NetEase and Tencent Receive Government Approval for 87 Domestic Online Game Licenses in February.

February 11, 2023

Trending News ☀️

NETEASE ($NASDAQ:NTES): NetEase and Tencent, two of the world’s largest video game companies, recently made headlines after receiving approval from China’s National Press and Publication Administration for 87 domestic online game licenses in February. The news was reported by Reuters and despite this, the stocks of both companies were fractionally lower in premarket trading on Friday. NetEase Inc. is a Chinese Internet technology company that is primarily known for providing online services such as gaming, content services, e-commerce, advertising, and search services. The company also developed one of the most popular Chinese webmail service providers, Youdao, and offers a variety of online games such as CrossFire, Ghost II, and Fantasy Westward Journey. It also saw an increase in its total net revenues for the year. This was largely due to increased user engagement across its services, driven by strong growth in its online games, e-commerce services, and music services.

The approval of 87 domestic online game licenses from China’s National Press and Publication Administration was a positive sign for NetEase, as it will help the company further expand its gaming portfolio. This could potentially increase user engagement and boost its revenue even further. Despite this news, the stock was fractionally lower in premarket trading on Friday. Overall, NetEase appears to be poised for long-term growth. With its strong portfolio of online services and the recent approval of 87 domestic online game licenses, it could soon gain even more momentum in the gaming market and help the company reach new heights.

Market Price

This is a major achievement for the two companies, and it helps to solidify their presence in the industry.

However, despite the positive news, NETEASE stock opened on Friday at $87.8 and closed at $86.7, down by 2.8% from its last closing price of 89.2. This could be a sign of investor skepticism regarding the news, or it could be simply due to market forces. It shows that they have been able to meet the criteria set by the Chinese government and secure the necessary licenses. This will allow them to keep their position as leaders in the online gaming industry, as it will give them access to an even larger customer base. The news of the licenses also speaks to the strength of these companies, as they were able to meet the government’s requirements and secure the licenses. This is an important sign that both companies are well-positioned in the industry, and are likely to remain competitive in the future. It gives them access to an even larger customer base and shows that they are well-positioned to remain competitive in the industry. Despite the drop in NETEASE stock on Friday, it is likely that this news will be beneficial for both companies in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netease. More…

| Total Revenues | Net Income | Net Margin |

| 95.52k | 22.08k | 19.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netease. More…

| Operations | Investing | Financing |

| 27.07k | -26.8k | -5.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netease. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 172.71k | 63.2k | 148.71 |

Key Ratios Snapshot

Some of the financial key ratios for Netease are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.5% | 16.2% | 20.7% |

| FCF Margin | ROE | ROA |

| 25.3% | 12.0% | 7.2% |

Analysis

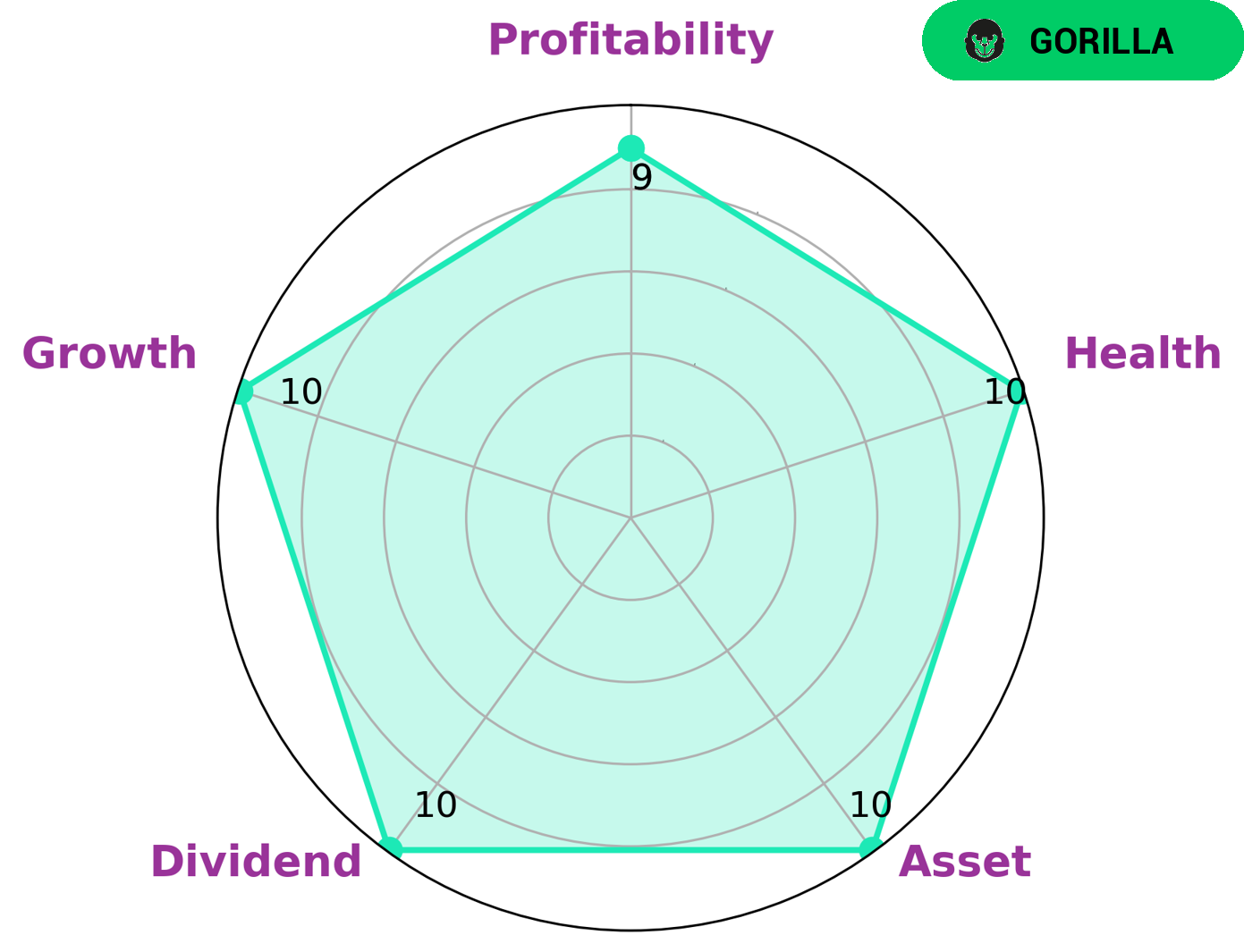

GoodWhale’s examination of the fundamentals of NETEASE reveals a strong financial performance from the company. With a high health score of 10 out of 10, the company is capable of paying off debt and funding future operations with its cashflows and debt. NETEASE is also strong in terms of asset, dividend, growth, and profitability. Its performance has been so impressive that it is classified as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors looking for a profitable, stable business may be interested in NETEASE. The company boasts strong fundamentals in all aspects of its finances, meaning investors can rest assured that the company is being managed responsibly and that their investments are secure. Furthermore, NETEASE’s consistent growth makes it an attractive prospect for those looking for long-term returns. Its classification as a ‘gorilla’ means that it can offer investors a great opportunity to make big gains in the stock market. Overall, NETEASE is a very attractive prospect for investors. Its strong financial performance and classification as a ‘gorilla’ means that it offers a secure and reliable opportunity to make gains in the stock market. It is well worth considering for any investor looking for a safe and profitable investment. More…

Summary

NetEase, one of China’s leading online game and content service providers, has recently seen positive news. In February, the company received government approval for 87 domestic online game licenses, which is expected to bring about positive growth for the company. For investors, NetEase presents a good opportunity for both long-term and short-term investments. The company has a strong financial position, strong cash flow and a high return on equity.

The addition of the new game licenses is expected to drive more user engagement and revenue growth, which will help to further strengthen the company’s financials. Based on current trends, it appears that investing in NetEase is a smart move.

Recent Posts