Littelfuse Stock Intrinsic Value – Littelfuse sees significant increase in short interest during August

September 17, 2024

☀️Trending News

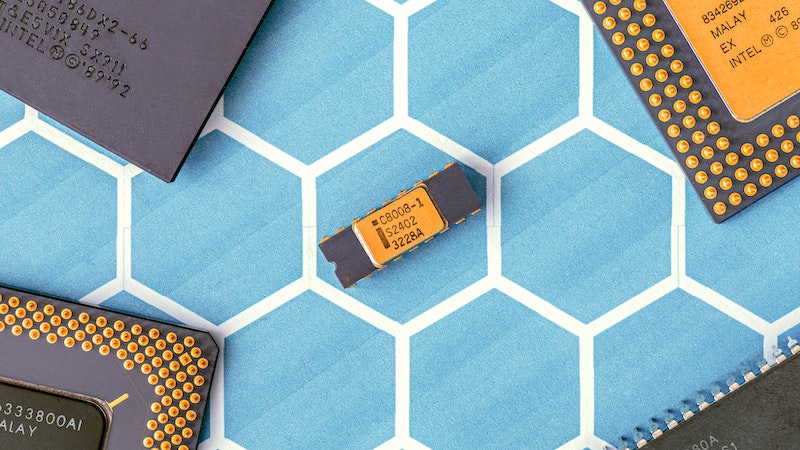

Littelfuse ($NASDAQ:LFUS), Inc. is a global leader in the design and manufacture of circuit protection, power control, and sensing technologies. The company’s products are used in a wide range of industries, including automotive, industrial, and consumer electronics. As one of the oldest companies in the circuit protection industry, Littelfuse has built a strong reputation for providing high-quality solutions to its customers.

However, in the month of August, Littelfuse saw a significant increase in short interest. Short interest refers to the number of shares of a company’s stock that have been sold short by investors. This means that these investors are betting that the stock price will decrease in the near future. While short selling is a common practice in the stock market, a high level of short interest can indicate negative sentiment towards a company’s stock. One possible reason could be the overall market volatility during this time period. As a result, many investors may have turned to short selling as a way to hedge against potential losses. Another factor that could have contributed to the increase in short interest for Littelfuse is the company’s financial performance. In July, Littelfuse reported its second-quarter earnings results, which showed a decline in revenue and earnings compared to the same period last year. This could have caused some investors to doubt the company’s future growth potential and may have led them to short sell the stock. However, it is important to note that short selling does not necessarily indicate a lack of confidence in a company’s long-term prospects. It is simply a trading strategy used by investors to potentially profit from a decrease in a stock’s price.

Additionally, short positions can be closed at any time, so it is not a definitive measure of investor sentiment towards a company. In conclusion, despite the significant increase in short interest for Littelfuse during August, it is important to take into consideration the various factors that could have contributed to this trend. As a well-established company with a strong track record, Littelfuse remains a leader in its industry and is likely to continue providing value to its customers and investors in the long run.

Share Price

Short interest refers to the number of shares of a particular stock that have been sold short by investors, betting that the stock’s price will decrease. In the case of Littelfuse, a leading manufacturer of circuit protection products, there has been a significant increase in short interest during the month of August. On Monday, the company’s stock opened at $249.61 and closed at $252.42, representing a 0.96% increase from its previous closing price of $250.01. This upward movement in stock price may have been influenced by the company’s second-quarter earnings report, which showed strong financial performance and exceeded analysts’ expectations. This could indicate a lack of confidence in the company’s future prospects among some investors, as they bet against the stock’s performance. It is worth noting that Littelfuse’s short interest has been steadily rising since the beginning of the year, reaching a peak in late July before slightly decreasing in August.

This suggests that some investors may have been anticipating a potential drop in the company’s stock price and positioned themselves accordingly. While short interest can be an indicator of market sentiment, it is important to note that it does not necessarily reflect the overall health or future potential of a company. Littelfuse has consistently demonstrated strong financial performance and has a solid track record in its industry, making it a reliable choice for investors. In conclusion, while Littelfuse’s short interest has seen a significant increase in August, overall market reaction to the company’s performance remains positive. As with any investment decision, it is important for investors to thoroughly research and consider all factors before making any decisions based on short interest alone. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Littelfuse. More…

| Total Revenues | Net Income | Net Margin |

| 2.36k | 259.49 | 11.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Littelfuse. More…

| Operations | Investing | Financing |

| 457.39 | -284.32 | -185.73 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Littelfuse. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4k | 1.51k | 96.56 |

Key Ratios Snapshot

Some of the financial key ratios for Littelfuse are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 22.7% | 15.6% |

| FCF Margin | ROE | ROA |

| 15.7% | 9.6% | 5.8% |

Analysis – Littelfuse Stock Intrinsic Value

As a financial analyst, I have thoroughly examined the financial performance of LITTELFUSE, a leading provider of circuit protection products. After conducting a detailed analysis, I have determined that the intrinsic value of LITTELFUSE’s share is around $266.4. This valuation is based on our proprietary Valuation Line, which takes into account various financial metrics such as revenue growth, profitability, and future earnings potential. At the current market price of $252.42, LITTELFUSE’s stock is undervalued by 5.3%. This means that investors have the opportunity to purchase shares at a fair price, with potential for future growth. However, it is important to note that market prices can fluctuate and may not always reflect the true intrinsic value of a company. One key factor contributing to the undervaluation of LITTELFUSE’s stock is its strong financial performance. Furthermore, LITTELFUSE has a solid product portfolio and a strong market position in the circuit protection industry. This provides the company with stability and potential for long-term growth. In addition, LITTELFUSE has a strong balance sheet with low levels of debt, which further supports its financial stability. In conclusion, my analysis shows that LITTELFUSE’s stock is currently undervalued and presents a good investment opportunity for investors. With its strong financial performance and market position, the company has the potential to deliver long-term value to shareholders. However, as with any investment, it is important for investors to conduct their own research and carefully consider all factors before making any decisions. Littelfuse_sees_significant_increase_in_short_interest_during_August”>More…

Peers

Littelfuse Inc, a global manufacturer of circuit protection solutions, competes with Samsung Electro-Mechanics Co Ltd, Shindengen Electric Manufacturing Co Ltd, and Atotech Ltd in the circuit protection device market. The company’s products are used in a variety of industries, including automotive, electronics, and industrial. Littelfuse Inc has a strong product portfolio and a history of innovation. The company is well-positioned to compete in the circuit protection device market.

– Samsung Electro-Mechanics Co Ltd ($KOSE:009150)

As of 2022, Samsung Electro-Mechanics Co Ltd has a market cap of 8.65T and a Return on Equity of 19.62%. The company manufactures and sells electronic and electrical components and products worldwide. It offers passive components, including capacitors, resistors, and inductors; printed circuit boards; and semiconductor packages. The company also provides optical products, such as lenses and optical modules for mobile devices, digital cameras, monitors, and automobiles; and electric vehicles.

– Shindengen Electric Manufacturing Co Ltd ($TSE:6844)

Shindengen Electric Manufacturing Co., Ltd. is engaged in the manufacture and sale of electric power control products and automotive electronic products. The Company operates in three business segments. The Electric Power Control Devices segment includes power semiconductor devices, thyristors, rectifiers, inverters and other power control devices. The Automotive Electronics Devices segment includes automotive voltage stabilizers, motor control devices, solenoids, relays and other automotive electronic devices. The Components segment includes capacitors, inductors and other electronic components. As of March 31, 2014, the Company had 69 subsidiaries and two associated companies.

Summary

In August, there was a significant increase in short interest for Littelfuse, Inc. This indicates that there was a higher demand for selling the company’s stock, suggesting a potential decrease in its value. Investors should take note of this trend and carefully consider their options before investing in Littelfuse. It may be wise to conduct thorough research and analysis on the company’s financials, market trends, and industry competition before making any investment decisions. Additionally, keeping an eye on future developments and news surrounding Littelfuse can provide valuable insights for investors looking to capitalize on potential opportunities or mitigate risks.

Recent Posts