Victory Capital Management Reduces Investment in Insight Enterprises, Inc

June 2, 2023

🌥️Trending News

Insight Enterprises ($NASDAQ:NSIT) is also a major distributor of technology products and services from leading industry vendors such as IBM, Microsoft, and Dell. The announcement from Victory Capital Management Inc. states that their reduction in investment is part of a strategic move towards re-allocating assets in order to maximize returns. While the exact details of the reduction are not released, it is clear that Insight Enterprises will feel the effect of this decision. However, the company remains committed to delivering quality services to its customers, and has built a strong reputation as a reliable source for technology solutions.

Price History

On Tuesday, Victory Capital Management Inc. announced a decrease in their investment in Insight Enterprises, Inc. This news caused Insight Enterprises’ stock to open at $136.4 and close at $136.1, a slight increase of 0.3% from the previous closing price of 135.7. Despite the news, shares of Insight Enterprises gained momentum throughout the day, indicating investors were not particularly concerned about the decrease in investment. This further suggests that investors remain confident in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Insight Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 10.1k | 273.95 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Insight Enterprises. More…

| Operations | Investing | Financing |

| 542.5 | -121.2 | -346.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Insight Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.96k | 3.39k | 47.31 |

Key Ratios Snapshot

Some of the financial key ratios for Insight Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 17.9% | 4.0% |

| FCF Margin | ROE | ROA |

| 4.8% | 15.9% | 5.1% |

Analysis

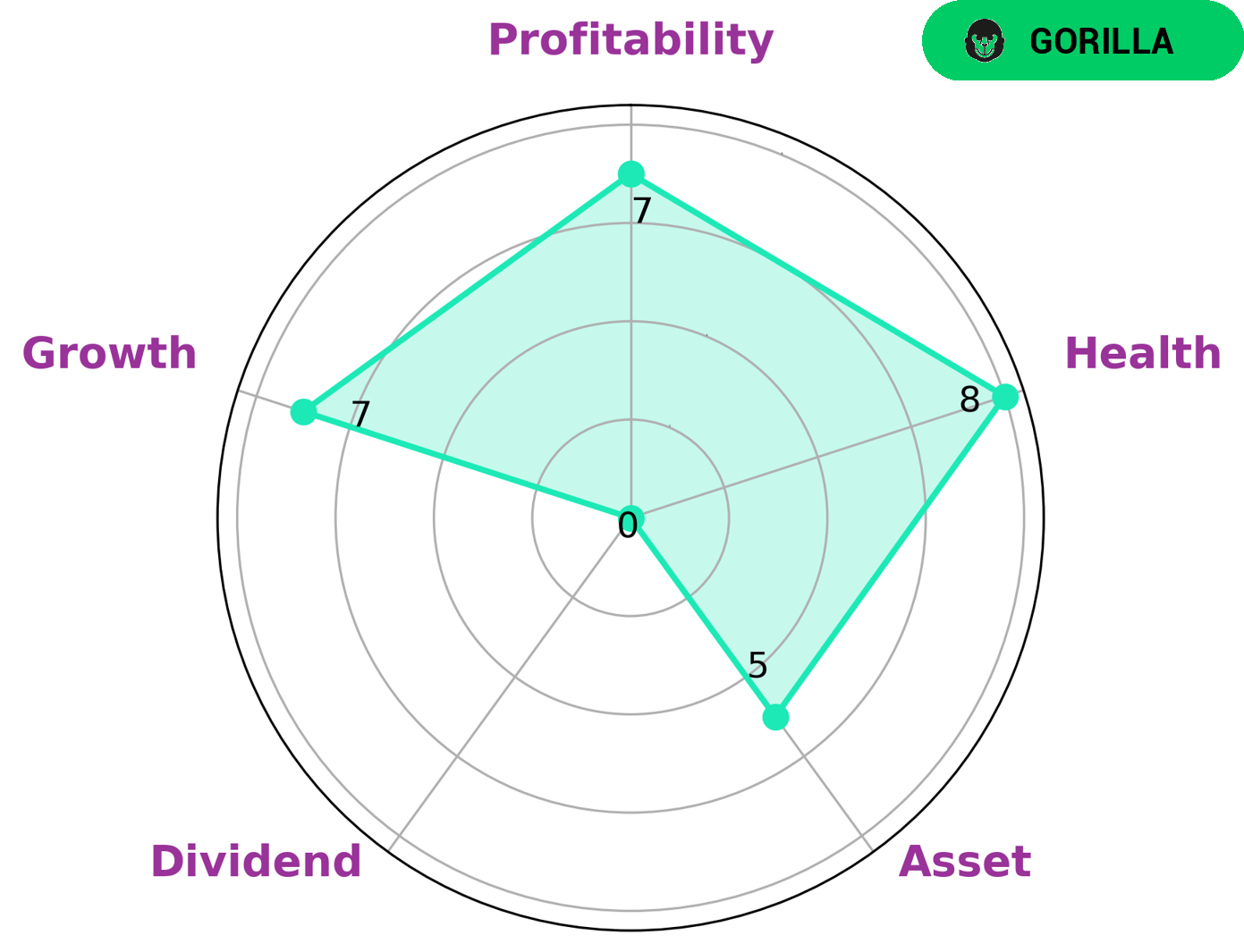

GoodWhale conducted an analysis of INSIGHT ENTERPRISES‘s wellbeing and found that they had a very healthy financial score of 8/10. This score is based on the company’s cashflows and debt, which suggests that INSIGHT ENTERPRISES is capable of paying off their debt and funding future operations. Additionally, we gave INSIGHT ENTERPRISES a strong score for growth and profitability, and a medium score for asset value and dividend. Based on these findings, we concluded that INSIGHT ENTERPRISES is classified as a ‘gorilla’ company, meaning that it has achieved stable and high revenue or earning growth due to their strong competitive advantage. The type of investors who may be interested in such a company may be institutional investors, such as pension funds or endowments, which are looking for steady returns with long-term investments. These investors would be attracted to the stability and potential for growth of INSIGHT ENTERPRISES. More…

Peers

It offers a comprehensive range of services and solutions to help organizations of all sizes drive growth and efficiency. Its competitors include WNS (Holdings) Ltd, Deveron Corp, and Nagarro SE.

– WNS (Holdings) Ltd ($NYSE:WNS)

WNS (Holdings) Ltd is a provider of outsourced business process management services. The company has a market capitalization of $4 billion as of 2022 and a return on equity of 15.87%. WNS offers a range of services including finance and accounting, human resources, customer care, research and analytics, and supply chain management. The company serves clients in a variety of industries such as healthcare, banking and financial services, insurance, manufacturing, retail, and travel and hospitality.

– Deveron Corp ($TSXV:FARM)

Deveron Corp is a publicly traded company with a market cap of 65.41M as of 2022. The company has a Return on Equity of -25.12%. Deveron Corp is engaged in the business of providing software and services to the energy industry.

– Nagarro SE ($OTCPK:NGRRF)

Nagarro SE is a German software development company that specializes in enterprise software solutions. The company has a market capitalization of 1.3 billion euros as of 2022 and a return on equity of 37.18%. Nagarro SE provides software development and consulting services to large and medium-sized organizations in a variety of industries, including automotive, banking and financial services, consumer goods, healthcare, insurance, manufacturing, retail, telecommunications, and utilities.

Summary

Victory Capital Management Inc. recently sold off most of their stock position in Insight Enterprises, Inc. This could be indicative of a shift in the company’s overall investment strategy. Insight Enterprises is an IT solutions provider to businesses and organizations, specializing in cloud computing, data storage, and other related services. Investors should consider the news of a large stock cut when making decisions about their own investments in the company.

In addition to the news of the Victory Capital Management stock sale, it is important to look at Insight Enterprises’ financials and performance over the past few quarters. As well as any competitive trends that could be impacting the company’s future prospects.

Recent Posts