Utah Retirement Systems Sell Shares of Jabil in 2023.

March 16, 2023

Trending News ☀️

In 2023, the Utah Retirement Systems, or URS, sold shares of Jabil Inc ($NYSE:JBL)., a global manufacturing, supply chain and product solutions company. URS is a public pension fund that provides retirement and other financial benefits for public employees within the state of Utah. The sale of Jabil Inc. shares was part of an ongoing effort by URS to diversify its investment portfolio. The company provides its customers with a range of electronics and components, from industrial components to consumer electronics. Jabil Inc. has a long history of innovation and customer satisfaction, which has made the company a valuable asset for URS.

By selling shares of Jabil Inc., URS is able to diversify its investments and reduce risk while still providing a return on investment. This allows URS to not only secure its financial portfolio but also to provide its members with greater financial security and stability. With the sale of Jabil Inc. shares, URS is able to take advantage of the company’s long-term growth potential while also providing its members with increased retirement benefits.

Share Price

On Monday, JABIL INC stock opened at $80.2 and closed at $81.4, down by 0.7% from last closing price of 81.9. Although the stock dropped slightly, overall media sentiment for the company remains mostly positive. Utah Retirement Systems announced that it would be selling its shares of Jabil Inc. in 2023, showing that the company has positive potential for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jabil Inc. More…

| Total Revenues | Net Income | Net Margin |

| 34.55k | 978 | 3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jabil Inc. More…

| Operations | Investing | Financing |

| 1.86k | -961 | -921 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jabil Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.51k | 17.98k | 18.84 |

Key Ratios Snapshot

Some of the financial key ratios for Jabil Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.5% | 27.8% | 4.0% |

| FCF Margin | ROE | ROA |

| 1.3% | 34.9% | 4.2% |

Analysis

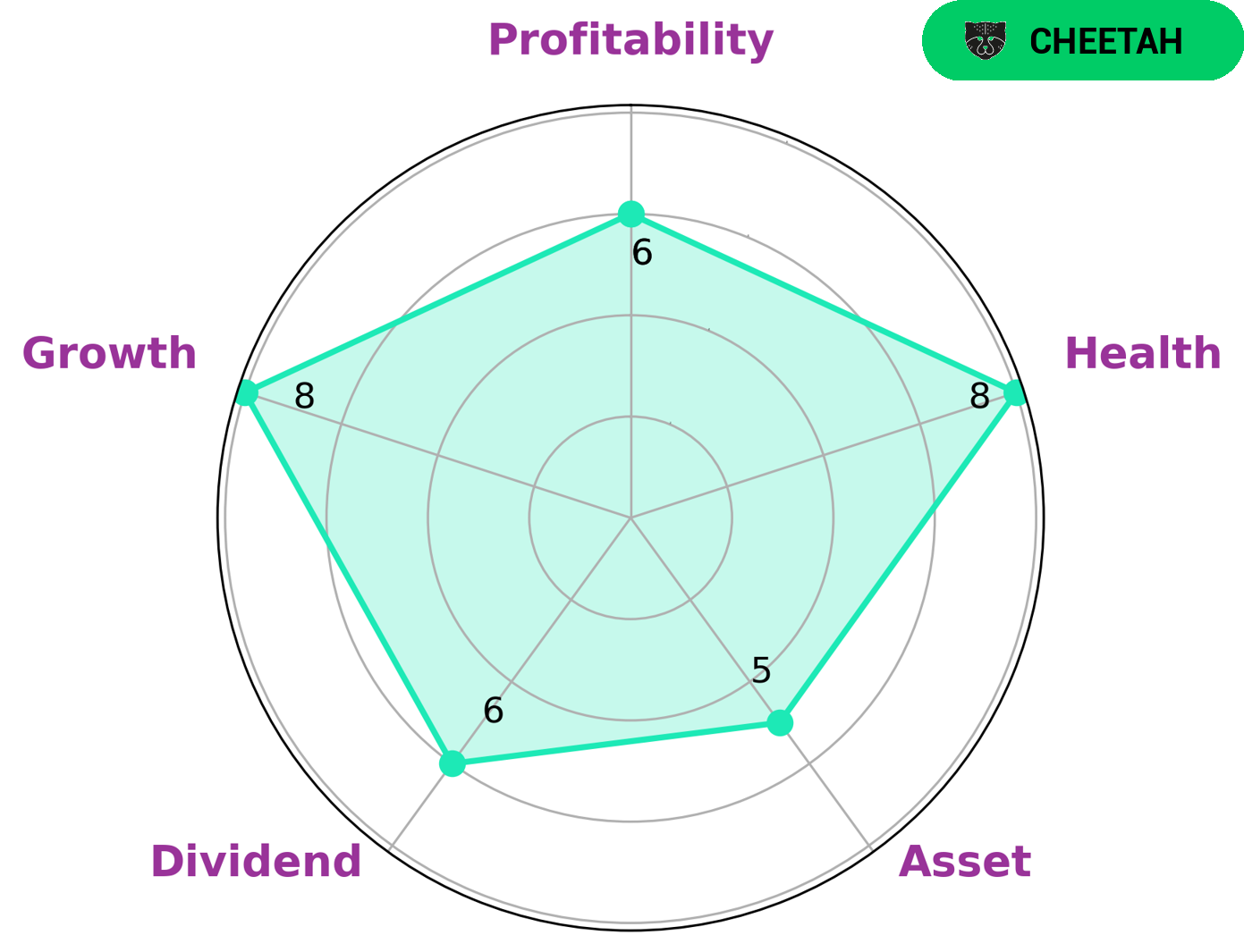

At GoodWhale, we conducted an analysis of JABIL INC‘s fundamentals. Our Star Chart shows that JABIL INC has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. JABIL INC is classified as a ‘cheetah’ type company, meaning that it achieved high revenue or earnings growth but is considered less stable due to lower profitability. As such, investors looking for growth may be interested in JABIL INC. The company is strong in terms of growth, and medium in terms of asset, dividend and profitability levels. Furthermore, because of its high health score and classification as a ‘cheetah’ type company, JABIL INC may be a good choice for investors looking for high-growth companies with the potential to weather future economic downturns. More…

Peers

It is headquartered in St. Petersburg, Florida, and it has been in business since 1966. The company has more than 100,000 employees, and its revenue was $17.9 billion in 2017. Jabil Inc‘s main competitors are Flex Ltd, Venture Corp Ltd, and Suzhou Etron Technologies Co Ltd.

– Flex Ltd ($NASDAQ:FLEX)

Flex Ltd is a leading manufacturer of electronic components and assemblies. The company has a market capitalization of 7.97 billion as of 2022 and a return on equity of 18.46%. Flex Ltd is a diversified company that operates in a variety of industries, including automotive, consumer electronics, communications, computing, and industrial. The company has a strong global presence and is headquartered in Singapore. Flex Ltd is a publicly traded company on the Singapore Stock Exchange.

– Venture Corp Ltd ($SGX:V03)

Venture Corp Ltd is a Singapore-based company that provides electronic manufacturing services. The company has a market cap of 4.64B as of 2022 and a Return on Equity of 12.65%. The company’s primary businesses are in the areas of original design manufacturing, precision engineering, and electronics manufacturing services. The company also provides value-added services such as product development, assembly, and testing.

– Suzhou Etron Technologies Co Ltd ($SHSE:603380)

As of 2022, Suzhou Etron Technologies Co Ltd has a market cap of 4.81B and a Return on Equity of 13.48%. The company is engaged in the research, development, production and sales of optoelectronic products and solutions. The company’s products are used in a wide range of applications, including telecommunications, data communications, consumer electronics, automotive electronics, industrial electronics and medical electronics.

Summary

Jabil Inc., a leading global electronics manufacturing services provider, is an attractive investment opportunity for investors seeking long-term growth. According to recent analysis by the Utah Retirement Systems, Jabil Inc. is expected to see strong growth in the next few years, with shares projected to increase in value by 2023. With a highly diverse customer base and a growing presence in the consumer electronics sector, Jabil Inc. looks set to remain a profitable investment option in the long-term.

Recent Posts