TE Connectivity Ltd. Experiences Uptick in Investment from Pacer Advisors

January 6, 2023

Trending News 🌥️

TE ($NYSE:TEL) Connectivity’s stock is publicly traded on the New York Stock Exchange under the ticker symbol TEL. Recently, TE Connectivity Ltd. has seen an uptick in investment from Pacer Advisors Inc., a registered investment advisor. This strong performance was driven by increased demand for the company’s products in the automotive and consumer electronics markets. The company has been able to take advantage of cost-saving measures, such as reducing its workforce and streamlining its supply chain, to maintain its profitability.

The increased investment from Pacer Advisors Inc. is a sign that the company’s long-term prospects remain strong despite the current economic climate. With its strong portfolio of products and services, TE Connectivity Ltd. is well positioned to continue to benefit from the increasing demand for its products in the coming years.

Price History

TE Connectivity‘s strategy focuses on innovation, customer service, and operational excellence. This has enabled the company to maintain its leadership position in the industry and expand its presence in new markets. The company has been expanding its portfolio of products and services, which likely contributed to the increased investment from Pacer Advisors Inc. Moreover, TE Connectivity is continuing to invest in its digital solutions and expand its presence in emerging markets, which should provide additional fuel for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Te Connectivity. More…

| Total Revenues | Net Income | Net Margin |

| 16.28k | 2.43k | 15.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Te Connectivity. More…

| Operations | Investing | Financing |

| 2.47k | -878 | -1.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Te Connectivity. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.78k | 9.88k | 33.96 |

Key Ratios Snapshot

Some of the financial key ratios for Te Connectivity are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.6% | 9.2% | 17.2% |

| FCF Margin | ROE | ROA |

| 10.4% | 16.5% | 8.4% |

VI Analysis

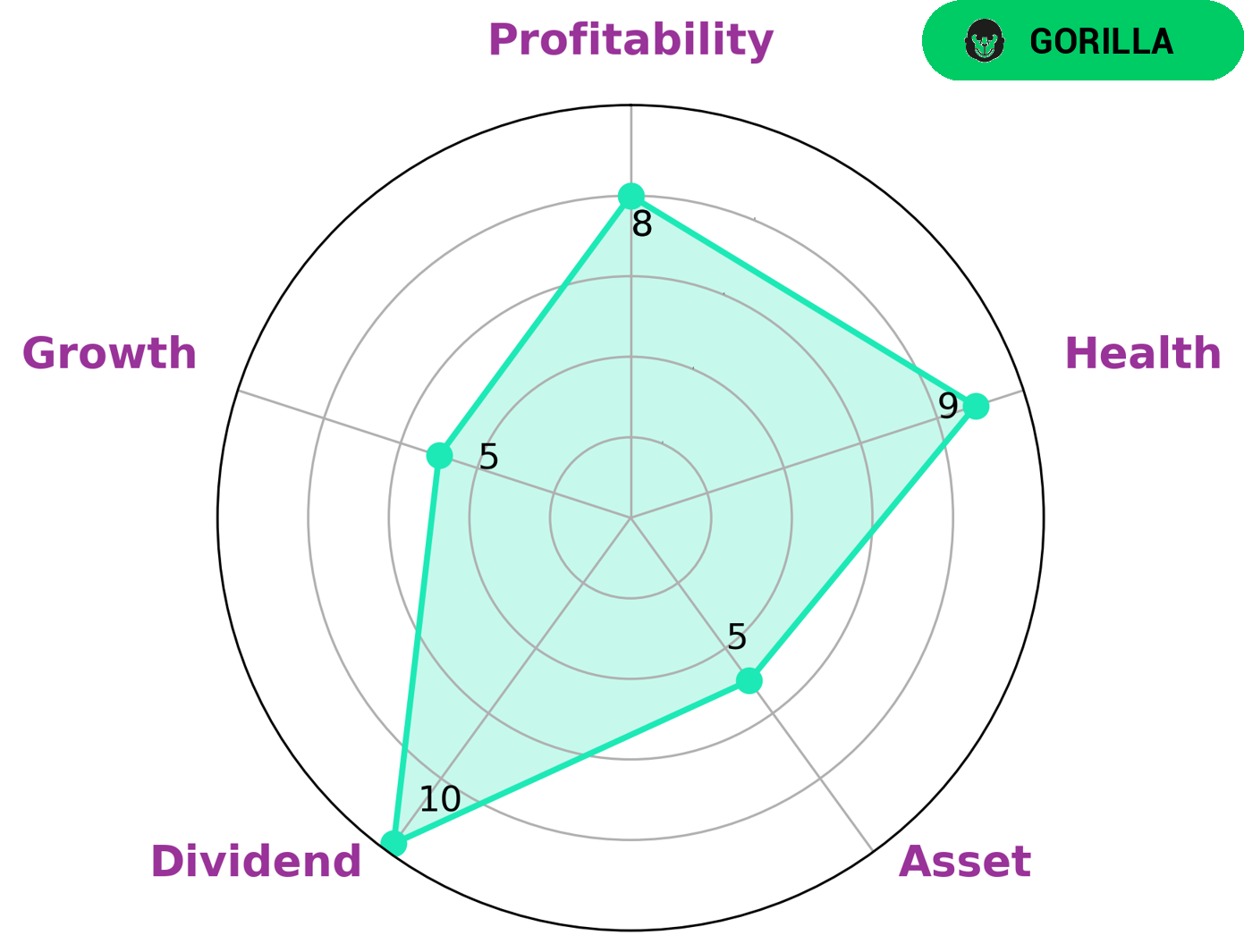

TE CONNECTIVITY is a company with very strong fundamentals, as indicated by its high health score of 9/10. This health score is determined by taking into account the company’s cashflows and debt, which indicates that the company is capable of paying off debt and funding future operations. The company is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in such a company would be those looking for a safe, long-term investment with a good dividend yield and a high level of profitability. TE CONNECTIVITY is especially strong in these areas, while also exhibiting medium growth in terms of assets. Overall, TE CONNECTIVITY can be seen as a reliable and profitable company with excellent long-term potential. It offers investors the opportunity to make a safe and secure investment with the potential to enjoy great returns in the future. More…

VI Peers

The company’s products are used in a variety of industries, including automotive, aerospace, telecommunications, industrial, and consumer electronics. TE Connectivity‘s main competitors are Amphenol Corp, Littelfuse Inc, Rexel SA, and other smaller companies. The company has a strong market position and offers a wide range of products.

However, its competitors are also well-established and offer similar products.

– Amphenol Corp ($NYSE:APH)

Amphenol Corp is a worldwide electronics manufacturer. They have a market cap of 43.95B as of 2022 and a Return on Equity of 23.34%. The company designs, manufactures, and markets electrical, electronic, and fiber optic connectors, interconnect systems, and coaxial and high-speed specialty cable.

– Littelfuse Inc ($NASDAQ:LFUS)

Littelfuse is a global manufacturer of circuit protection devices. Its products are used in a variety of industries, including automotive, consumer electronics, industrial, and telecommunications. The company has a market cap of 5.37B and a ROE of 13.41%.

– Rexel SA ($OTCPK:RXEEY)

As of 2022, Rexel SA has a market cap of 5.33B and a Return on Equity of 14.71%. The company is a leading distributor of electrical supplies and equipment. It operates in over 30 countries and serves a wide range of customers, from large corporates to small businesses. Rexel is committed to providing quality products and services, and to being a responsible corporate citizen.

Summary

Pacer Advisors Inc. has recently made an investment in TE Connectivity Ltd., a world leader in connectivity and sensor solutions. The investment marks an uptick in activity for the company, which seeks to further expand its offerings in the global market. TE Connectivity’s portfolio of products ranges from connectors and cable assemblies to communication and navigation equipment. This investment will provide TE Connectivity with the resources to increase its research and development, capital investments, and expand its reach in the global markets.

TE Connectivity’s management team is confident that this new injection of capital will enable them to grow their presence and gain market share in the highly competitive industry. The company also plans to use the funds to further develop its core products and services, as well as explore new opportunities for growth.

Recent Posts