Pacer Advisors Boosts Investment in Extra Space Storage Despite Mixed Ratings from Analysts

May 3, 2023

Trending News ☀️

Extra Space ($TSE:9622) Storage Inc. is a leading owner, operator and developer of self-storage facilities in the United States. Pacer Advisors Inc. has recently increased its stake in the company by purchasing an additional 72374 shares. While this move has been seen as a vote of confidence in Extra Space Storage, analysts have offered a mixed review of the stock’s performance. Some analysts have praised the company’s ability to generate steady revenue even in uncertain economic times, while others have expressed doubts about its ability to grow in the long-term.

In addition, some have noted that the stock’s price-earnings ratio is higher than average, making it less attractive for investors seeking value. Despite these mixed ratings, Pacer Advisors is continuing to invest in Extra Space Storage, indicating that it believes in the company’s potential.

Market Price

The stock opened at JP¥935.0 and managed to close at JP¥940.0, up by 1.0% from the previous closing price of JP¥931.0. While the stock had seen a drop in price earlier this month, the market responded well to the renewed investment from Pacer Advisors. Space_Storage_Despite_Mixed_Ratings_from_Analysts”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Space. More…

| Total Revenues | Net Income | Net Margin |

| 46.71k | 1.39k | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Space. More…

| Operations | Investing | Financing |

| -29.79 | -82.08 | -1.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Space. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 35.4k | 5.81k | 1.21k |

Key Ratios Snapshot

Some of the financial key ratios for Space are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.3% | -12.7% | 4.6% |

| FCF Margin | ROE | ROA |

| -0.2% | 4.5% | 3.8% |

Analysis

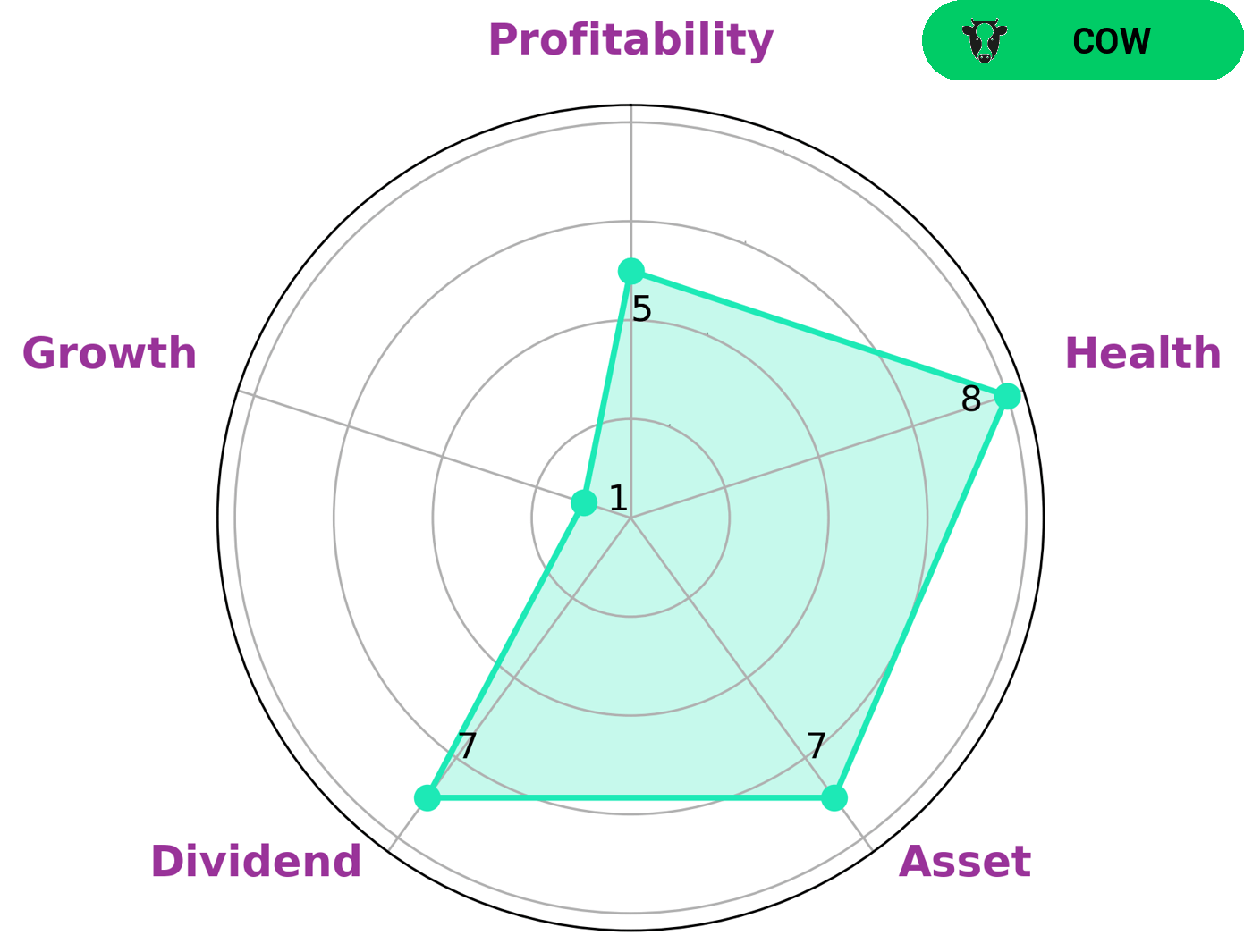

At GoodWhale, we recently conducted an analysis of the wellbeing of SPACE. Our Star Chart revealed that SPACE is strong in asset, dividend and medium in profitability, but weak in growth. Upon further review, we have concluded that SPACE has a high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable of safely riding out any crisis without the risk of bankruptcy. Based on our findings, we classify SPACE as a ‘cow’, a type of company we believe has the track record of paying out consistent and sustainable dividends. This type of company may be attractive to those looking for steady return on investment and long-term appreciation. It may also be appealing to those who prefer to diversify their investments with a mix of high-growth and low-risk stocks. More…

Peers

Space Co Ltd is in a fiercely competitive environment with LingNan Eco & Culture-Tourism Co Ltd, NOMURA Co Ltd and Hangzhou Landscape Architecture Design Institute Co Ltd all vying for market share. With every company striving to deliver the best products and services to customers, Space Co Ltd is under pressure to stay ahead of its competitors.

– LingNan Eco & Culture-Tourism Co Ltd ($SZSE:002717)

LingNan Eco & Culture-Tourism Co Ltd is a Chinese travel and tourism company that specializes in eco-tourism and cultural experiences. The company has a market cap of 5.19B as of 2023, which is indicative of the company’s growing presence in the industry. Its Return on Equity (ROE) of -2.64% is a sign that the company is not faring well financially. This could likely be attributed to the fact that the tourism industry has been hit hard by the COVID-19 pandemic. Despite this, LingNan Eco & Culture-Tourism Co Ltd has remained a strong contender in the market and looks forward to a promising future.

– NOMURA Co Ltd ($TSE:9716)

Nomura Co Ltd is a leading financial services group based in Japan. It is a full-service global investment bank, securities and asset management firm, providing a broad range of financial products and services to both individuals and corporations. As of 2023, Nomura’s market cap stands at 102.53B, making it one of the largest players in the industry. Its Return on Equity (ROE) of 7.72% shows that the company is performing well and is highly profitable. This indicates that investors are confident in the company’s ability to generate returns.

– Hangzhou Landscape Architecture Design Institute Co Ltd ($SZSE:300649)

Hangzhou Landscape Architecture Design Institute Co Ltd is a Chinese company that specializes in landscape architecture and design. In 2023, it had a market capitalization of 2.58 billion US dollars and a Return on Equity (ROE) of 4.14%. This indicates that the company is a reliable and well-managed organization, which has been able to generate significant value for its shareholders. Its market capitalization is also a testament to its success in the landscape architecture and design industry, as it is one of the largest companies in the sector. The company’s ROE suggests that it is able to efficiently allocate its resources, as it is able to generate a healthy return on its equity investments.

Summary

Investors are taking a closer look at Extra Space Storage Inc. as mixed ratings from analysts emerge. Pacer Advisors Inc. recently increased its stake in the company, adding 72374 shares. Investors are keeping an eye on the stock performance of Extra Space Storage, considering the current climate in the storage industry.

With many companies contending for storage space, Extra Space Storage must focus on the continued delivery of quality services to maintain its position in the market. Analysts’ ratings offer insight into potential trends in the global storage market and guide investors on where to place their bets.

Recent Posts