Insight Enterprises Reports Record Q4 2023 Non-GAAP EPS of $2.53, Beating Estimates by $0.41

February 13, 2023

Trending News 🌧️

This result was higher than the expected amount by $0.41, making it a positive surprise to shareholders and investors. The positive results further demonstrate Insight’s ability to adjust to a rapidly changing global environment and to deliver high-quality solutions to their customers. Insight Enterprises ($NASDAQ:NSIT) has been providing innovative IT solutions and services to businesses, governments, educational institutions and healthcare organizations for over thirty years. Their comprehensive portfolio consists of enterprise-wide solutions, including hardware, software, cloud, advanced analytics and AI-driven services. Insight Enterprises also provides expertise in areas such as security, networking, storage, data center, collaboration and mobility solutions. The company’s strong performance during the fourth quarter was a result of increased demand for their solutions and services, especially from the healthcare and education sectors. Insight Enterprises also saw an increase in its share price due to their successful acquisition of PCM, Inc., a leading IT solutions provider for small-to-medium businesses.

Insight Enterprises is committed to driving innovation in the IT solutions space. They have recently announced investments in artificial intelligence, automation and cloud-based technologies, which will enable them to deliver even more efficient solutions to their customers. The company is also focused on expanding its presence in international markets and growing its customer base. The impressive fourth quarter earnings report from Insight Enterprises is yet another testament to the company’s ability to capitalize on the ever-changing IT landscape and to deliver the most cutting-edge solutions and services to their customers. As the company continues to innovate and expand, shareholders and investors can look forward to more record-breaking performance from Insight Enterprises in the near future.

Price History

The news surrounding the global economy has been mostly negative lately, but one company that has managed to beat expectations is Insight Enterprises. On Thursday, INSIGHT ENTERPRISES reported record non-GAAP earnings per share of $2.53 for their fourth quarter of 2023, beating market expectations by $0.41. This news obviously caused investors to take notice, as the stock opened at $121.0 and closed at $125.2, soaring by 11.5% from its previous closing price of $112.3. This record fourth quarter performance was driven by strong sales in the company’s technology and supply chain business units. Sales of varied technologies, such as software, servers, storage and networking, were particularly strong, and INSIGHT ENTERPRISES was able to capitalize on this increased demand.

This news is especially encouraging given the fact that the global economy is still reeling from the effects of the pandemic. The company’s strategic investments in technology and supply chain solutions have also allowed them to remain competitive in an ever-changing market. This news also serves as a reminder of the importance of investing in innovative technologies and supply chain solutions in order to remain competitive in a rapidly changing market. With their record earnings and strong revenue growth, INSIGHT ENTERPRISES is well-positioned to continue its success in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Insight Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 10.43k | 280.61 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Insight Enterprises. More…

| Operations | Investing | Financing |

| 98.11 | -137.84 | 114.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Insight Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.11k | 3.47k | 46.54 |

Key Ratios Snapshot

Some of the financial key ratios for Insight Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.5% | 17.7% | 4.0% |

| FCF Margin | ROE | ROA |

| 0.3% | 15.9% | 5.1% |

Analysis

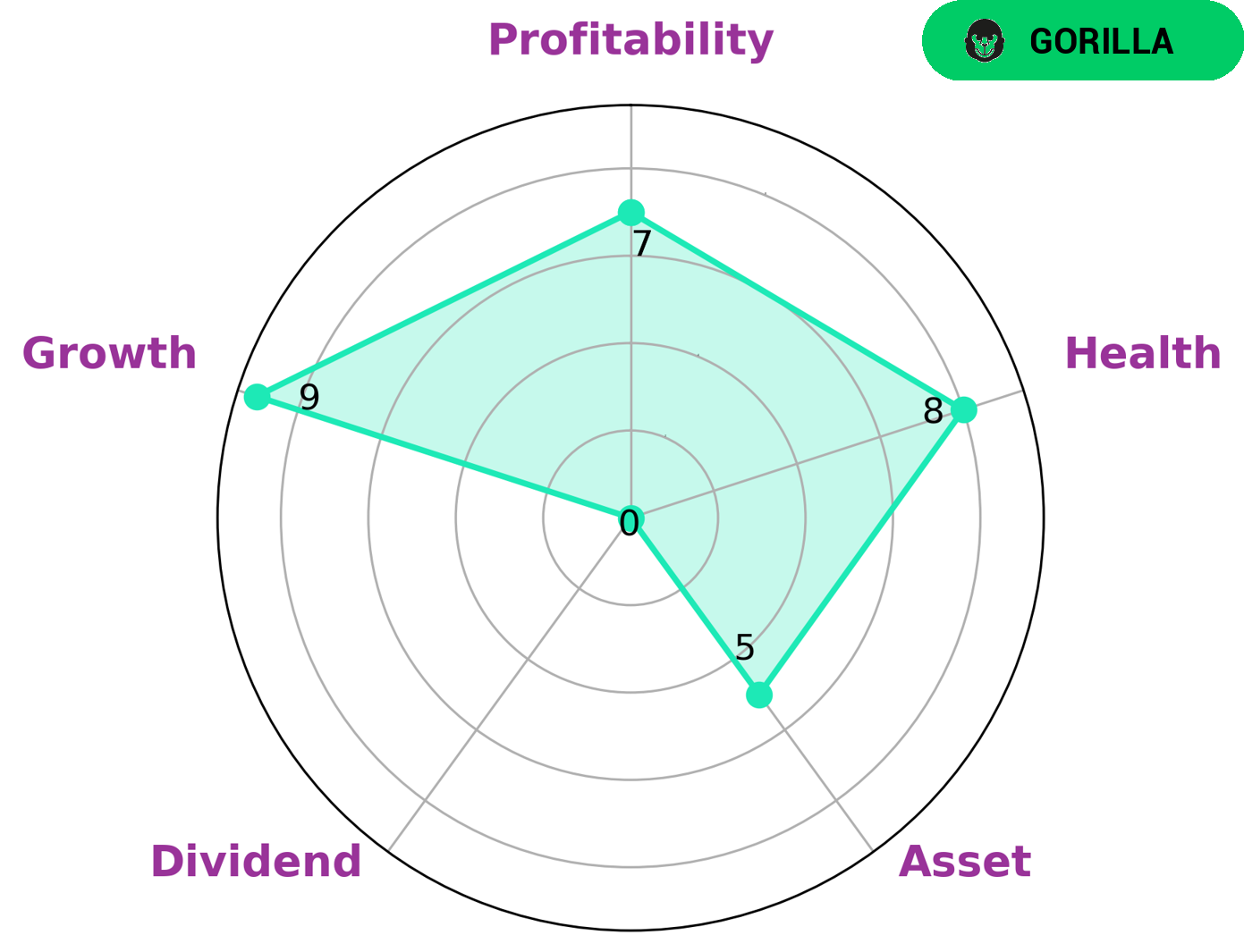

The Star Chart shows that the company achieves a high health score of 8/10, indicating it is capable of paying off debt and funding future operations. Its growth, profitability, and assets are all rated as strong, while its dividend is rated as weak. It is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This may be appealing to investors who are looking for stability and consistent growth. Also, this type of company generally has a strong competitive advantage, which means that potential investors can expect to get a return on their investment. Additionally, as this company has low debt and is able to fund future operations, investors may view it as a low risk investment. Finally, the company’s ability to generate consistent revenues and earnings may make it an attractive option for investors who are looking for a long-term investment. These investors may be looking to hold the stock for many years, as this type of company often demonstrates strong performance over time. In summary, INSIGHT ENTERPRISES is an attractive investment option for investors who are looking for stable growth and a strong competitive advantage. Its low debt, ability to fund future operations, and consistent revenues and earnings all make it an appealing option for long-term investors. More…

Peers

It offers a comprehensive range of services and solutions to help organizations of all sizes drive growth and efficiency. Its competitors include WNS (Holdings) Ltd, Deveron Corp, and Nagarro SE.

– WNS (Holdings) Ltd ($NYSE:WNS)

WNS (Holdings) Ltd is a provider of outsourced business process management services. The company has a market capitalization of $4 billion as of 2022 and a return on equity of 15.87%. WNS offers a range of services including finance and accounting, human resources, customer care, research and analytics, and supply chain management. The company serves clients in a variety of industries such as healthcare, banking and financial services, insurance, manufacturing, retail, and travel and hospitality.

– Deveron Corp ($TSXV:FARM)

Deveron Corp is a publicly traded company with a market cap of 65.41M as of 2022. The company has a Return on Equity of -25.12%. Deveron Corp is engaged in the business of providing software and services to the energy industry.

– Nagarro SE ($OTCPK:NGRRF)

Nagarro SE is a German software development company that specializes in enterprise software solutions. The company has a market capitalization of 1.3 billion euros as of 2022 and a return on equity of 37.18%. Nagarro SE provides software development and consulting services to large and medium-sized organizations in a variety of industries, including automotive, banking and financial services, consumer goods, healthcare, insurance, manufacturing, retail, telecommunications, and utilities.

Summary

Despite the overall negative news environment, the company’s stock rose on the news of higher-than-expected EPS. Investors looking to add Insight Enterprises to their portfolios may want to consider the company’s growth potential and its current fundamentals such as market capitalization and price-earnings ratio. With a prudent strategy and the right risk tolerance, Insight Enterprises could make for a good addition to any portfolio.

Recent Posts