Ameresco Stock Intrinsic Value – Ameresco and Sunel to Pursue 1.5 GW of Solar Projects in Europe

April 26, 2023

Trending News 🌥️

Ameresco ($NYSE:AMRC), Inc., the leading independent provider of comprehensive energy efficiency and renewable energy solutions for the public and private sectors, has recently announced its collaboration with Sunel, the leading Spanish engineering and production company for developing renewable energy projects, to submit bids for solar projects in Europe that exceed 1.5 GW. This strategic partnership is expected to significantly expand the renewable energy market share of both companies in Europe, as well as to make a meaningful contribution to the energy transition of Europe. The company offers a comprehensive set of services, including energy efficiency, renewable energy, mission critical, water and wastewater, and energy resources services, that enable customers to reduce operating expenses, enhance asset value, and realize sustainability goals.

As Europe looks to transition its energy system towards renewables, this collaboration between Ameresco and Sunel is expected to have a major positive impact on the renewable energy sector in Europe. This project will enable both companies to further increase their presence in Europe and to help the region move towards a more sustainable future.

Share Price

On Monday, Ameresco Inc. (AMRC) and Sunel SA announced plans to pursue 1.5GW of solar projects in Europe. This news caused Ameresco’s stock price to rise significantly, with the stock opening at $43.2 and closing at $46.6, a 7.0% jump from the prior closing price of $43.6. This increase in Ameresco’s stock price is largely due to the potential profits that can be gained from the European solar projects. As a leading provider of comprehensive energy services, Ameresco is well-positioned to take advantage of the burgeoning solar energy market in Europe.

In collaboration with Sunel, another leading alternative energy company, Ameresco is now looking to develop and finance up to 1.5GW of solar projects across Europe. This could provide a great opportunity for both companies to further expand their foothold in the European alternative energy industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ameresco. More…

| Total Revenues | Net Income | Net Margin |

| 1.82k | 94.93 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ameresco. More…

| Operations | Investing | Financing |

| -338.29 | -328.36 | 730.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ameresco. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.88k | 1.96k | 15.86 |

Key Ratios Snapshot

Some of the financial key ratios for Ameresco are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.1% | 38.0% | 7.5% |

| FCF Margin | ROE | ROA |

| -36.5% | 10.5% | 3.0% |

Analysis – Ameresco Stock Intrinsic Value

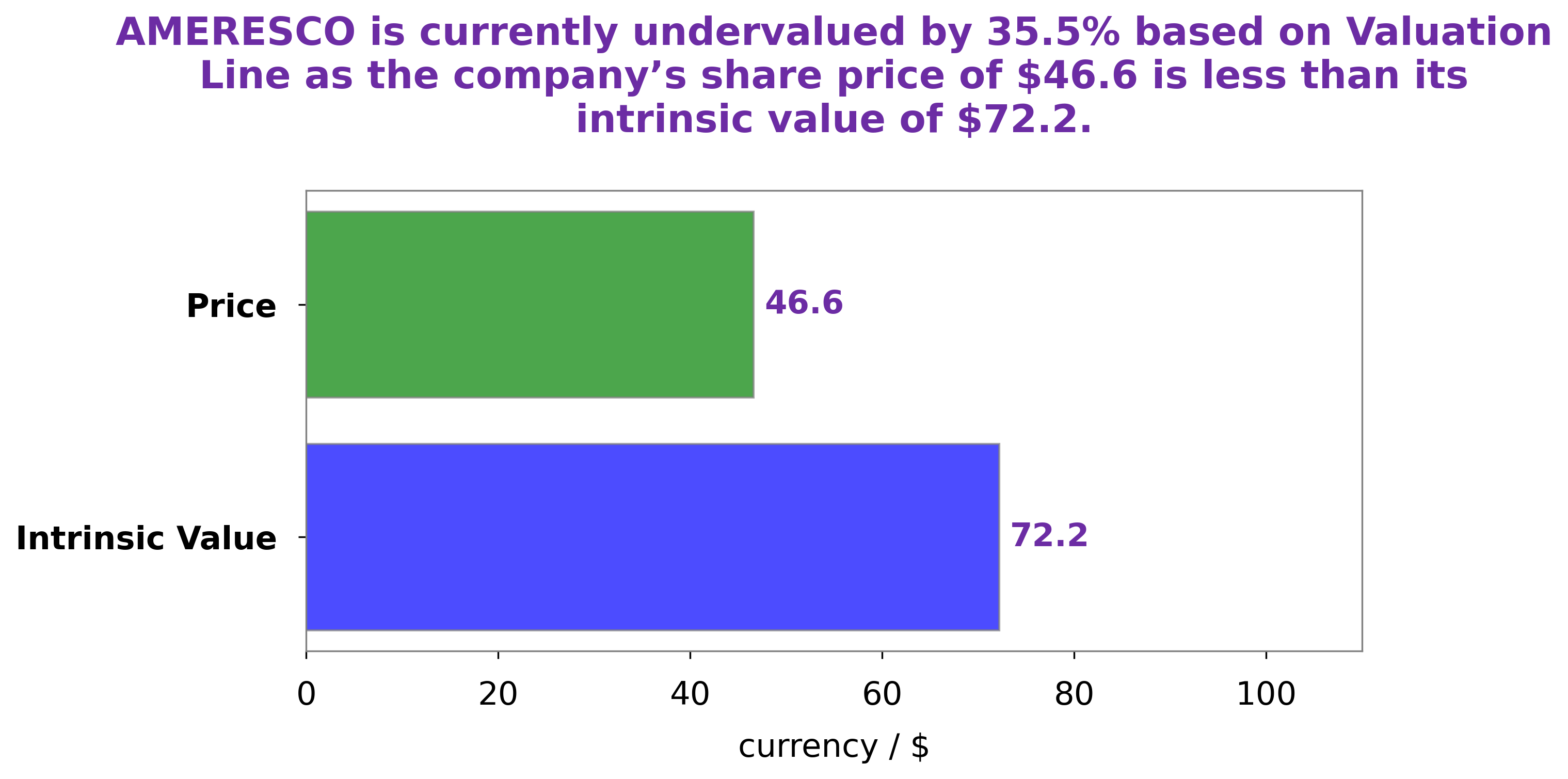

At GoodWhale, after analyzing AMERESCO’s fundamentals, we have made the following assessment. Our proprietary Valuation Line has calculated the fair value of AMERESCO share to be around $72.2. However, right now AMERESCO stock is trading at $46.6, which is undervalued by 35.4%. This gives investors a great opportunity to capitalize on the mispricing of the stock. Ameresco_and_Sunel_to_Pursue_1.5_GW_of_Solar_Projects_in_Europe”>More…

Peers

The company offers a comprehensive range of services, including energy efficiency, renewable energy, distributed generation, demand response, and energy storage. Ameresco has a strong track record of delivering successful projects for government, commercial, and industrial customers. Ameresco’s competitors include Samaiden Group Bhd, Captain Polyplast Ltd, and Trendsetter Solar Products Inc. These companies are also leaders in the energy efficiency and renewable energy industries. Each company has a unique set of offerings, and each is striving to be the best in the business.

– Samaiden Group Bhd ($KLSE:0223)

Samaiden Group Bhd is a Malaysian conglomerate with a market capitalization of 296.45 million as of 2022. The company’s return on equity is 12.46%. Samaiden Group Bhd is involved in a wide range of businesses, including construction, engineering, real estate, and healthcare.

– Captain Polyplast Ltd ($BSE:536974)

Polyplast Ltd is a publicly traded company with a market capitalization of $785.91 million as of 2022. The company has a return on equity of 11.43%. Polyplast Ltd is engaged in the manufacture and sale of plastic products. The company’s products include pipes, fittings, and sheets. Polyplast Ltd is headquartered in India.

Summary

Ameresco, Inc. (AMRC) has seen an increase in its stock price after the announcement that it is partnering with Sunel to submit joint bids for European solar projects totaling 1.5 GW. Investors are excited about this news as the company is likely to expand its presence in the global renewable energy market. While Ameresco has a history of providing renewable energy solutions and services in North America and Europe, the new projects will greatly increase its reach in Europe.

Analysts expect the stock to continue to perform strongly as the company seeks to capitalize on this additional opportunity. As investors continue to watch Ameresco, they should also consider the competitive landscape and watch for any new developments in the European renewable energy market.

Recent Posts