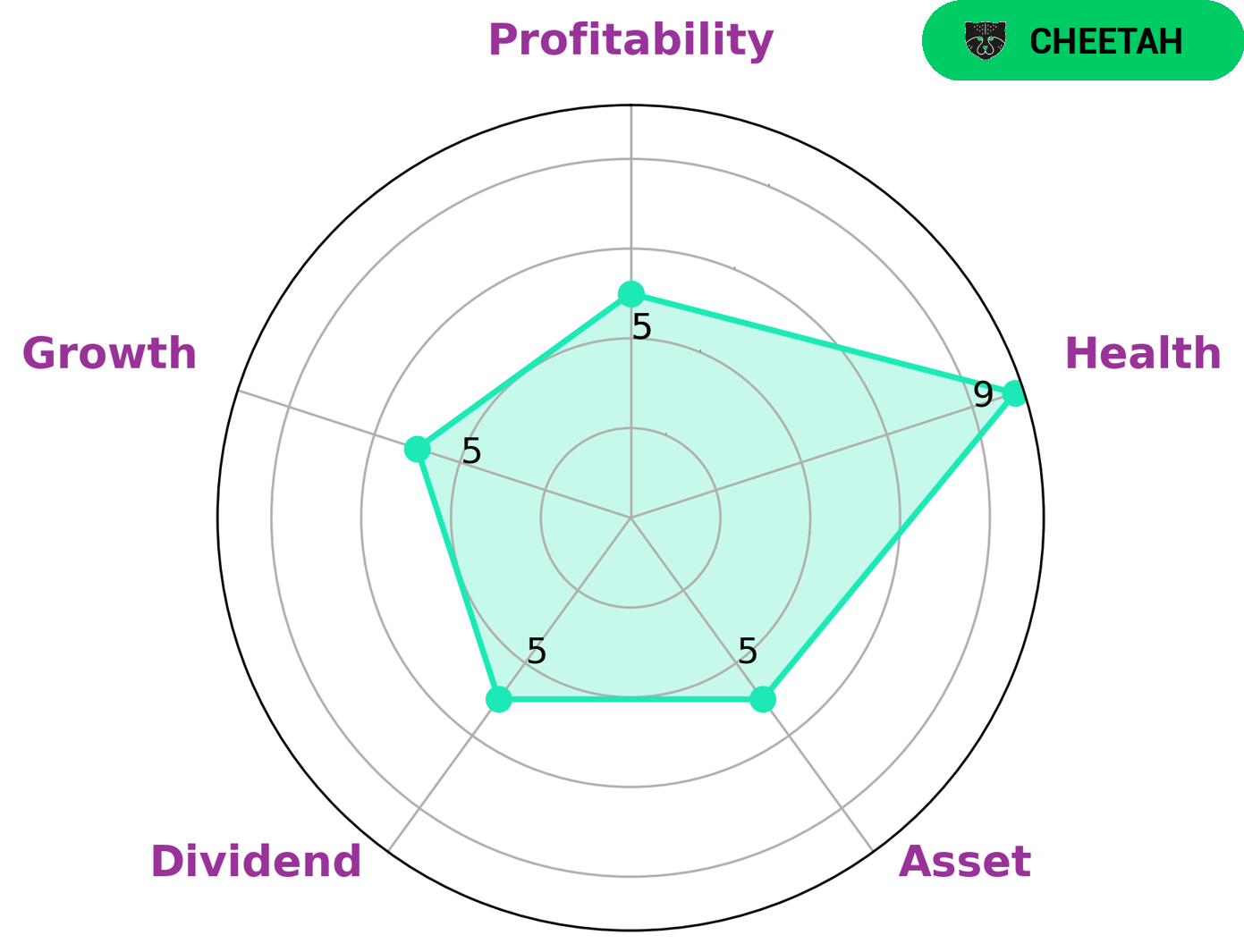

After carefully analyzing ARCOSA’s financials, GoodWhale’s Star Chart classified them as a ‘cheetah’, a type of company that achieves high growth in revenue or earnings but has lower profitability. This type of company may interest investors who have a higher risk appetite, as they look to capitalize on the higher potential for returns. Despite this, ARCOSA has a health score of 9/10 from GoodWhale, indicating that they are able to safely ride out any crisis without the risk of bankruptcy. GoodWhale also rates ARCOSA as strong in cashflow and debt and medium in asset, dividend, growth, profitability. This signals that ARCOSA is a relatively safe investment with potential for returns. Arcosa“>More…

Peers

The company has a wide range of products and services that cover all aspects of infrastructure development, from design and construction to financing and operations. Arcosa Inc’s main competitors are Sterling Construction Co Inc, Trace SOP EOOD, BCPL Railway Infrastructure Ltd.

– Sterling Construction Co Inc ($NASDAQ:STRL)

Sterling Construction Co Inc is a construction company that specializes in the building of transportation infrastructure projects. The company has a market capitalization of $938.7 million as of 2022 and a return on equity of 19.94%. The company’s main operations are focused on the construction of highways, roads, bridges, and other transportation-related infrastructure projects.

– Trace SOP EOOD ($LTS:0M7W)

Trace SOP EOOD is a Bulgaria-based company engaged in the provision of software solutions. The Company offers a range of software products, including an accounting system, a human resources and payroll system, and a customer relationship management system, among others. Trace SOP EOOD has a market capitalization of 88.07M as of 2022, a return on equity of 3.34%. The company provides software solutions to businesses of all sizes, from small businesses to large enterprises. Trace SOP EOOD’s products are used by businesses in a variety of industries, including healthcare, manufacturing, retail, and government.

– BCPL Railway Infrastructure Ltd ($BSE:542057)

The market capitalization of BCPP Railway Infrastructure Ltd. as of 2022 was 729.99 million, with a return on equity of 9.17%. The company is engaged in the business of providing railway infrastructure services. It is a subsidiary of Bharat Cookware & Pressure Pipe Ltd.

Summary

Arcosa, Inc. saw a recent sale of 316 shares by Russell Investments Group Ltd. This signals a potential investment shift within the company’s stock portfolio. The company has also seen an increase in revenue for the last four quarters, putting it in a strong position for future investments. Arcosa, Inc. is a well-known name in the construction and infrastructure industry, and its strong financial performance suggests investors should continue to keep an eye on its progress.

Recent Posts