Western Wealth Management LLC Invests in TE Connectivity Ltd. with 1324 Shares.

February 2, 2023

Trending News ☀️

Western Wealth Management LLC recently invested in TE ($NYSE:TEL) Connectivity Ltd. with the purchase of 1324 shares. TE Connectivity Ltd. is a global technology leader that designs and manufactures connectivity and sensor solutions for customers in a broad range of industries including automotive, aerospace and defense, industrial, energy, healthcare, and data communications. The company is headquartered in Switzerland and is listed on the New York Stock Exchange and the Swiss Exchange. The company’s products range from connectors and components to power systems and sensor solutions to communication systems and embedded solutions. TE Connectivity Ltd. also provides engineering and product design services to help customers find the right solution for their specific needs.

The company has a strong commitment to sustainability and is dedicated to providing innovative solutions that are designed to reduce energy consumption, increase reliability, and reduce environmental impact. TE Connectivity Ltd. also strives to create a culture of innovation and collaboration that helps to drive growth and create value for its customers and shareholders. With the purchase of 1324 shares, Western Wealth Management LLC is taking a long-term view on the company’s future growth prospects and its potential to create value for its investors.

Share Price

The news sentiment on the investment has been mostly positive, with investors expecting the move to be beneficial to the company long-term. On Monday, TE CONNECTIVITY stock opened at $123.8 and closed at $125.5, up by 0.1% from last closing price of 125.4. This indicates that the investment was seen positively in the markets as it pushed up the stock price slightly. This could be due to the company’s strong financial performance, as well as its focus on technological innovation.

The company has also been expanding its global presence, investing in new markets and partnerships to increase its reach and profitability. Investors will certainly be keeping a close eye on the company’s progress in the coming months, as it looks to capitalize on this new investment and push forward with its growth plans. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Te Connectivity. More…

| Total Revenues | Net Income | Net Margin |

| 16.3k | 2.26k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Te Connectivity. More…

| Operations | Investing | Financing |

| 2.52k | -944 | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Te Connectivity. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.35k | 9.88k | 33.96 |

Key Ratios Snapshot

Some of the financial key ratios for Te Connectivity are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 9.3% | 16.0% |

| FCF Margin | ROE | ROA |

| 10.7% | 14.8% | 7.7% |

VI Analysis

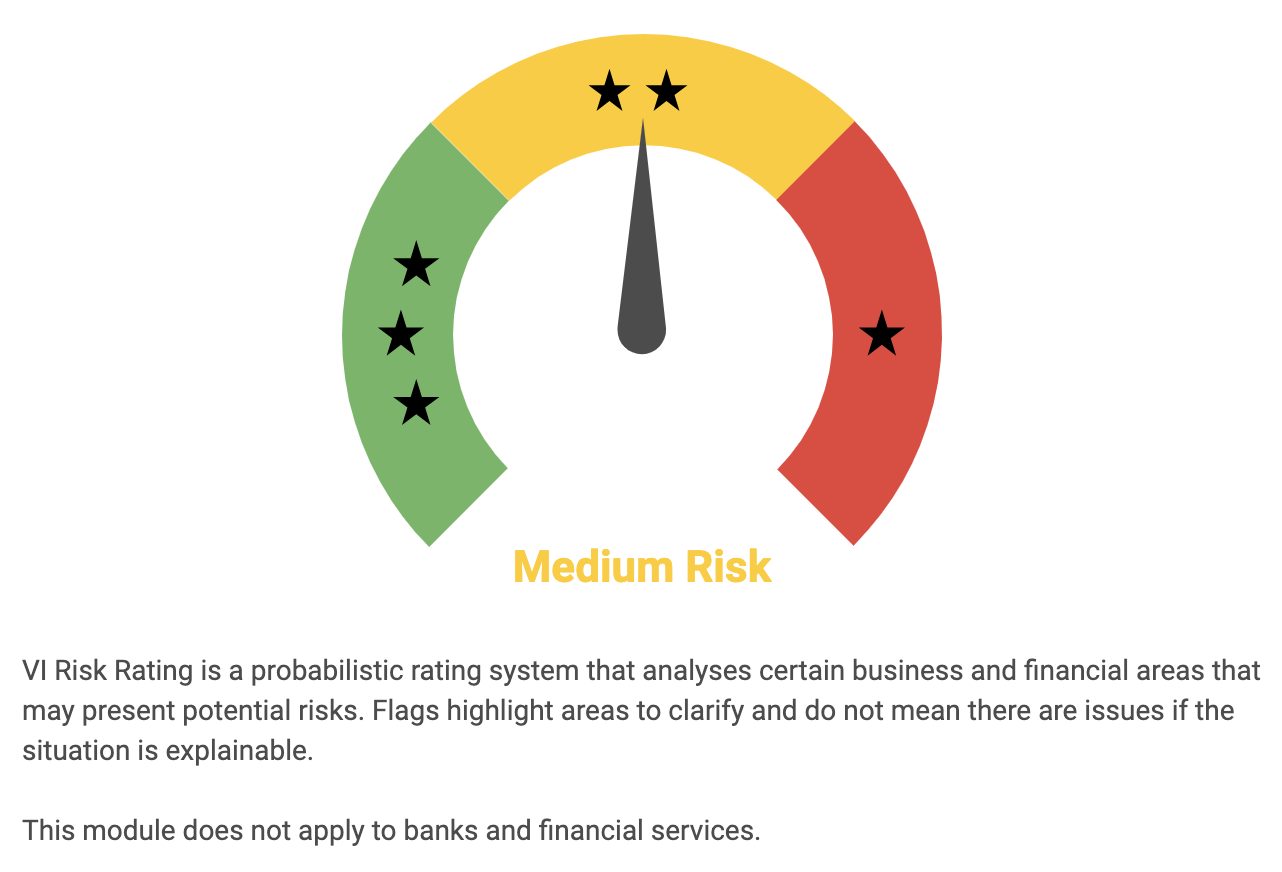

The VI App is a powerful tool for investors to analyze the fundamentals of TE CONNECTIVITY and determine its long-term potential. According to the VI Risk Rating, TE CONNECTIVITY is a medium risk investment in terms of financial and business aspects. The app has also detected two risk warnings in the non-financial balance sheet. The app is easy to use and offers an in-depth analysis of the company’s financials, including its income statement, balance sheet and cash flow statement. It also provides an overview of the industry and competitive landscape, as well as a comprehensive analysis of the company’s key performance indicators. The app allows investors to assess the company’s financial health and identify potential risks or opportunities. It also provides insights into the company’s growth prospects and profitability.

With this information, investors can make informed decisions about investing in TE CONNECTIVITY. The app provides a detailed view of the company’s operations and enables investors to track its performance over time. It also allows users to compare TE CONNECTIVITY to its peers and competitors in the industry. This helps investors get a better understanding of the company’s competitive position in the market. Overall, the VI App is a great way for investors to get an in-depth look at TE CONNECTIVITY’s fundamentals and make informed decisions about investing in the company. To take full advantage of the app, users must register to view the two risk warnings in the non-financial balance sheet.

Peers

The company’s products are used in a variety of industries, including automotive, aerospace, telecommunications, industrial, and consumer electronics. TE Connectivity‘s main competitors are Amphenol Corp, Littelfuse Inc, Rexel SA, and other smaller companies. The company has a strong market position and offers a wide range of products.

However, its competitors are also well-established and offer similar products.

– Amphenol Corp ($NYSE:APH)

Amphenol Corp is a worldwide electronics manufacturer. They have a market cap of 43.95B as of 2022 and a Return on Equity of 23.34%. The company designs, manufactures, and markets electrical, electronic, and fiber optic connectors, interconnect systems, and coaxial and high-speed specialty cable.

– Littelfuse Inc ($NASDAQ:LFUS)

Littelfuse is a global manufacturer of circuit protection devices. Its products are used in a variety of industries, including automotive, consumer electronics, industrial, and telecommunications. The company has a market cap of 5.37B and a ROE of 13.41%.

– Rexel SA ($OTCPK:RXEEY)

As of 2022, Rexel SA has a market cap of 5.33B and a Return on Equity of 14.71%. The company is a leading distributor of electrical supplies and equipment. It operates in over 30 countries and serves a wide range of customers, from large corporates to small businesses. Rexel is committed to providing quality products and services, and to being a responsible corporate citizen.

Summary

TE Connectivity Ltd. has been the subject of much investor interest recently, with Western Wealth Management LLC investing in 1324 shares. The sentiment surrounding the company appears to be generally positive, suggesting that it is a sound investment choice. Analysts have identified a number of reasons to be bullish on the company’s future prospects, including its diverse portfolio of innovative products and services, its commitment to responsible environmental practices, and its ongoing investment in research and development.

Furthermore, the company’s strong financials and consistently impressive financial results suggest that it is well-positioned to achieve long-term profitability. Investors should also note that TE Connectivity Ltd. has long been an industry leader and is likely to remain so in the foreseeable future.

Recent Posts