Citi Predicts Tencent’s New Game to Challenge NetEase in ’23, Stock Prices Dip

December 7, 2023

☀️Trending News

NETEASE ($NASDAQ:NTES): Citi has released a report predicting that Tencent’s new game will challenge NetEase’s dominance in the Chinese gaming market in 2023 due to the anticipated approval of one more batch of games by China. This news has caused a dip in NetEase’s stock prices as investors become increasingly concerned about the potential competition. NetEase is a leading interactive entertainment and Internet services provider in China. It has developed and operated some of China’s most popular online games, including Fantasy Westward Journey, Ghost, and Datang. The company also provides online music services, advertising services, email services, and e-commerce platforms. NetEase’s stock is traded on the Nasdaq Global Select Market under the ticker symbol NTES. Investors are watching closely to see how NetEase will respond to the challenge posed by Tencent’s new game. It remains to be seen how this will affect their stock prices in the long run.

However, Citi remains bullish on NetEase’s future as they believe that their existing portfolio of games will still remain popular amongst gamers.

Market Price

On Tuesday, NETEASE stock prices saw a slight dip as Citi analysts predicted that Tencent’s new game could challenge the company’s domination in gaming by 2023. The stock opened at $101.2 and closed at $102.7, down by 1.4% from the last closing price of 104.2. Tencent has been a major player in the global gaming market for many years but with the upcoming release of a new game, Citi predicts that the company will become a major competitor for NETEASE. With its strong brand recognition and existing user base, Tencent appears to be in a prime position to challenge NETEASE’s current dominance.

NETEASE has been pushing into the gaming market for some time now, and this new competition could force the company to re-evaluate its strategies and consider how it can stay ahead of the game. As such, investors are cautious of NETEASE’s ability to maintain its competitive edge and maintain its stock prices. It remains to be seen how this new development will affect the company’s overall success in the gaming market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netease. More…

| Total Revenues | Net Income | Net Margin |

| 101.68k | 26.79k | 25.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netease. More…

| Operations | Investing | Financing |

| 32.53k | -2.45k | -32.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netease. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 171.58k | 47.63k | 186.03 |

Key Ratios Snapshot

Some of the financial key ratios for Netease are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.4% | 20.3% | 24.9% |

| FCF Margin | ROE | ROA |

| 27.9% | 13.5% | 9.2% |

Analysis

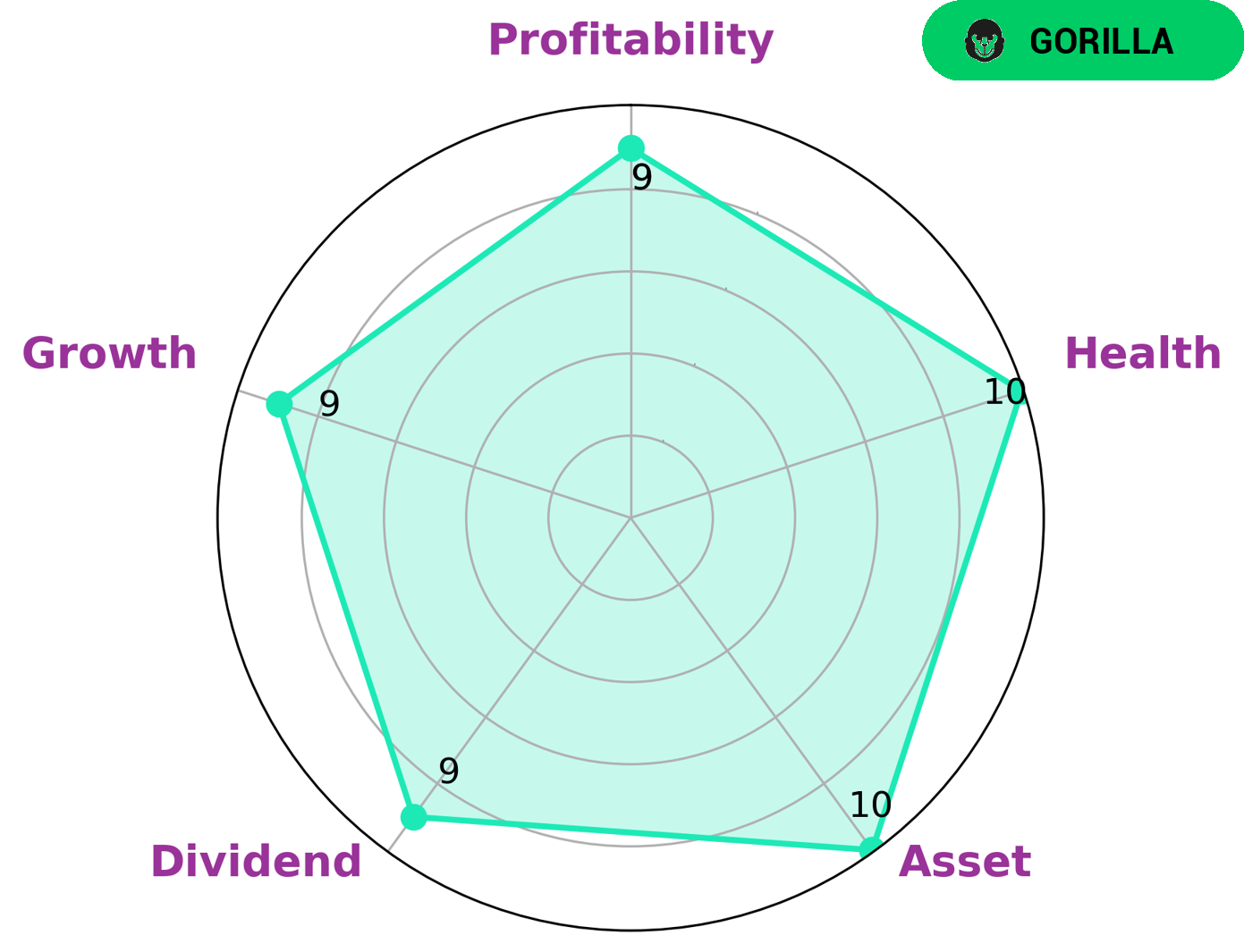

GoodWhale has analyzed the fundamentals of NETEASE and found it to be classified as a ‘gorilla’ type of company according to the Star Chart. This means that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for long-term growth potential and safety of capital should be interested in such a company. Additionally, NETEASE has a high health score of 10/10 considering cashflows and debt. This means that the company is capable of paying off debt and funding future operations. NETEASE is also strong in asset, dividend, growth, and profitability. All these factors indicate a strong investment potential for this company. More…

Summary

NetEase, Inc. (NTES) is a Chinese internet technology company offering online services such as gaming, music streaming, e-commerce, and other services. The company recently dipped in the stock market after Tencent, its main rival, announced the launch of a new game. This new game could present a challenge to NetEase’s current gaming business.

Analysts at Citi are expecting one more batch of game approvals from Chinese regulators in 2023, which may provide NetEase with an opportunity to compete with its rivals. Investors should keep an eye on NetEase’s performance in the gaming sector as it could provide potential opportunities for growth.

Recent Posts