Skillz Appoints Alvin Lobo as Chief Financial Officer, Promotes Jason Roswig to President.

March 1, 2023

Trending News ☀️

Skillz Inc ($NYSE:SKLZ). has recently announced the appointment of Alvin Lobo as their new Chief Financial Officer (CFO). This appointment comes with the promotion of former CFO Jason Roswig, who first joined the company in August 2022, to serve as President of the company. Lobo is an experienced individual with a vast range of financial experience, having previously held the same position at Score Media and Gaming before rejoining Skillz Inc. He brings a wealth of knowledge to the table, making him an ideal candidate for the CFO role. Lobo will be responsible for the financial health of the company, including the development and implementation of financial strategies and plans. Roswig is a highly reliable and respected leader within the industry, with a proven track record of success at his previous positions.

As President of the company, he will be responsible for leading the executive team and driving the company’s overall strategy and direction. His extensive knowledge and experience will be essential in helping Skillz Inc. reach its goals. With their combined experience, Skillz Inc. is sure to make a positive impact in the gaming industry going forward.

Share Price

This news saw SKILLZ INC‘s stock open at $0.6 and close at the same price at the end of the day, a decrease of 0.7% from the prior closing price of 0.6. SKILLZ INC CEO and Co-Founder Andrew Paradise expressed his delight at the new appointments, stating his confidence in their ability to lead the company to greater levels of success. Jason Roswig has been with SKILLZ INC for over seven years, steadily rising through the ranks to become President.

The new appointments mark an important moment for SKILLZ INC as they look towards a more prosperous future. Investors and market watchers will be closely monitoring SKILLZ INC’s progress in the coming weeks, expecting the stock to rebound. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Skillz Inc. More…

| Total Revenues | Net Income | Net Margin |

| 335.88 | -386.24 | -104.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Skillz Inc. More…

| Operations | Investing | Financing |

| -243.61 | -327.08 | 270.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Skillz Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 772.41 | 340.11 | 1.03 |

Key Ratios Snapshot

Some of the financial key ratios for Skillz Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 96.3% | – | -109.0% |

| FCF Margin | ROE | ROA |

| -73.5% | -48.9% | -29.6% |

Analysis

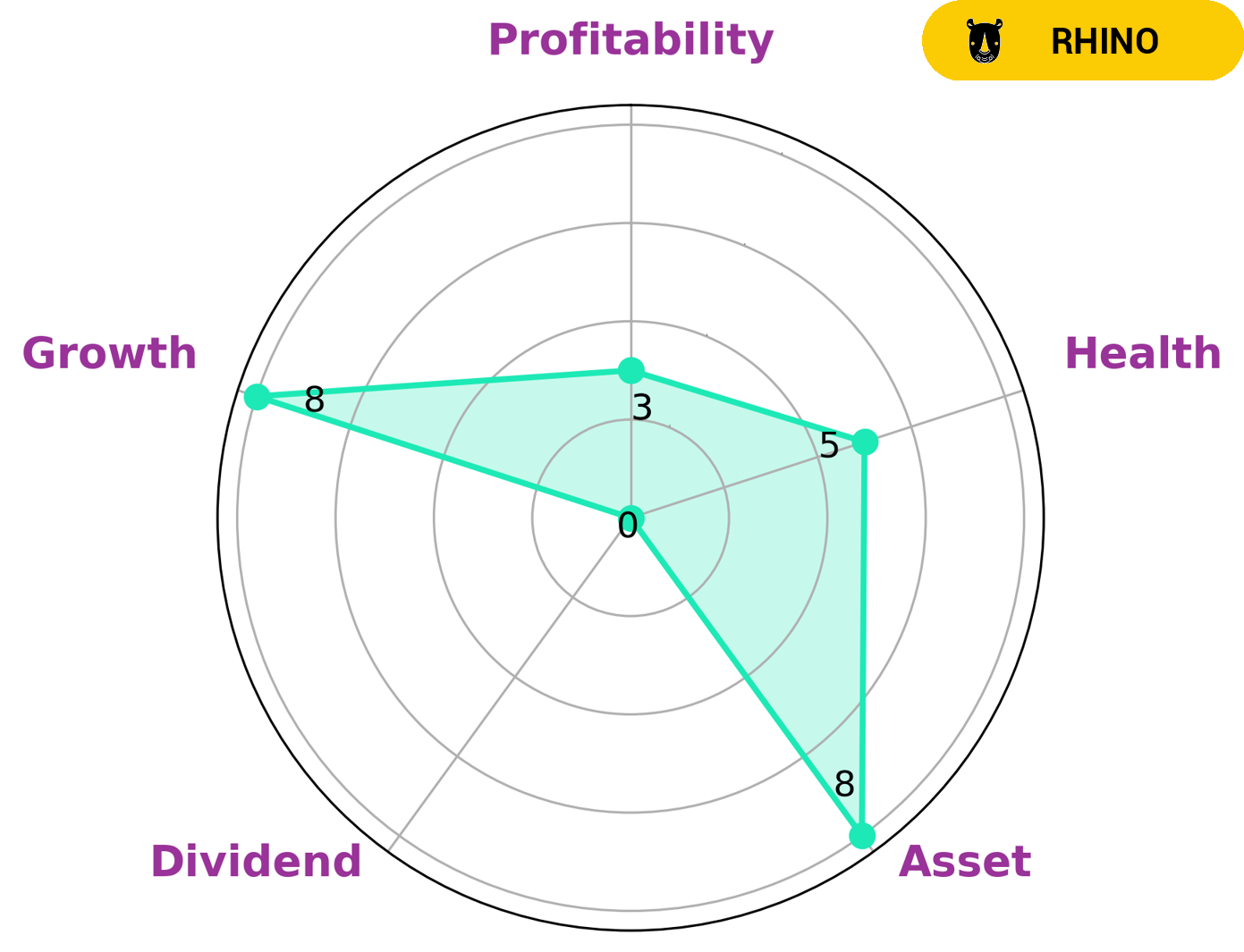

As a GoodWhale analyst, I recently assessed SKILLZ INC‘s financials. They are classified as a ‘rhino’ company according to Star Chart, meaning they have achieved moderate revenue or earnings growth. This type of company could be of particular interest to value investors who are seeking to invest in solid companies that have the potential to perform well in the long-term. In terms of financial health, SKILLZ INC is rated 5/10, which indicates that, barring any major negative events, they are in a strong position to ride out any current market crises. Looking at their core financials, the company is strong in assets and growth, but weak in dividends and profitability. Of course, any investor considering SKILLZ INC should take the time to analyze their financials in-depth to ensure the company is a sound investment choice. More…

Peers

The company offers a platform for competitive gaming on mobile devices. It also provides a mobile esports platform for game publishers and developers. The company was founded in 2012 and is headquartered in San Francisco, California. Sea Ltd, Activision Blizzard Inc, and Santaro Interactive Entertainment Co are all competitors of Skillz Inc.

– Sea Ltd ($NYSE:SE)

Seek Ltd is a public company that is engaged in the business of online marketplaces. It has a market cap of 25.75B as of 2022 and a return on equity of -24.13%. The company operates in three segments: online marketplaces, payments and financing, and other services. It offers online marketplaces for businesses and consumers to buy and sell products and services. Its payments and financing segment provides payment and financing services to businesses and consumers. Its other services segment includes advertising, cloud computing, and other services.

– Activision Blizzard Inc ($NASDAQ:ATVI)

Activision Blizzard, Inc. is an American video game holding company based in Santa Monica, California. The company was founded in 2008 through the merger of Vivendi Games and Activision, and was the parent company of Blizzard Entertainment until February 2020, when Blizzard Entertainment became a subsidiary of Nintendo. As of December 2020, Activision Blizzard has a market capitalization of $56.25 billion and a return on equity of 7.93%. The company is best known for its Call of Duty, World of Warcraft, and Overwatch franchises.

– Santaro Interactive Entertainment Co ($OTCPK:STIE)

Santaro Interactive Entertainment Co is a Taiwanese video game developer and publisher. The company was founded in 2006 and is headquartered in Taipei, Taiwan. Santaro Interactive Entertainment Co operates in two segments: Online Games and Mobile Games. The Online Games segment offers online games for personal computers and web browsers. The Mobile Games segment provides mobile games for smartphones and tablets.

As of 2022, Santaro Interactive Entertainment Co has a market cap of 698.75k and a Return on Equity of 15.33%. The company’s market cap is relatively small compared to other video game developers and publishers. However, its ROE is higher than the average for the video game industry. Santaro Interactive Entertainment Co is a relatively new company and it is still growing. The company has a strong focus on online and mobile gaming.

Summary

S k i l l z I n c . , a l e a d i n g m o b i l e e S p o r t s p l a t f o r m , h a s r e c e n t l y a p p o i n t e d A l v i n L o b o t o b e t h e i r n e w C h i e f F i n a n c i a l O f f i c e r a n d p r o m o t e d J a s o n R o s w i g t o P r e s i d e n t . T h i s m o v e s t r e n g t h e n s t h e c o m p a n y ‘ s c o m m i t m e n t t o s o u n d f i n a n c i a l m a n a g e m e n t a n d s h o u l d h e l p t h e m c a p i t a l i z e o n t h e r a p i d l y i n c r e a s i n g d e m a n d f o r m o b i l e e S p o r t s . A n a l y s t s b e l i e v e t h a t S k i l l z I n c . i s u n d e r v a l u e d w i t h p l e n t y o f g r o w t h p o t e n t i a l , s u p p o r t e d b y t h e c o m p a n y ‘ s s t r o n g c o m p e t i t i v e e d g e , r o b u s t t e c h n o l o g i c a l i n f r a s t r u c t u r e a n d i m p r e s s i v e m a r k e t i n g c a p a b i l i t i e s . A s m o r e g a m i n g c o m p a n i e s m a k e t h e l e a p i n t o m o b i l e , S k i l l z I n c . ‘ s l e a d e r s h i p c h a n g e s c a n b e s e e n a s a s a v v y m o v e t h a t p o s i t i o n s t h e m t o g a i n m a r k e t s h a r e.

Recent Posts