AIG Decreases Investment in Exponent,

June 12, 2023

🌥️Trending News

Exponent ($NASDAQ:EXPO), Inc. has recently seen a decrease in American International Group Inc.’s ownership of its shares. This is a significant shift in the stock market, as Exponent, Inc. is a leading provider of engineering and scientific consulting services. The company works with clients from sectors such as biotechnology, energy, and aerospace to help solve complex technical challenges. Recently, American International Group Inc. has seemingly lessened its ownership of shares in Exponent, Inc. This news has resulted in a significant drop in the stock price of Exponent, Inc. and has made investors question the future of the company.

Despite this setback, Exponent, Inc. is still considered to be a strong company with a long history of success. The company remains committed to providing high-quality engineering and scientific consulting services and continues to be a leader in the industry.

Market Price

On Wednesday, the American insurance giant AIG announced that it had decreased its investment in Exponent, Inc. Despite the news, Exponent’s stock opened at $95.5 and closed at $96.6, up by 1.2% from its prior closing price of 95.4. This indicates that investors are still positive on the company’s outlook. Although AIG’s reduction in investment is a setback, it did not appear to affect the confidence of the market in Exponent’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exponent. More…

| Total Revenues | Net Income | Net Margin |

| 525.12 | 101.84 | 21.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exponent. More…

| Operations | Investing | Financing |

| 93.81 | -12.04 | -215.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exponent. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 566.43 | 224.57 | 6.72 |

Key Ratios Snapshot

Some of the financial key ratios for Exponent are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.4% | 8.1% | 25.4% |

| FCF Margin | ROE | ROA |

| 15.6% | 25.1% | 14.7% |

Analysis

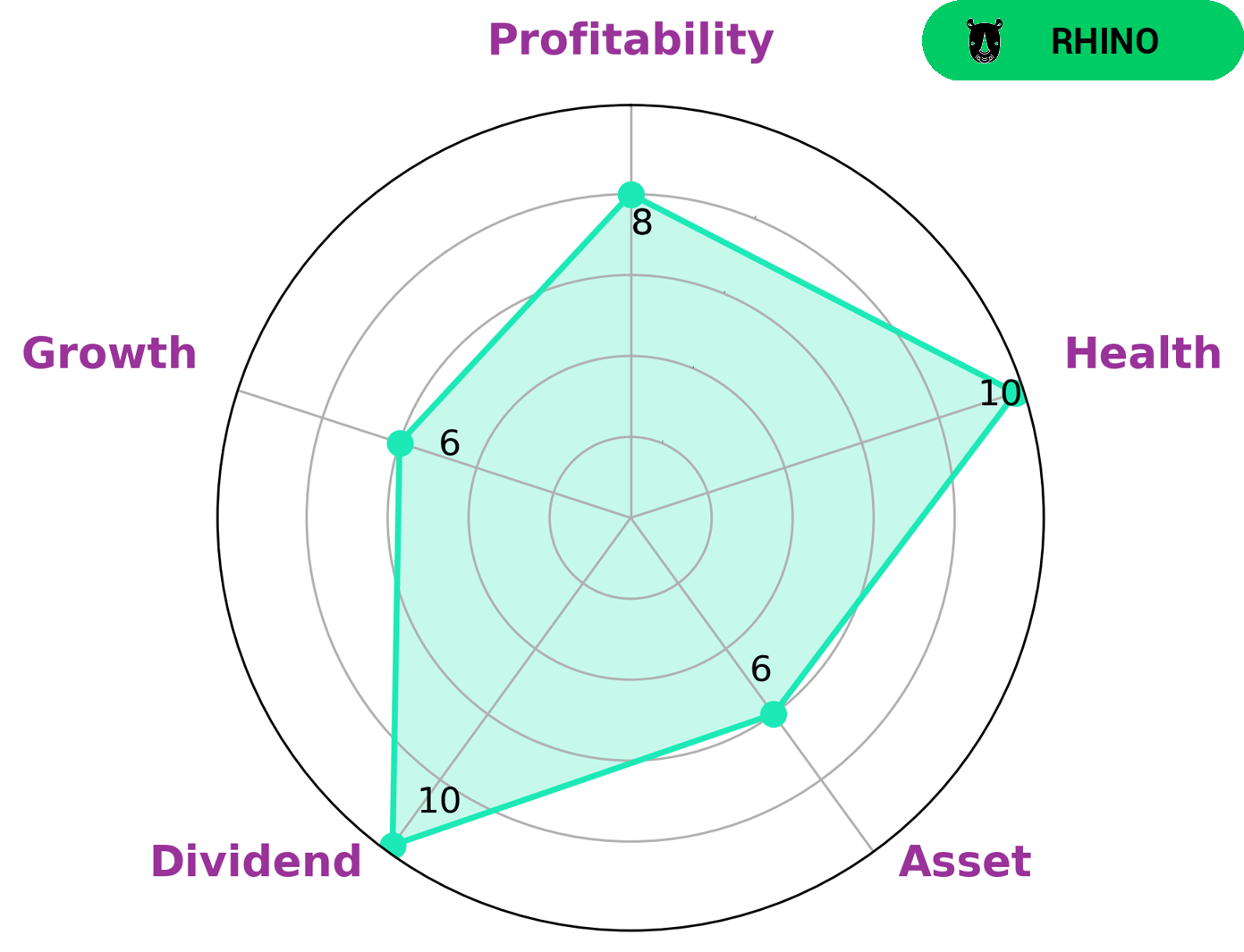

At GoodWhale, we have conducted a thorough analysis of EXPONENT‘s fundamentals and are pleased to provide our insights. Our Star Chart review reveals that EXPONENT has a high health score of 10/10 with regard to its cashflows and debt, indicating that the company is capable of safely riding out any potential crises without risk of bankruptcy. Additionally, EXPONENT’s performance in dividend, profitability and asset growth is strong; and its growth rate is medium. Based on this information, we classify EXPONENT as a “rhino” type of company, one which has achieved moderate revenue or earnings growth. Investors interested in such a company would likely be those looking for companies that are stable and capable of providing reliable dividends, while still offering some potential for growth. Companies like EXPONENT, with their strong cashflows and debt levels, may offer investors a safe investment opportunity in a volatile market. More…

Peers

With over 3,000 employees in more than 85 offices around the world, Exponent has the breadth and depth of expertise to support our clients with multidisciplinary solutions to solve the most complex problems. We work with a range of clients in the oil and gas, chemical, pharmaceutical, power, manufacturing, and technology industries, as well as government agencies and nonprofit organizations.

– Zhenhai Petrochemical Engineering Co Ltd ($SHSE:603637)

Zhenhai Petrochemical Engineering Co Ltd is a Chinese company that provides engineering, procurement, and construction services to the petrochemical industry. The company has a market capitalization of 2.09 billion as of 2022 and a return on equity of 5.9%. Zhenhai Petrochemical Engineering Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sino Daan Co Ltd ($SZSE:300635)

Sino Daan Co Ltd is a company that manufactures and sells electronic products. The company has a market cap of 1.92B as of 2022 and a return on equity of 3.86%. The company’s products include mobile phones, tablets, laptops, and other electronic devices.

– Wison Engineering Services Co Ltd ($SEHK:02236)

Wison Engineering Services Co Ltd has a market cap of 1.12B as of 2022. The company provides engineering, procurement, and construction services in China. It has a Return on Equity of -2.43%.

Summary

Exponent, Inc. has recently been under the watchful eye of investors as American International Group Inc. has decreased its stake in the company. Analysts suggest that the reduced investment is likely due to low earnings and stagnant revenue in the past quarter. However, some investors see potential in the company’s recent acquisitions and new product releases, believing that these could lead to an upturn in performance in the near future. While Exponent Inc. will need to show increased performance and revenue to attract more investors, it could still be a good stock choice for those willing to take on some risk.

Recent Posts