PARTNERS WITH Catalyst Power To Provide Ev Charging For Commercial And Industrial Businesses In Northeast

April 25, 2023

Trending News 🌥️

Blink Charging ($NASDAQ:BLNK) Co. (BLNK), a leading owner, operator, and provider of electric vehicle (EV) charging services, has recently announced a strategic partnership with Catalyst Power to provide EV charging services for commercial and industrial businesses in the Northeast. The company’s mission is to build an interconnected, leading-edge charging network that meets the needs of both demographic and geographic areas. Furthermore, Blink has a strong focus on developing innovative technologies to enhance its charging services, like its Blink IQ app, to provide customers with easy access to its charging services. Additionally, the company offers a variety of financing options to help businesses and consumers make the switch to EVs.

Price History

The announcement was met with mixed reactions in the stock market, as BLINK CHARGING’s stock opened at $7.8 and closed at $7.6, down by 2.6% from the last closing price of 7.8. Despite the slight dip in the stock price, investors are optimistic about the long-term success of the partnership and its potential to drive growth for BLINK CHARGING. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Blink Charging. More…

| Total Revenues | Net Income | Net Margin |

| 61.14 | -91.56 | -149.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Blink Charging. More…

| Operations | Investing | Financing |

| -82.36 | -57.44 | 6.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Blink Charging. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 362.54 | 101.58 | 5.07 |

Key Ratios Snapshot

Some of the financial key ratios for Blink Charging are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 180.9% | – | -146.0% |

| FCF Margin | ROE | ROA |

| -143.8% | -21.0% | -15.4% |

Analysis

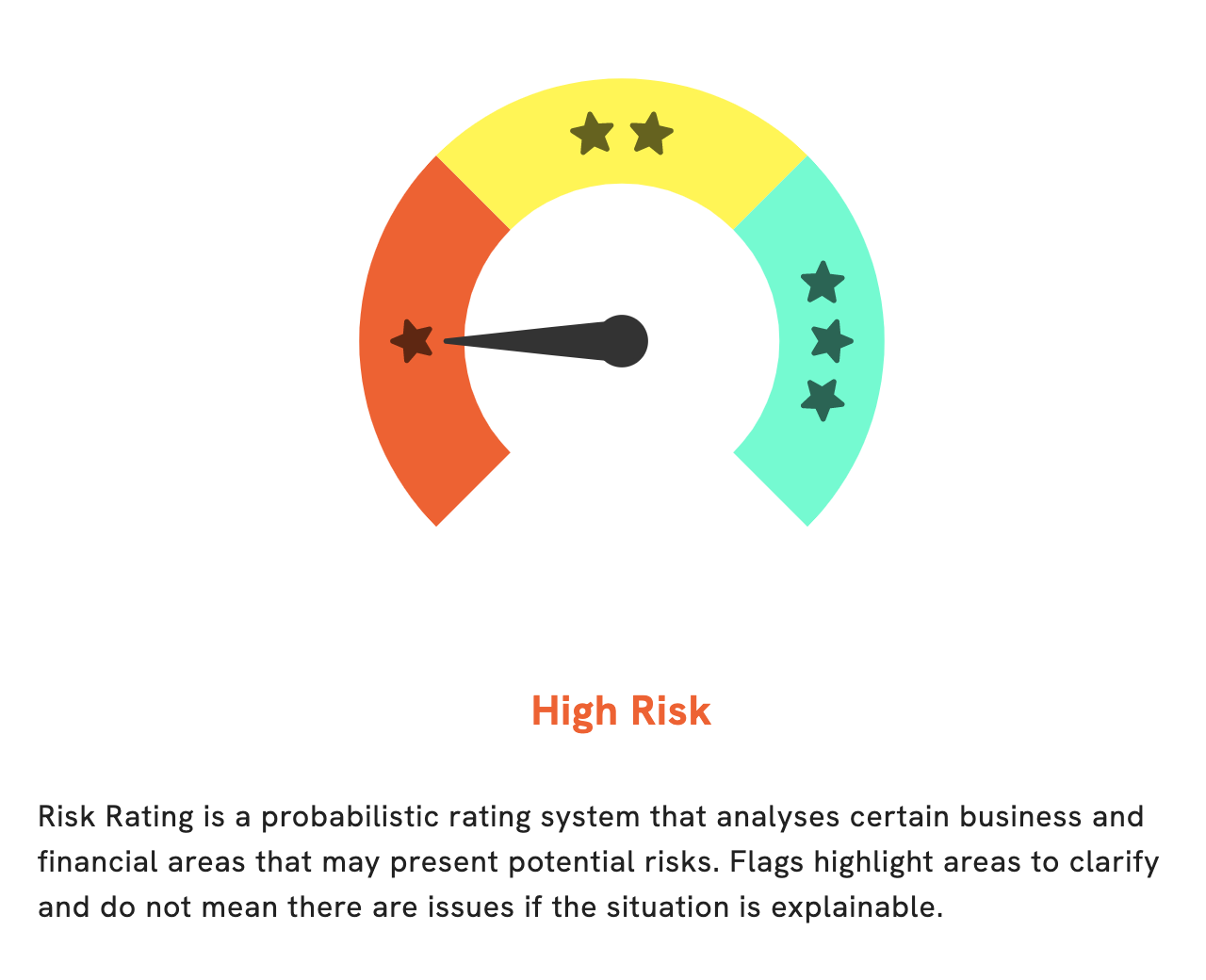

GoodWhale can help you analyze the financials of BLINK CHARGING. After doing a thorough financial analysis, our Risk Rating determined that BLINK CHARGING is a high risk investment in terms of financial and business aspects. We have detected 4 risk warnings in their income statement, balance sheet, cashflow statement, and financial journal that you can take a look at, once you become a registered user. Our analysis will provide you with a comprehensive understanding of the company’s financial health and allow you to make the right decision when it comes to investing in BLINK CHARGING. More…

Peers

The electric vehicle (EV) charging market is currently dominated by Blink Charging Co, but it faces stiff competition from Yurtec Corp, Daisan Co Ltd, and Tokyo Energy & Systems Inc. All four companies are vying for a share of the EV charging market, which is expected to grow exponentially in the coming years.

– Yurtec Corp ($TSE:1934)

Yurtec is one of the world’s largest manufacturers of construction materials, with a focus on concrete and steel. The company has a market cap of 50.63B as of 2022 and a Return on Equity of 5.38%. Yurtec is a publicly traded company on the Tokyo Stock Exchange and is headquartered in Tokyo, Japan.

– Daisan Co Ltd ($TSE:4750)

Daisan Co Ltd is a Japanese company that manufactures and sells electronic and electrical products. It has a market cap of 3.97B as of 2022 and a ROE of 1.65%. The company was founded in 1949 and is headquartered in Osaka, Japan.

– Tokyo Energy & Systems Inc ($TSE:1945)

Tokyo Energy & Systems Inc. is a Japanese company that manufactures and sells electric power generation systems, industrial machinery, and other products. The company has a market capitalization of 31.91 billion as of 2022 and a return on equity of 2.58%. Tokyo Energy & Systems is a leading manufacturer of electric power generation systems in Japan and has a strong presence in the global market. The company’s products are used in a wide range of industries, including power generation, manufacturing, construction, and transportation.

Summary

Blink Charging, a leading provider of electric vehicle (EV) charging services, has partnered with Catalyst Power to offer EV charging services for commercial and industrial businesses in the Northeast. This partnership will allow Blink’s customers to benefit from Catalyst Power’s access to clean energy and its reliable network of charging infrastructure. Investing in Blink Charging stock could be a wise decision for investors, as the company is well-positioned to capitalize on the increasing demand for EV charging services in the Northeast.

As more businesses look for sustainable energy solutions, Blink’s expanded services could be a major advantage for its customers. Furthermore, the partnership could lead to increased revenues for Blink in the future.

Recent Posts