Janney Montgomery Scott LLC Unloads Stake in EMCOR Group,

May 3, 2023

Trending News 🌥️

The disposal was made to Defense World, a leading defense services company. EMCOR ($NYSE:EME) Group, Inc. is a publicly-traded international leader in the construction and facilities services sector.

Price History

On Tuesday, Janney Montgomery Scott LLC unloaded its stake in EMCOR Group, Inc., with the stock opening at $167.3 and closing at $166.7, down 0.5% from the previous closing price of 167.6. Despite this, Janney Montgomery Scott LLC chose to exit its position in the publicly traded EMCOR Group, Inc. stock. It remains to be seen what the future holds for the company, or if shareholders will follow Janney Montgomery Scott LLC’s lead and offload their stock.

If a large number of investors choose to sell their shares, it could cause the price of EMCOR Group, Inc. stock to drop further. For now, investors will be watching to see how this decision impacts the company and its share price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Emcor Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.37k | 444.21 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Emcor Group. More…

| Operations | Investing | Financing |

| 509.16 | -152.25 | -445.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Emcor Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.64k | 3.57k | 41.4 |

Key Ratios Snapshot

Some of the financial key ratios for Emcor Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 10.0% | 5.5% |

| FCF Margin | ROE | ROA |

| 3.9% | 19.4% | 6.9% |

Analysis

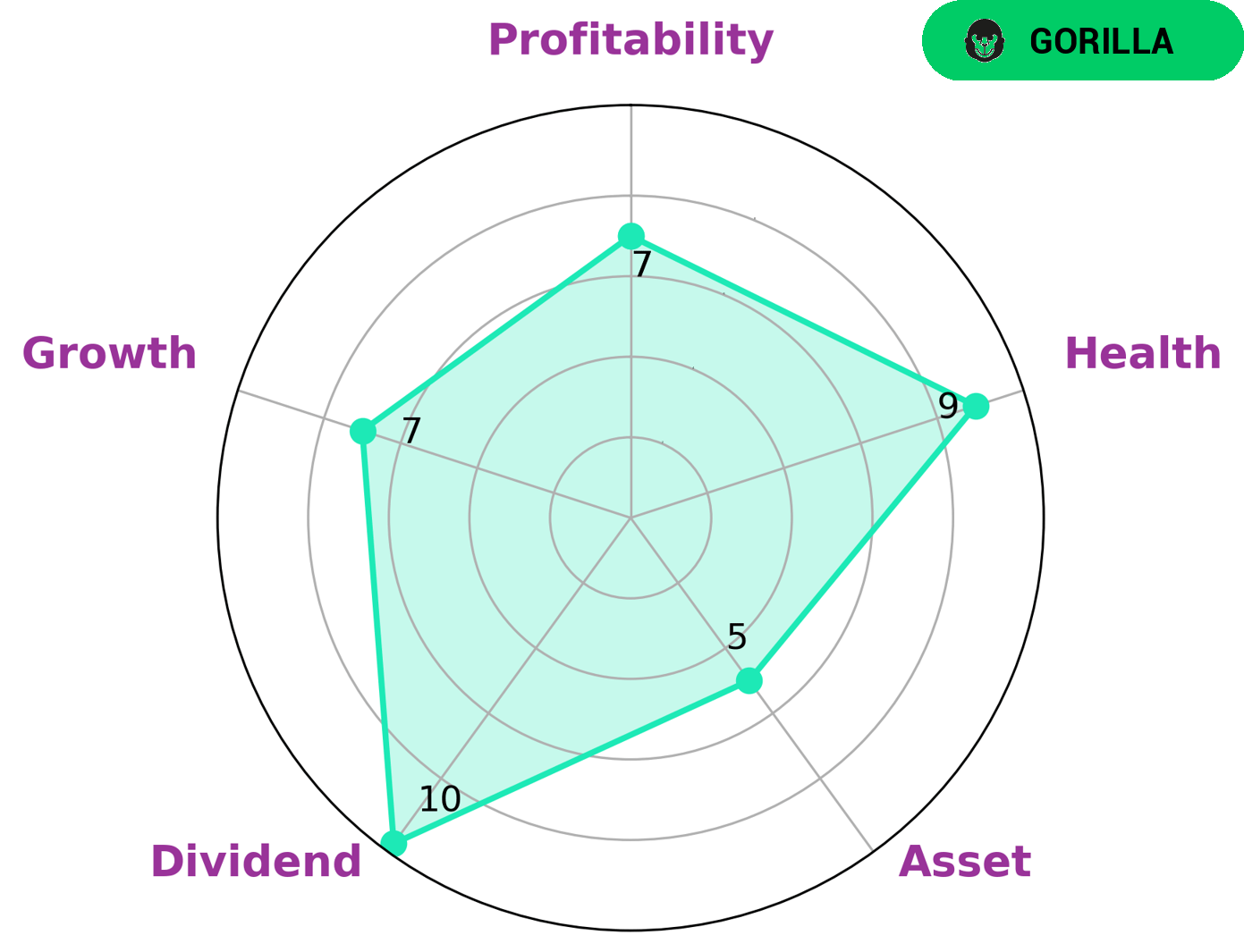

At GoodWhale, we conducted an analysis of EMCOR GROUP‘s wellbeing. Our star chart reveals that EMCOR GROUP has a high health score of 9/10 with respect to its cashflows and debt. This suggests that they are capable of sustaining future operations in times of financial crisis. We have also determined that EMCOR GROUP is strong in dividend, growth, and profitability, and medium in asset. Given its overall strength and stability, we believe that EMCOR GROUP would attract investors who are seeking to diversify their portfolio with a well-rounded company that offers a healthy return on their investments. Institutional investors and individual investors who prioritize strong and stable returns may be particularly interested in EMCOR GROUP. More…

Peers

EMCOR Group Inc. is in the business of providing electrical and mechanical construction and facilities services. The company operates in three segments: Commercial & Industrial, Utilities & Power, and Federal. EMCOR Group Inc. has a market capitalization of $8.3 billion and its competitors include Comfort Systems USA Inc, Sterling Construction Co Inc, and NV5 Global Inc.

– Comfort Systems USA Inc ($NYSE:FIX)

Comfort Systems USA Inc is a leading provider of mechanical and electrical installation, maintenance, and repair services in the United States. The company has a market cap of 3.81 billion and a return on equity of 14.84%. Comfort Systems USA Inc provides a wide range of services to a diversified customer base, including commercial, industrial, and institutional clients. The company’s services include heating, ventilation, and air conditioning (HVAC), plumbing, piping, controls, and metalwork. Comfort Systems USA Inc has a strong commitment to safety, quality, and customer satisfaction. The company has a workforce of over 4,000 employees and operates in over 100 locations across the United States.

– Sterling Construction Co Inc ($NASDAQ:STRL)

Sterling Construction Company, Inc. engages in the construction of infrastructure for the development and maintenance of transportation and water infrastructure in the United States. The company operates through two segments, Transportation Infrastructure Construction, and Commercial and Industrial Construction. The Transportation Infrastructure Construction segment includes the construction of highways, roads, bridges, airfields, ports, light rail, and heavy rail systems. The Commercial and Industrial Construction segment comprises the construction of parking structures, office buildings, healthcare facilities, educational facilities, retail centers, and other commercial/industrial projects. Sterling Construction Company, Inc. was founded in 1956 and is headquartered in The Woodlands, Texas.

As of 2022, Sterling Construction Company’s market cap is 755.09 million dollars and its ROE is 23.39%. Sterling Construction Company is a construction company that operates in the United States, constructing various infrastructure projects such as highways, bridges, and office buildings.

– NV5 Global Inc ($NASDAQ:NVEE)

NV5 Global Inc. is a provider of professional and technical engineering and consulting solutions to public and private sector clients in the infrastructure, energy, construction, real estate, and environmental markets. The company has a market cap of $2.11 billion and a return on equity of 8.78%. NV5’s services include program management, project management, construction management, and general consulting. The company serves a variety of clients, including government agencies, municipalities, utilities, developers, and commercial and industrial businesses.

Summary

EMCOR Group, Inc., an electrical and mechanical construction and facilities services provider, recently saw Janney Montgomery Scott LLC sell 632 of its shares. Analysts remain positive about the stock, noting the company’s strong earnings report and robust operating performance. In addition, the company has a healthy balance sheet and growing dividends, making EMCOR Group an attractive option for long-term investors.

Recent Posts