HRT Financial LP Increases Stake in APi Group Co. by 115.2% in 4th Quarter

June 4, 2023

🌥️Trending News

API ($NYSE:APG): APi Group Corp. is a leading provider of specialized services to the energy, industrial, commercial, and government markets. It is an international corporation that designs, fabricates, and installs critical components for large infrastructure projects. The company’s operational divisions are divided into three distinct units that include specialty construction, specialty fabrications, and specialty services. HRT Financial LP recently revealed in their latest filing with the Securities and Exchange Commission that they had significantly increased their stake in APi Group Co. by 115.2% in the 4th quarter. This followed a steady stream of investments by HRT Financial LP in APi Group Co., which has helped the company to grow and expand its operations in multiple industries.

HRT Financial LP has also been instrumental in providing the financial backing for some of APi Group’s most ambitious projects. It is also a sign that they have faith in APi Group’s ability to continue to innovate and provide quality services to its customers. With this increased stake, HRT Financial LP has further demonstrated their confidence in APi Group Co., which will undoubtedly lead to greater success in the future.

Analysis

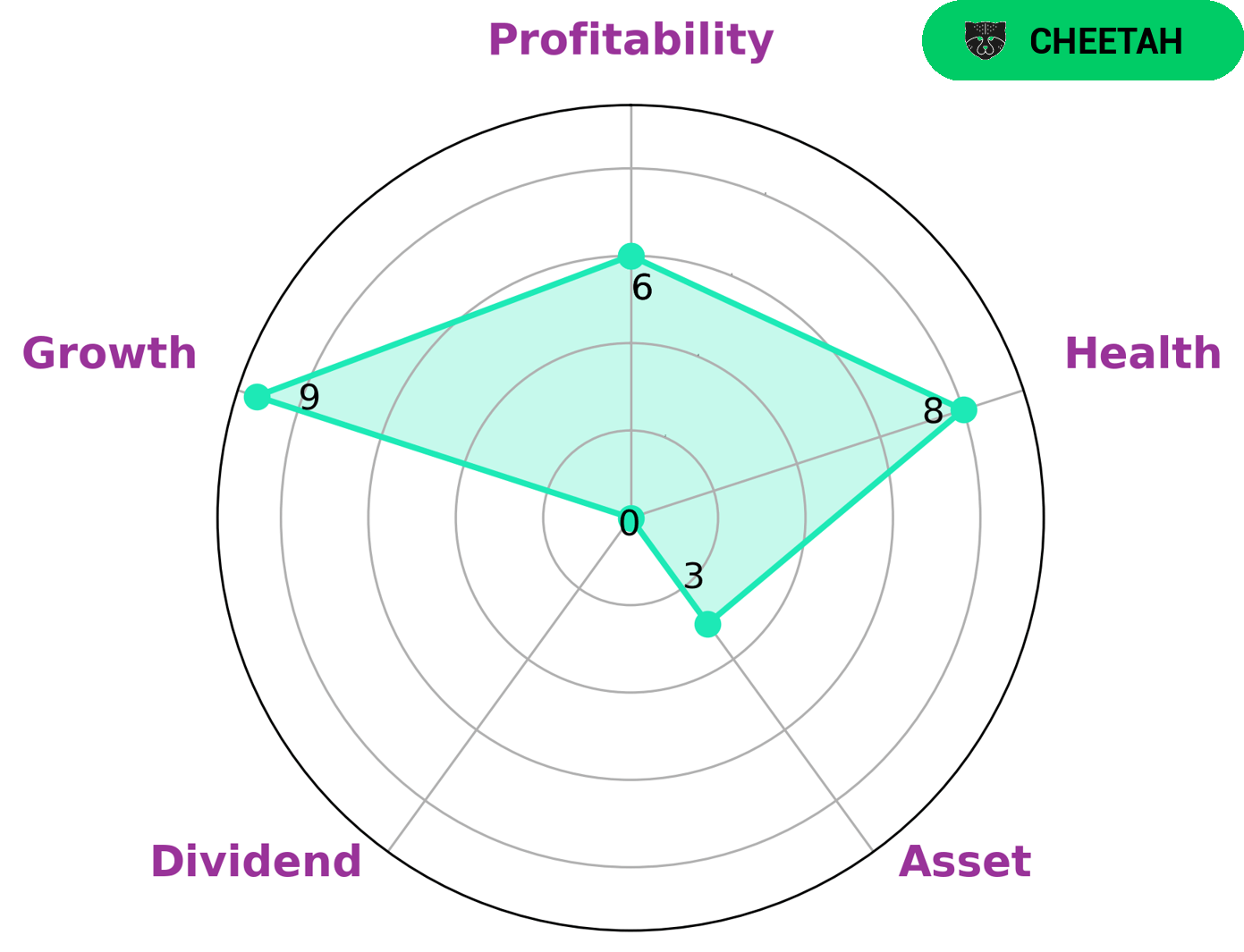

GoodWhale has conducted an analysis of API GROUP‘s financials and found that, based on the Star Chart, API GROUP is strong in growth, medium in profitability and weak in asset and dividend. We have classified API GROUP as a ‘cheetah’, indicating that it has achieved high revenue or earnings growth but is considered less stable due to its lower profitability. The company has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of paying off its debt and funding future operations. This may be attractive to investors who are looking for high growth opportunities with some degree of stability. These investors may be willing to take on a higher risk of potential loss in return for the potential of higher returns. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Api Group. More…

| Total Revenues | Net Income | Net Margin |

| 6.7k | 62 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Api Group. More…

| Operations | Investing | Financing |

| 387 | -44 | -291 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Api Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.77k | 5.6k | 9.2 |

Key Ratios Snapshot

Some of the financial key ratios for Api Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 0.0% | 4.3% |

| FCF Margin | ROE | ROA |

| 4.5% | 7.1% | 2.3% |

Peers

In the engineering and construction industry, APi Group Corp competes with Primoris Services Corp, MasTec Inc, and SPIE SA. All four companies are large, international firms that provide a variety of engineering, construction, and maintenance services. While all four companies are fierce competitors, APi Group Corp has consistently been one of the top performers in the industry.

– Primoris Services Corp ($NASDAQ:PRIM)

Primoris Services Corporation is a leading provider of specialty contracting services operating in the United States, Canada, and Mexico. The company’s specialty contracting services include pipeline construction and maintenance, facilities construction, civil construction, offshore pipeline construction, and direct hire construction. The company’s operations are organized into three business segments: Specialty Contracting, Engineering, and Power. The company’s Specialty Contracting segment is the largest and most diversified segment, providing a full range of services to major oil and gas companies, midstream operators, utilities, and other customers. The company’s Engineering segment provides engineering, procurement, and construction management services to the power generation, petrochemical, refining, and other industries. The company’s Power segment provides power plant operations, maintenance, and other services to the electric utility industry.

– MasTec Inc ($NYSE:MTZ)

MasTec Inc is a publicly traded infrastructure engineering and construction company in the United States. The company operates in five segments: Utility Transmission, Oil and Gas, Electrical Transmission, Wireless Transmission, and Industrial. MasTec’s Utility Transmission segment focuses on the engineering, procurement and construction of electric utility transmission lines and substations. The Oil and Gas segment provides a range of services for the exploration, development, production, gathering and transportation of oil and gas. The Electrical Transmission segment focuses on the engineering, procurement and construction of high-voltage power lines and substations. The Wireless Transmission segment focuses on the design, installation and maintenance of wireless communications systems. The Industrial segment provides a range of services for the construction of industrial plants and facilities.

– SPIE SA ($LTS:0R8M)

SPIE SA is a French-based company that provides services for the oil and gas industry. The company has a market capitalization of 3.84 billion as of 2022 and a return on equity of 12.83%. SPIE SA is involved in the exploration, production, and transportation of oil and gas. The company also provides services for the mining industry.

Summary

API Group is a company that provides services within the areas of fire and life safety, construction and building products, industrial services, and oil and gas. This indicates bullish sentiment in API Group, suggesting that analysts and investors may expect the company to perform well in the near future. Analysts also note that API Group’s competitive advantages are its highly diversified business portfolio, global presence, and strong customer relationships.

Recent Posts