Roblox Corporation Reports Unexpected Loss Despite Surpassing Bookings Expectations

May 12, 2023

Trending News 🌧️

Despite surpassing its bookings expectations, ROBLOX CORPORATION ($NYSE:RBLX) reported an unexpected loss in its latest earnings report. The company’s GAAP EPS of -$0.44 was $0.05 lower than analyst predictions.

However, ROBLOX CORPORATION did exceed expectations when it came to bookings, reporting a total of $773.82M, which was $8.45M higher than what was forecasted. ROBLOX CORPORATION is a leading online gaming platform that enables users to create and share their own games and experiences. The company is known for its innovative approach to gaming and technology, and is constantly expanding its offerings. With its recent acquisition of Roblox Live, the company is now able to provide a more immersive gaming experience for its players by allowing them to broadcast their games live on platforms like Twitch and YouTube. This acquisition is another example of the company’s commitment to giving its users the best possible gaming experience. ROBLOX CORPORATION has made impressive progress in recent months and despite the unexpected loss, it is clear that the company is on track to continue to grow and succeed in the future.

Earnings

ROBLOX CORPORATION recently reported its FY2022 Q4 earnings, ending December 31 2022. Total revenue for the quarter was 579.0M USD, which is an increase of 1.8% compared to the previous year. This marks a significant increase, as total revenue has been steadily increasing over the past 3 years, from 310.01M USD to 579.0M USD. The company reported a net income loss of 289.93M USD, despite the higher-than-expected total revenue.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Roblox Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | -924.37 | -41.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Roblox Corporation. More…

| Operations | Investing | Financing |

| 369.3 | -441.05 | 43.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Roblox Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.38k | 5.07k | 0.51 |

Key Ratios Snapshot

Some of the financial key ratios for Roblox Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.6% | – | -40.1% |

| FCF Margin | ROE | ROA |

| -2.6% | -152.8% | -10.4% |

Share Price

Despite this, shares of the company opened at $37.3 and closed at $38.9, a rise of 7.4% from its prior closing price of $36.2. The company reported a net loss of 8 cents per share for the quarter, compared to the expectation of 7 cents of earnings set by Wall Street analysts. ROBLOX CORPORATION attributed the loss to their investments in products and services to improve user experience. The company also said that their investments in advertising and customer acquisition also negatively impacted their profits. While their bookings exceeded expectations, their total costs were higher than expected, resulting in a net loss for the quarter.

Despite this unexpected loss, ROBLOX CORPORATION’s stock price rose by 7.4%. This could be due to investors buying into the idea that investments in products and services will help the company in the long run. Live Quote…

Analysis

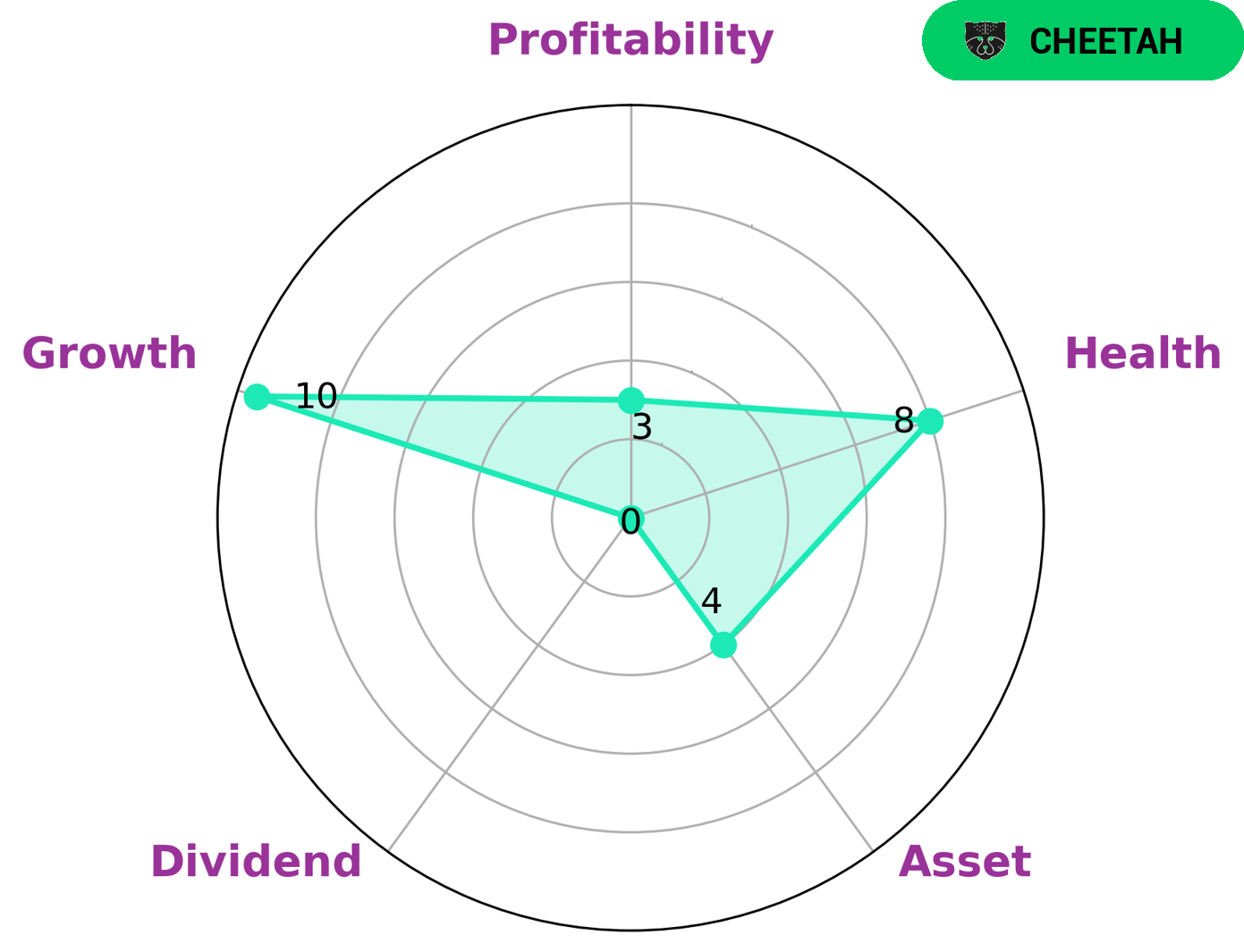

GoodWhale has conducted an analysis of ROBLOX CORPORATION‘s fundamentals and has drawn some conclusions. Our Star Chart gave the company a high health score of 8/10, indicating that it is capable of managing its cashflows and debt, and funding future operations. Furthermore, ROBLOX CORPORATION has been classified as a ‘cheetah’ company. This means that the company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Considering its strong growth, medium asset strength and weak dividend and profitability scores, we believe that investors with a higher risk tolerance may be interested in such a company. Investors that focus on capital appreciation may be especially attracted to ROBLOX CORPORATION due to its potential for continued growth. Additionally, those investors who are looking for more stability should be aware that ROBLOX CORPORATION is not as stable as other companies in the market. More…

Peers

The company was founded in 2004 and is headquartered in San Mateo, California. Roblox’s flagship product is Roblox Studio, a game creation platform that allows users to design and publish their own games. The company also operates roblox.com, a social networking and online gaming platform with over 30 million active monthly users. Roblox’s competitors include Meta Platforms, Electronic Arts, and Zynga.

– Meta Platforms Inc ($NASDAQ:EA)

Electronic Arts Inc. is an American video game company based in Redwood City, California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization, after Activision Blizzard. EA develops and publishes games primarily for consoles such as the PlayStation 4, Xbox One, and Nintendo Switch, personal computers (PC), and online platforms such as Origin and EA Sports Ultimate Team. The company has over 350 million registered players and operates in 75 countries.

Summary

Roblox Corporation‘s stock price moved up on the same day that their GAAP EPS (earnings per share) and bookings were announced. Roblox reported a GAAP EPS of -$0.44, which missed estimates by $0.05. Bookings, however, came in at $773.82M, beating estimates by $8.45M.

Despite the miss on the GAAP EPS, investors were encouraged by the strong bookings number, which can be an indicator of strong future performance. Investors should continue to monitor Roblox’s upcoming earnings and bookings numbers to get a better sense of how the company is performing.

Recent Posts