Avnet Stock Fair Value Calculation – Avnet Offers Remarkably Low Prices for Semiconductor Distribution

May 26, 2023

Trending News 🌧️

Avnet ($NASDAQ:AVT) is an international distributor of electronic components, computer products, and embedded technology. Avnet offers remarkably low prices for semiconductor distribution. With their extensive selection of quality components, Avnet provides unbeatable value. Avnet’s pricing is extremely competitive and their customer service is impeccable. They are knowledgeable and experienced, providing expert advice and guiding customers through the entire process. To make the purchasing process even easier, Avnet allows users to purchase items directly online. Furthermore, Avnet also offers various services such as technical support, design consulting, and supply chain solutions. This helps customers streamline their operations and get the best value for their money.

Additionally, Avnet also offers customization options so that customers can get the exact components they need. Avnet is a trusted name in the semiconductor industry and with their remarkably low prices, it is no wonder why they are a popular choice for distribution. With their wide range of products and services, Avnet is sure to provide customers with exactly what they need at an affordable price.

Stock Price

On Thursday, AVNET, a semiconductor distribution company, saw a significant rise in its stock price. The stock opened at $42.4 and closed at $44.0, up by 4.2% from its previous closing price of $42.2. This increase in stock price is likely due to AVNET’s remarkable ability to offer low prices for its semiconductor products and services.

They have a wide range of quality products which are offered at competitive prices, making them a popular option for customers looking for cost-effective solutions. Furthermore, their excellent customer support and committed services help to ensure customer satisfaction. Avnet_Offers_Remarkably_Low_Prices_for_Semiconductor_Distribution”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avnet. More…

| Total Revenues | Net Income | Net Margin |

| 26.35k | 862.39 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avnet. More…

| Operations | Investing | Financing |

| -1.15k | -154.22 | 1.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avnet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.11k | 7.47k | 50.71 |

Key Ratios Snapshot

Some of the financial key ratios for Avnet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.2% | 52.8% | 4.7% |

| FCF Margin | ROE | ROA |

| -4.9% | 17.2% | 6.4% |

Analysis – Avnet Stock Fair Value Calculation

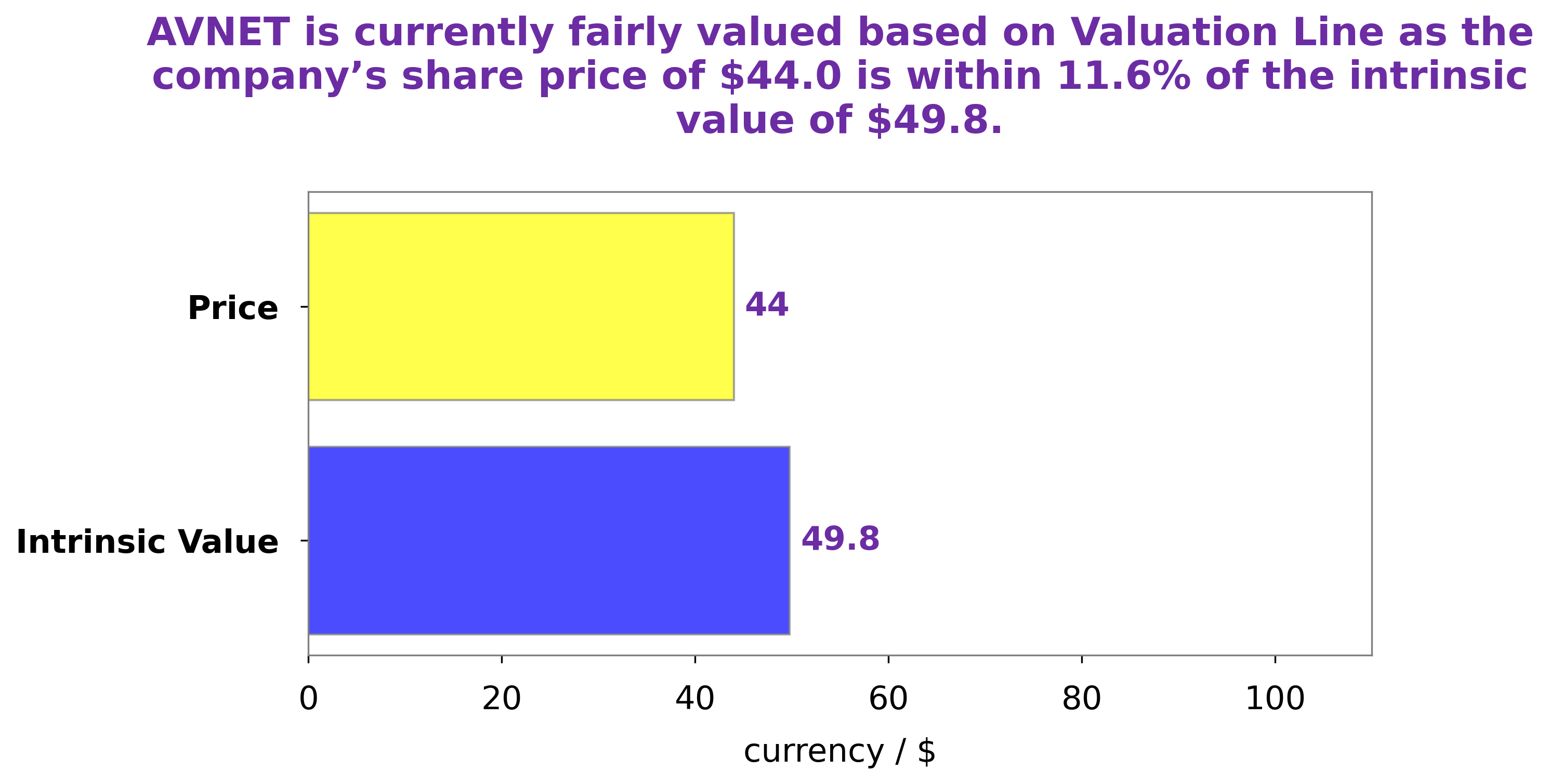

GoodWhale recently conducted an in-depth analysis of AVNET fundamentals. Our proprietary Valuation Line, which uses fundamental metrics to calculate the intrinsic value of stocks, estimated the intrinsic value of AVNET share to be around $49.8. Currently, AVNET stock is trading at $44.0, suggesting it is undervalued by 11.6%. This presents an attractive investment opportunity for those looking for a stock with strong value potential. Avnet_Offers_Remarkably_Low_Prices_for_Semiconductor_Distribution”>More…

Peers

The company competes with Arrow Electronics Inc, Shanghai Yct Electronics Group Co Ltd, and Honey Hope Honesty Enterprise Co Ltd.

– Arrow Electronics Inc ($NYSE:ARW)

Arrow Electronics Inc is an American company that specializes in electronic components and enterprise computing solutions. The company has a market capitalization of 6.34 billion as of 2022 and a return on equity of 22.84%. The company was founded in 1935 and is headquartered in Denver, Colorado. Arrow Electronics is a global provider of electronic components and enterprise computing solutions. The company serves more than 125,000 original equipment manufacturers, contract manufacturers, and commercial customers through a network of more than 460 locations in 58 countries.

– Shanghai Yct Electronics Group Co Ltd ($SZSE:301099)

Shanghai Yct Electronics Group Co Ltd has a market cap of 5.2B as of 2022, a Return on Equity of 12.95%. The company is engaged in the design, development, manufacture and sale of electronic products and components. It offers a range of products, including integrated circuits, semiconductors, personal computers, mobile phones, home appliances, office equipment, automotive electronics and lighting products. The company has a global customer base and operates in China, North America, Europe and Asia.

– Honey Hope Honesty Enterprise Co Ltd ($TPEX:8043)

Honey Hope Honesty Enterprise Co Ltd is a Taiwanese company that produces and sells a variety of health and beauty products. The company has a market cap of 1.82B as of 2022 and a Return on Equity of 5.28%. Honey Hope Honesty Enterprise Co Ltd’s products include skincare, haircare, and makeup products. The company’s products are sold in Taiwan, China, Hong Kong, and Macau.

Summary

AVNET is a well-known semiconductor distributor with an impressive track record of delivering products to customers on time. The company has exhibited strong financial performance, with steady increases in both revenue and profits year over year.

Additionally, the company has strong cash flow, low debt, and a healthy financial position that provides reassurance for investors. With its impressive financial performance and massive customer base, AVNET is an attractive investment opportunity. Its stock is likely to continue to move up with increasing optimism from the market.

Recent Posts