DIRTT Environmental Solutions’ Share Price Drops Below 50-Day Moving Average of $0.86 in 2023.

March 24, 2023

Trending News ☀️

The share price of DIRTT ($TSX:DRT) Environmental Solutions has recently dropped below its 50-day moving average of $0.86 in 2023. This is a major concern for investors, as the mean price of the company’s stock was previously seen as a reliable indicator of its performance. In the short-term, this could lead to a decrease in investor confidence, leading to a further drop in the share price. The company has not released any significant news that could explain the sudden drop, and the stock has been relatively stable in the past few weeks. This could be due to macroeconomic factors such as a downturn in the overall market or an increase in competitors in the market.

Additionally, it could be related to lower sales or profits due to rising costs or a decrease in demand for the company’s products and services. Despite this recent setback, DIRTT Environmental Solutions still has potential for growth. The company has a strong focus on sustainability and has been making strides in developing innovative green solutions to environmental challenges. Its products and services have been well-received by customers and it has an impressive track record of successful projects. As such, there is still potential for long-term growth and investors should seek to understand what has caused the recent drop before making any decisions about their investments.

Price History

Despite mostly positive news about the company at the time of writing, its share price opened at CA$0.7 and closed at CA$0.7, up by 1.5% from prior closing price of 0.7. This marks the company’s lowest stock price in the 50-day period, causing investors to take note of the downward trend in their investments. The company has yet to comment on the effects of the stock drop and its potential implications for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DRT. More…

| Total Revenues | Net Income | Net Margin |

| 172.16 | -54.96 | -27.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DRT. More…

| Operations | Investing | Financing |

| -44.26 | -4.02 | -0.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 143.65 | 125.66 | 0.18 |

Key Ratios Snapshot

Some of the financial key ratios for DRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.4% | -39.3% | -28.9% |

| FCF Margin | ROE | ROA |

| -28.1% | -159.5% | -21.7% |

Analysis

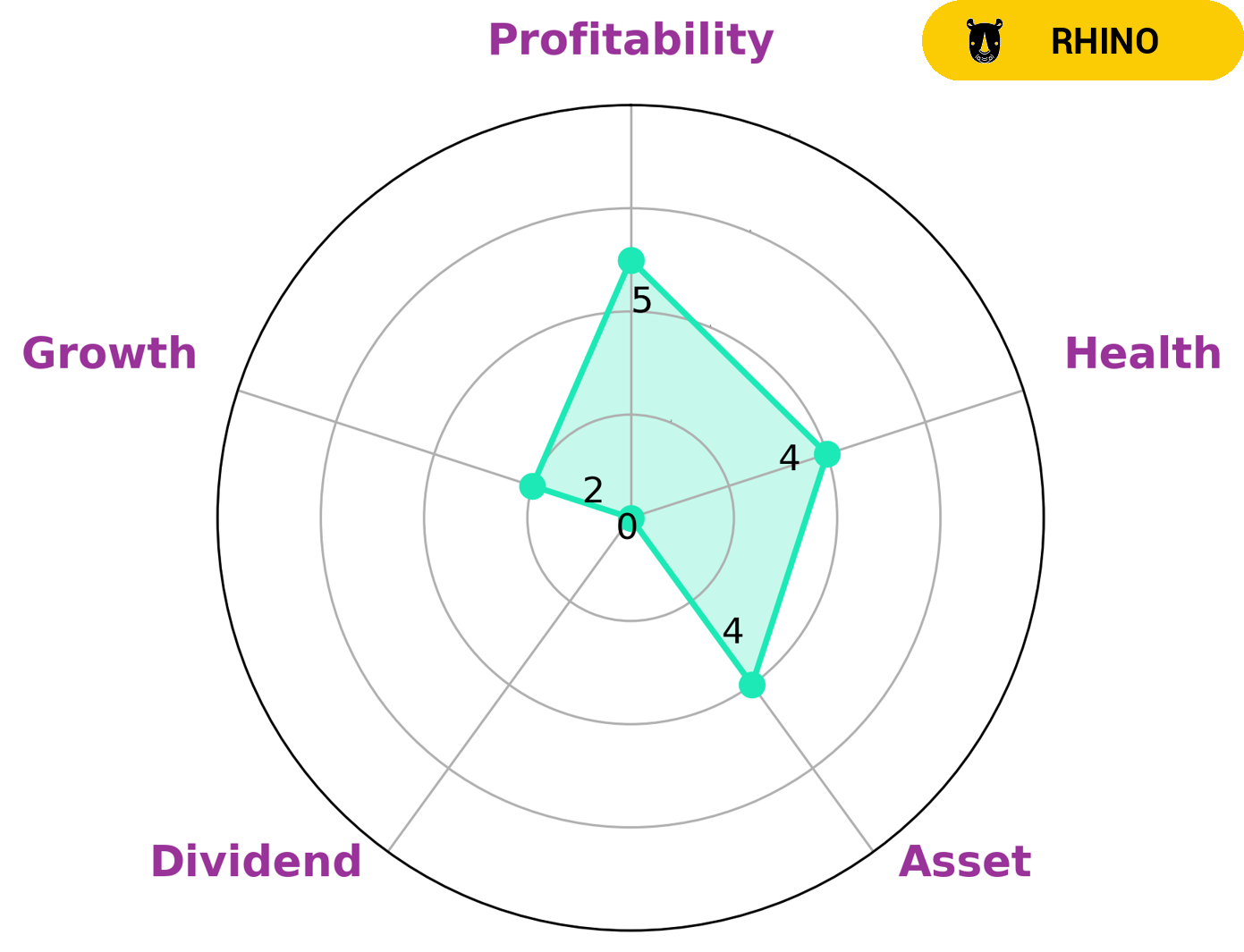

At GoodWhale, we have conducted an assessment of DIRTT ENVIRONMENTAL SOLUTIONS’ fundamentals. According to our Star Chart, DIRTT ENVIRONMENTAL SOLUTIONS is classified as a ‘rhino’, which we consider to be a company with moderate revenue or earnings growth. We believe that investors who are looking for moderate returns would be interested in investing in DIRTT ENVIRONMENTAL SOLUTIONS. Furthermore, we have assessed DIRTT ENVIRONMENTAL SOLUTIONS’ health score to be 4/10 with regard to its cashflows and debt. This means that the company might be able to pay off its debt and fund future operations. However, DIRTT ENVIRONMENTAL SOLUTIONS is strong in liquidity, medium in asset quality, profitability, and weak in dividend strength and growth. More…

Peers

The competition in the construction industry is heating up as Dirtt Environmental Solutions Ltd takes on its competitors IBI Group Inc, KOZO KEIKAKU ENGINEERING Inc, and Pernix Group Inc. All four companies are vying for a piece of the pie in this rapidly growing industry. IBI Group is a large, international engineering firm with a strong presence in the construction industry. KOZO KEIKAKU ENGINEERING is a Japanese engineering firm that has been making inroads into the construction industry in recent years. Pernix Group is a construction firm specializing in turn-key projects.

– IBI Group Inc ($TSX:IBG)

Kozo Keikaku Engineering Inc. is a Japanese construction company with a market capitalization of 14.82 billion as of 2022. The company’s return on equity (ROE) is 14.42%. Kozo Keikaku Engineering is engaged in the design, construction, and maintenance of buildings, plants, and other structures. The company has expertise in the construction of hospitals, office buildings, retail facilities, and homes.

Summary

DIRTT Environmental Solutions is an environmental services company that has seen its share price drop below the 50-day moving average of $0.86 in 2023. Despite this recent dip, the company has seen mostly positive news in the recent past. Analysts suggest that DIRTT Environmental Solutions is a sound investment due to the company’s strong portfolio of environmental services, its considerable market share, and its steady revenue growth.

Moreover, the company has displayed impressive technological advancements and notable sustainability initiatives in areas such as renewable energy, waste reduction, and water conservation. As a result, investors have been encouraged by DIRTT Environmental Solutions’ potential to generate long-term returns.

Recent Posts