TE Connectivity Executive Sells $1.3M in Company Stock, Signals Confidence in Industrial Solutions Division

September 10, 2024

☀️Trending News

TE ($NYSE:TEL) Connectivity Ltd. is a global technology company that designs and manufactures electronic components and solutions for a wide range of industries. The company’s products are used in various applications such as sensor systems, connectors, and wire and cable solutions. In addition, TE Connectivity offers comprehensive services to support its customers’ needs. In recent news, it was announced that TE Connectivity’s President of Industrial Solutions, Shadrak W. Kroeger, sold $1.3 million worth of the company’s stock. This sale was made public by TE Connectivity, with Kroeger’s involvement in the transaction being disclosed. This news has caused a stir in the investment community, as it is seen as a clear signal of confidence in the company’s Industrial Solutions division. The fact that a high-ranking executive within TE Connectivity has chosen to sell a significant amount of company stock speaks volumes about the company’s current and future outlook. It is worth noting that this sale is not an isolated incident, as Kroeger has been steadily selling off stock in TE Connectivity over the past few months.

However, the recent sale of $1.3 million is by far the largest amount sold by any TE Connectivity executive in recent times. This move by Kroeger indicates that he believes the Industrial Solutions division is performing well and will continue to do so in the future. As the President of this division, Kroeger is likely privy to insider information about the company’s financials and strategies, making his decision to sell a strong indicator of his confidence in the direction of this particular division. Moreover, this sale also sends a positive message to investors about TE Connectivity as a whole. When high-level executives show faith in their own company by investing their own money into its stock, it can inspire confidence in the market. This could potentially lead to increased investments and a boost in the company’s stock value. It is a testament to the company’s strength and stability, and may potentially have a positive impact on its stock performance in the future. Investors should take note of this move and consider it as a positive indicator for TE Connectivity’s continued success.

Price History

On Thursday, the stock of TE Connectivity (TE) opened at $148.17 and closed at $147.07, experiencing a decrease of 0.41% from the previous closing price of $147.68.

However, despite this slight dip, there was a notable event that occurred within the company that signaled confidence in its future. One of TE Connectivity’s executives recently sold $1.3 million worth of company stock, according to a filing with the Securities and Exchange Commission. This sale was made under a prearranged trading plan and represents a significant portion of the executive’s holdings. The fact that this sale was pre-planned suggests that it was not a reactionary move, but rather a strategic one. This executive’s sale of TE Connectivity stock can be seen as a vote of confidence in the company’s Industrial Solutions division. This division is responsible for producing products such as connectors, sensors, and relays for industrial applications. With the global industrial sector expected to continue growing, it is understandable why an executive within the company would have faith in this division. The sale also indicates that the executive believes that the current stock price is an opportune time to sell. This suggests that they anticipate a potential increase in the future, which aligns with analysts’ projections for TE Connectivity. With a strong financial position and a portfolio of innovative products, the company is poised for continued success in the industrial solutions market. In summary, while TE Connectivity’s stock may have experienced a slight decline, the recent sale of company stock by one of its executives sends a positive signal about the company’s future. It demonstrates confidence in the Industrial Solutions division and suggests that there may be potential for growth in the near future. As always, investors should conduct their own research and analysis before making any investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Te Connectivity. More…

| Total Revenues | Net Income | Net Margin |

| 16.02k | 3.32k | 22.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Te Connectivity. More…

| Operations | Investing | Financing |

| 3.27k | -971 | -1.92k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Te Connectivity. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.07k | 9.82k | 42.27 |

Key Ratios Snapshot

Some of the financial key ratios for Te Connectivity are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.6% | 14.5% | 16.0% |

| FCF Margin | ROE | ROA |

| 16.0% | 13.0% | 6.9% |

Analysis

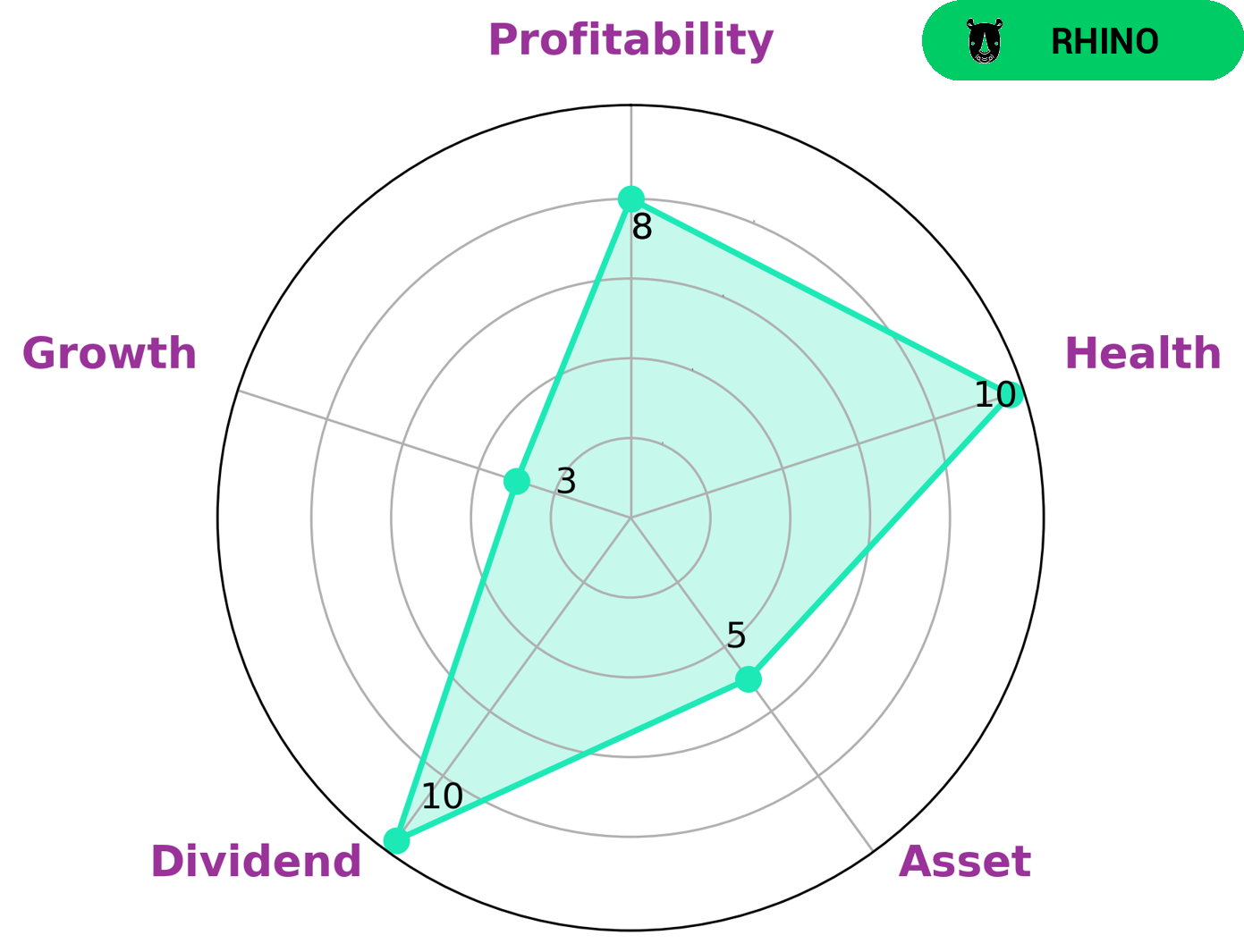

As a financial analyst at GoodWhale, I have examined the welfare of TE CONNECTIVITY and have found some key points to consider for potential investors. Firstly, according to our Star Chart analysis, TE CONNECTIVITY is a strong company in terms of dividend payments and profitability. This means that they are able to consistently pay out dividends to their shareholders and have a good track record of making profits. However, the company is only rated as medium in terms of assets and weak in terms of growth. One of the most important factors to consider when investing in a company is its financial health. In this aspect, TE CONNECTIVITY scores very well with a high health score of 10/10. This is due to their strong cashflows and low levels of debt. This indicates that the company is able to sustain its operations even in times of crisis, making it a stable investment option. In terms of growth potential, TE CONNECTIVITY falls under the category of ‘rhino’ according to our classification system. This means that the company has achieved moderate revenue or earnings growth, which may not be as attractive to some investors seeking high growth opportunities. However, it also means that the company has a more stable and predictable performance compared to companies with higher growth potential. Based on these observations, I believe that TE CONNECTIVITY would be a suitable investment option for investors who prioritize stability and consistent dividend payments. The company’s strong financial health and moderate growth potential make it a relatively low-risk investment choice. However, investors seeking higher growth opportunities may not find TE CONNECTIVITY as appealing. Ultimately, it is important for investors to carefully consider their own investment goals and risk tolerance before making any decisions. More…

Peers

The company’s products are used in a variety of industries, including automotive, aerospace, telecommunications, industrial, and consumer electronics. TE Connectivity‘s main competitors are Amphenol Corp, Littelfuse Inc, Rexel SA, and other smaller companies. The company has a strong market position and offers a wide range of products.

However, its competitors are also well-established and offer similar products.

– Amphenol Corp ($NYSE:APH)

Amphenol Corp is a worldwide electronics manufacturer. They have a market cap of 43.95B as of 2022 and a Return on Equity of 23.34%. The company designs, manufactures, and markets electrical, electronic, and fiber optic connectors, interconnect systems, and coaxial and high-speed specialty cable.

– Littelfuse Inc ($NASDAQ:LFUS)

Littelfuse is a global manufacturer of circuit protection devices. Its products are used in a variety of industries, including automotive, consumer electronics, industrial, and telecommunications. The company has a market cap of 5.37B and a ROE of 13.41%.

– Rexel SA ($OTCPK:RXEEY)

As of 2022, Rexel SA has a market cap of 5.33B and a Return on Equity of 14.71%. The company is a leading distributor of electrical supplies and equipment. It operates in over 30 countries and serves a wide range of customers, from large corporates to small businesses. Rexel is committed to providing quality products and services, and to being a responsible corporate citizen.

Summary

In a recent transaction, Shadrak W. Kroeger, President of Industrial Solutions at TE Connectivity Ltd, sold over $1.3 million in company stock. This sale raises concerns for investors as it may indicate a lack of confidence in the company’s future performance. Additionally, with the stock currently trading at a relatively high price, it may be seen as an opportune time for Kroeger to cash out. Investors should closely monitor any further selling activity from executives at TE Connectivity and consider this latest transaction as a potential red flag for the company’s stock.

Recent Posts