Maureen T. F. Reitman, VP of Exponent,, Sells 2000 Shares

December 1, 2023

☀️Trending News

Maureen T. F. Reitman, Vice President of Exponent ($NASDAQ:EXPO), Inc., recently sold 2000 shares of the company’s stock. Exponent, Inc. is a diversified technology and engineering consulting firm. As a leading expert in engineering and sciences, Exponent has a wide range of services and works with clients in various industries such as automotive and commercial vehicles, electronics and semiconductor, consumer products, energy and natural resources, healthcare, medical devices, manufacturing, and telecommunications. The company has earned international recognition for its work in product safety, failure analysis, and product development. Furthermore, Exponent’s portfolio of services has been used in litigation support as well as contract and consulting services in the US and abroad.

Exponent has experienced tremendous growth since its founding, both financially and in its number of employees. The company’s stock has consistently outperformed the market and has drawn the attention of both institutional and individual investors. Maureen T. F. Reitman’s recent sale of 2000 shares of Exponent is an indication that the company continues to remain a reliable investment opportunity.

Stock Price

The stock opened at $76.6 and ended the day at $76.5, a decrease of 0.7% from the previous closing price of $77.0. This comes after Exponent‘s stock had been steadily rising since February of this year. It will be interesting to see if the price continues to go down or if the current dip is just a minor adjustment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exponent. More…

| Total Revenues | Net Income | Net Margin |

| 541.22 | 101.93 | 20.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exponent. More…

| Operations | Investing | Financing |

| 103.83 | -12.04 | -215.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exponent. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 602.46 | 248.83 | 6.95 |

Key Ratios Snapshot

Some of the financial key ratios for Exponent are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 9.8% | 21.2% |

| FCF Margin | ROE | ROA |

| 16.0% | 20.2% | 11.9% |

Analysis

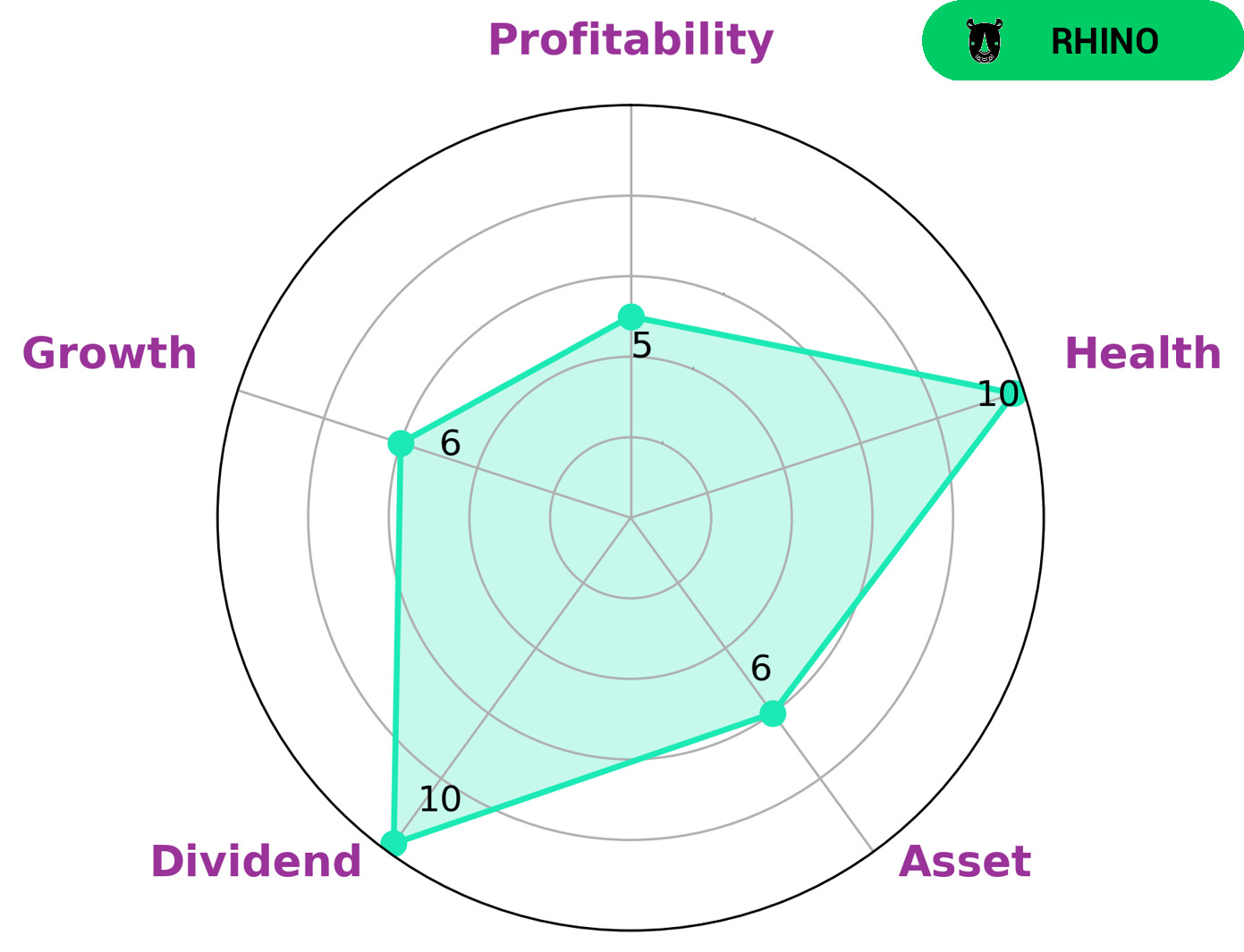

GoodWhale has conducted an analysis of EXPONENT‘s fundamentals and classified the company as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. According to our Star Chart, EXPONENT has a health score of 10/10, indicating that it is capable of paying off debt and funding future operations. We can also see that EXPONENT is strong in dividend and has medium asset, growth, and profitability. This type of company may be attractive to investors who are seeking steady returns with moderate risk. Investors who value income, stability, and predictability may find EXPONENT to be an attractive option. Moreover, its high health score indicates that EXPONENT is capable of generating returns over the long term. In conclusion, EXPONENT appears to be a strong investment opportunity with a good balance between risk and return. More…

Peers

With over 3,000 employees in more than 85 offices around the world, Exponent has the breadth and depth of expertise to support our clients with multidisciplinary solutions to solve the most complex problems. We work with a range of clients in the oil and gas, chemical, pharmaceutical, power, manufacturing, and technology industries, as well as government agencies and nonprofit organizations.

– Zhenhai Petrochemical Engineering Co Ltd ($SHSE:603637)

Zhenhai Petrochemical Engineering Co Ltd is a Chinese company that provides engineering, procurement, and construction services to the petrochemical industry. The company has a market capitalization of 2.09 billion as of 2022 and a return on equity of 5.9%. Zhenhai Petrochemical Engineering Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sino Daan Co Ltd ($SZSE:300635)

Sino Daan Co Ltd is a company that manufactures and sells electronic products. The company has a market cap of 1.92B as of 2022 and a return on equity of 3.86%. The company’s products include mobile phones, tablets, laptops, and other electronic devices.

– Wison Engineering Services Co Ltd ($SEHK:02236)

Wison Engineering Services Co Ltd has a market cap of 1.12B as of 2022. The company provides engineering, procurement, and construction services in China. It has a Return on Equity of -2.43%.

Summary

Investors should take note of a recent stock transaction made by Maureen T. F. Reitman, the Vice President of Exponent Inc. She has sold 2000 shares of the company’s stock, a significant amount considering the stock’s current market capitalization. This could be a warning sign that there could be underlying issues with the company’s financial health. Investors should look into the company’s balance sheet and cash flow statements to get a better understanding of the company’s financial situation.

Additionally, they should analyze Exponent’s performance relative to other firms in the same industry, and review analyst estimates for near-term performance. Doing so will help investors make an informed decision about whether buying or selling the stock is a good idea.

Recent Posts