NIPPON ELECTRIC GLASS to Lead Flexible Substrates Market to Reach USD 778.6 Million by 2029 at 10.57% CAGR.

March 29, 2023

Trending News ☀️

NIPPON ELECTRIC GLASS ($TSE:5214), one of the world’s largest manufacturers of glass and related materials, is poised to lead the Flexible Substrates Market to reach a value of USD 778.6 million by 2029. Flexible substrates are gaining prominence due to their growing application in numerous sectors, such as automotive, consumer electronics, and healthcare. The increasing demand for Electronic Grade Laminate (EGL) substrates and advanced packaging technologies, such as System-in-Package (SiP), has prompted NIPPON ELECTRIC GLASS to focus on developing advanced substrates. This is expected to drive the growth of the flexible substrates market in the years to come. NIPPON ELECTRIC GLASS is a well-known name in the glass industry and has a considerable presence in various regions.

The company follows a diversified business strategy, which includes the production of flat sheets and specialty glass products, as well as its involvement in the manufacture of flexible substrates for advanced packaging solutions. Leveraging its advanced research and development capabilities, NIPPON ELECTRIC GLASS is set to continue leading the flexible substrates market with an estimated CAGR of 10.57%. With continuous advancements being made in advanced packaging solutions, NIPPON ELECTRIC GLASS is expected to remain ahead of the competition and continue leading the flexible substrates market. The company is making investments in research and development and expanding its presence across various regions to capitalize on the increasing demand for flexible substrates in the coming years.

Market Price

On Tuesday, the company’s stock opened at JP¥2480.0 and closed at JP¥2481.0, which was a 0.2% increase from the previous closing price of 2477.0. This signals positive investor sentiment in the company, as it suggests that they are confident in NIPPON ELECTRIC GLASS’s ability to lead the flexible substrates market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nippon Electric Glass. More…

| Total Revenues | Net Income | Net Margin |

| 325.73k | 36.27k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nippon Electric Glass. More…

| Operations | Investing | Financing |

| 46.3k | -31.75k | -29.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nippon Electric Glass. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 755.43k | 214k | 5.77k |

Key Ratios Snapshot

Some of the financial key ratios for Nippon Electric Glass are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 19.9% | 15.4% |

| FCF Margin | ROE | ROA |

| 14.2% | 5.8% | 4.2% |

Analysis

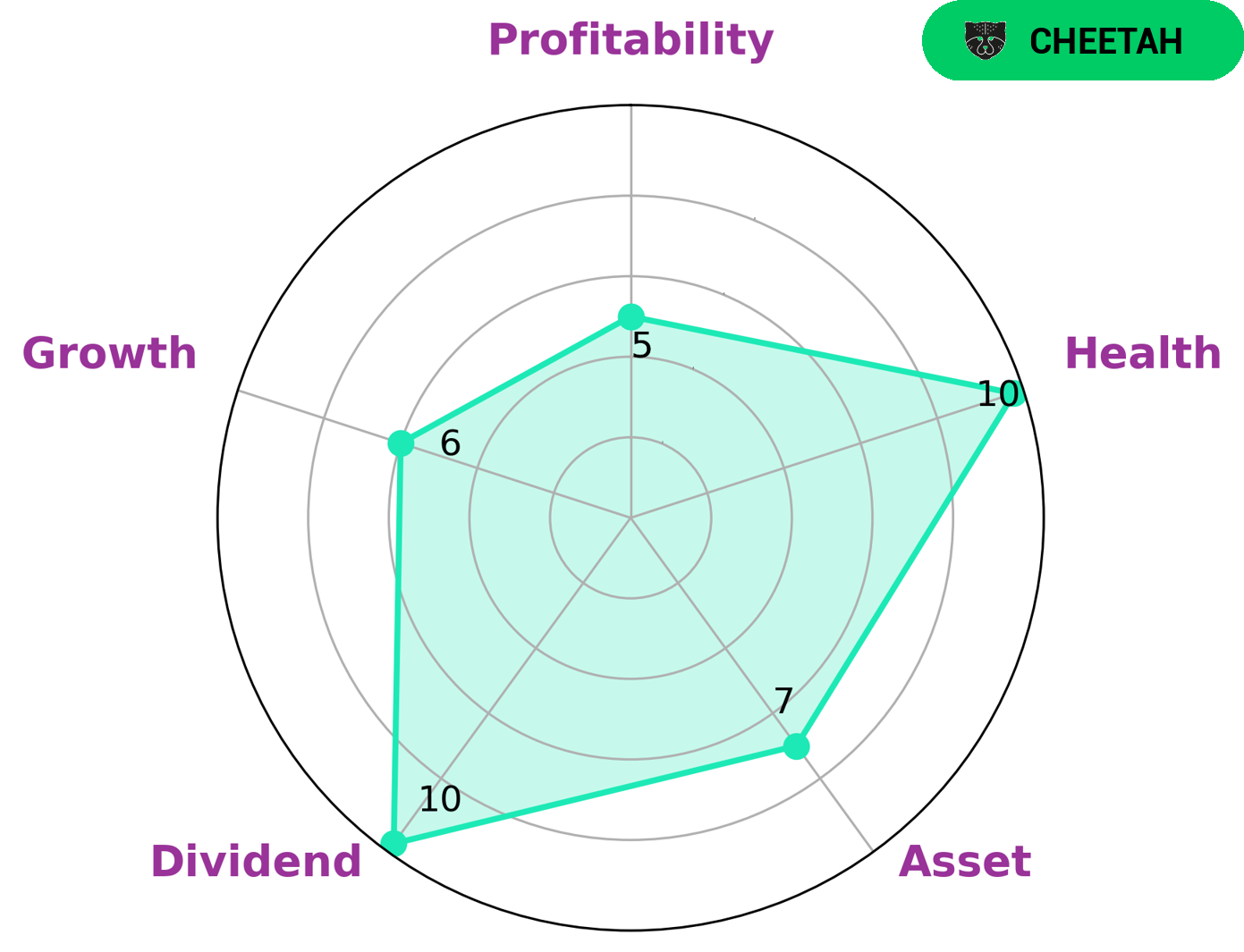

GoodWhale has conducted an in-depth analysis of NIPPON ELECTRIC GLASS’s fundamentals, and the results are as follows. According to our Star Chart, NIPPON ELECTRIC GLASS is strong in asset, dividend, and medium in growth, profitability. We have classified NIPPON ELECTRIC GLASS as a ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this information, potential investors may be interested in NIPPON ELECTRIC GLASS as it has a high health score of 10/10 considering its cashflows and debt, and is capable to pay off debt and fund future operations. In addition, the company’s strong performance in asset and dividend may be attractive for investors looking for a more stable investment. More…

Peers

The competition between Nippon Electric Glass Co Ltd and its competitors, Ohara Inc, AimCore technology Co Ltd, and Okamoto Glass Co Ltd, is fierce. Each company strives to outdo the others in terms of technological advances, product quality, and customer service, making the fight for market share and profits a cut-throat one.

– Ohara Inc ($TSE:5218)

O’Hara Inc is a multinational engineering and manufacturing corporation headquartered in Tokyo. It is one of the largest companies in the industry and has been around for over a century. The company specializes in the production of automobiles, electronics, and other various engineering products. As of 2023, O’Hara Inc has a market capitalization of 27.4 billion dollars and a return on equity of 4.97%. This market cap indicates a strong level of investor confidence in the company’s future performance. The return on equity further speaks to its efficient utilization of resources, as it indicates returns above the industry average. In short, O’Hara Inc is a strong and reputable player in the engineering and manufacturing sector that has managed to achieve both high market capitalization and a healthy return on equity.

– AimCore technology Co Ltd ($TPEX:3615)

AimCore Technology Co Ltd is a technology company that provides comprehensive IT services, including IT infrastructure, cloud computing, software engineering, and digital media services. As of 2023, AimCore Technology Co Ltd has a market cap of 1.18B, giving investors a clear picture of the company’s financial standing. Additionally, the company has a Return on Equity of 2.26%, which is a good indicator of the company’s profitability. This suggests that the company is successfully using its equity to generate returns.

– Okamoto Glass Co Ltd ($TSE:7746)

Okamoto Glass Co Ltd is a Japanese glass manufacturer that produces a variety of products for commercial, industrial, and residential use. With a total market capitalization of 3.12B as of 2023, it remains one of the leading glass companies in the country. It has also achieved a return on equity (ROE) of 17.73%, indicating that its investors have earned a significant return on their investments. The company is constantly innovating to stay ahead of the competition and keeps investing in research and development to stay competitive.

Summary

NIPPON ELECTRIC GLASS is well-positioned to become a leader in the flexible substrates market. Media coverage has been overwhelmingly positive, making NIPPON ELECTRIC GLASS an attractive investment opportunity. With its innovative technology, established reputation in the industry, and cutting-edge products, this company is poised to capitalize on the current growth of the market and provide investors with an attractive return.

Recent Posts