Nippon Electric Glass Stock Fair Value Calculator – Nippon Electric Glass Co. Ltd. Shares Plunge 4.9% Mid-Day Friday

May 5, 2023

Trending News ☀️

Nippon Electric Glass ($TSE:5214) Co., Ltd. (NEG) experienced a steep decline in its stock price during Friday’s mid-day session, dropping 4.9%. It produces a wide range of specialty glass products for the automotive, electronics, building materials, and medical industries, as well as optical glass for optical instruments, cameras, and mobile phones. This has caused investors to become more cautious, leading to a dip in stock prices of many firms.

NEG’s performance has been further weakened by the unfavorable exchange rates between the Japanese yen and foreign currencies. Despite these factors, NEG remains confident in its ability to sustain its long-term growth and profitability.

Analysis – Nippon Electric Glass Stock Fair Value Calculator

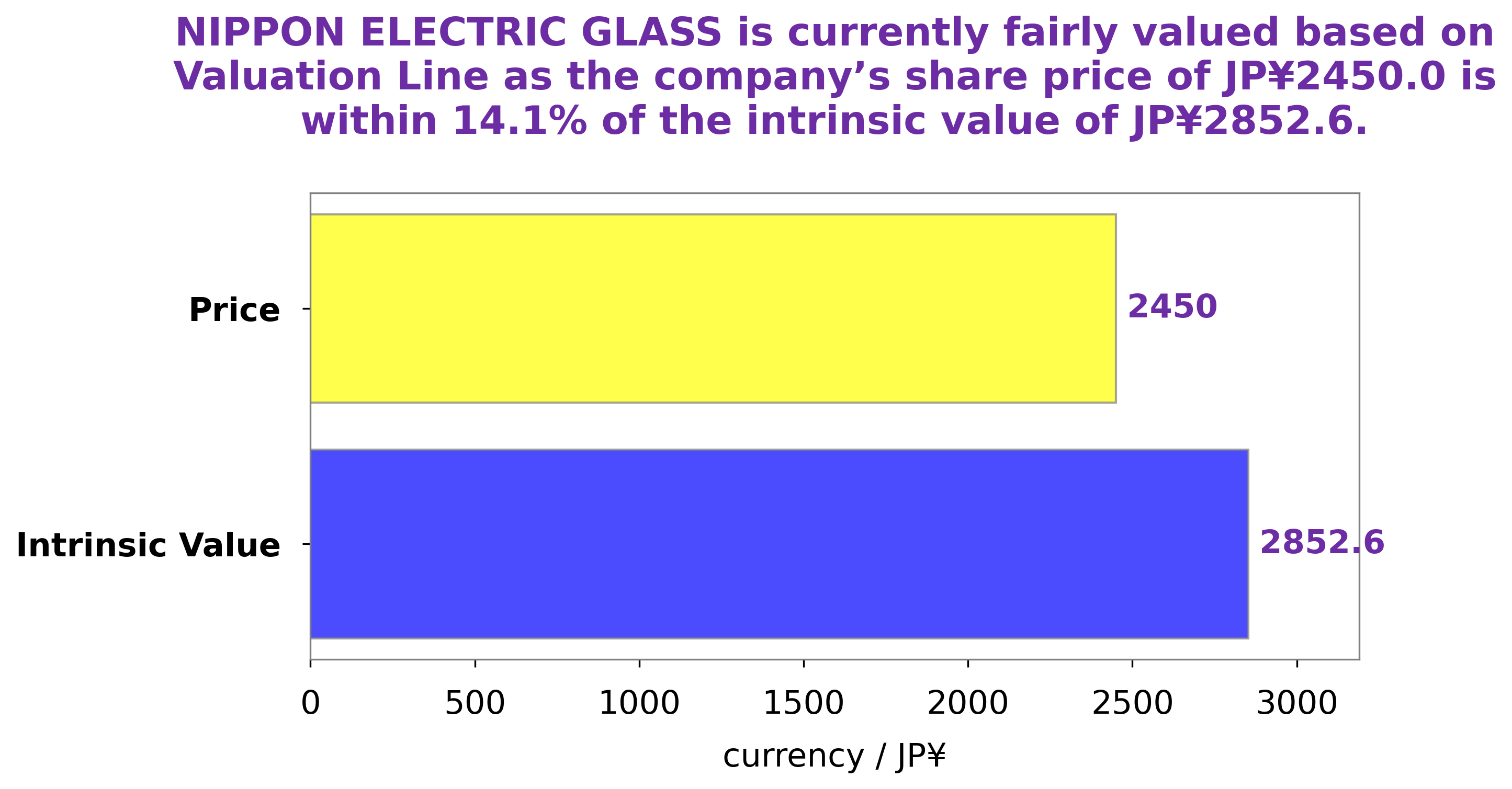

At GoodWhale we recently conducted an analysis of NIPPON ELECTRIC GLASS’s wellbeing. After thoroughly evaluating the company’s fundamentals, our proprietary Valuation Line revealed an intrinsic value of JP¥2852.6 for each share. Yet, NIPPON ELECTRIC GLASS is currently trading at JP¥2450.0, indicating a fair price that is undervalued by 14.1%. This provides an opportunity for investors to purchase the shares at a discounted rate. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nippon Electric Glass. More…

| Total Revenues | Net Income | Net Margin |

| 325.73k | 36.27k | 10.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nippon Electric Glass. More…

| Operations | Investing | Financing |

| 46.3k | -31.75k | -29.18k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nippon Electric Glass. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 755.43k | 214k | 5.77k |

Key Ratios Snapshot

Some of the financial key ratios for Nippon Electric Glass are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 19.9% | 15.4% |

| FCF Margin | ROE | ROA |

| 14.2% | 5.8% | 4.2% |

Peers

The competition between Nippon Electric Glass Co Ltd and its competitors, Ohara Inc, AimCore technology Co Ltd, and Okamoto Glass Co Ltd, is fierce. Each company strives to outdo the others in terms of technological advances, product quality, and customer service, making the fight for market share and profits a cut-throat one.

– Ohara Inc ($TSE:5218)

O’Hara Inc is a multinational engineering and manufacturing corporation headquartered in Tokyo. It is one of the largest companies in the industry and has been around for over a century. The company specializes in the production of automobiles, electronics, and other various engineering products. As of 2023, O’Hara Inc has a market capitalization of 27.4 billion dollars and a return on equity of 4.97%. This market cap indicates a strong level of investor confidence in the company’s future performance. The return on equity further speaks to its efficient utilization of resources, as it indicates returns above the industry average. In short, O’Hara Inc is a strong and reputable player in the engineering and manufacturing sector that has managed to achieve both high market capitalization and a healthy return on equity.

– AimCore technology Co Ltd ($TPEX:3615)

AimCore Technology Co Ltd is a technology company that provides comprehensive IT services, including IT infrastructure, cloud computing, software engineering, and digital media services. As of 2023, AimCore Technology Co Ltd has a market cap of 1.18B, giving investors a clear picture of the company’s financial standing. Additionally, the company has a Return on Equity of 2.26%, which is a good indicator of the company’s profitability. This suggests that the company is successfully using its equity to generate returns.

– Okamoto Glass Co Ltd ($TSE:7746)

Okamoto Glass Co Ltd is a Japanese glass manufacturer that produces a variety of products for commercial, industrial, and residential use. With a total market capitalization of 3.12B as of 2023, it remains one of the leading glass companies in the country. It has also achieved a return on equity (ROE) of 17.73%, indicating that its investors have earned a significant return on their investments. The company is constantly innovating to stay ahead of the competition and keeps investing in research and development to stay competitive.

Summary

Nippon Electric Glass Co., Ltd. has seen a significant drop in their stock price during mid-day trading on Friday. This marks a 4.9% decrease in the company’s share value. Investors should keep a close eye on Nippon Electric Glass as the stock’s performance continues to be volatile. Analysts suggest that investors should watch out for any further drops in the stock and should consider if buying or selling the stock is a good option based on their investment objectives. Other factors to consider include the company’s financial performance and growth prospects in the near future.

Additionally, investors should analyze the market conditions and consider any potential risks before making any investments.

Recent Posts