Kopin Corporation Stock Fair Value – Kopin Secures Major Military Contract for Weapon Sight Module

April 26, 2023

Trending News 🌥️

Kopin Corporation ($NASDAQ:KOPN) has just announced a major military contract win worth $1.1M. This marks a significant milestone for Kopin, a US-based company that specializes in the development and manufacture of innovative wearable and hearable technologies. The newly-awarded contract is testament to Kopin’s commitment to delivering cutting-edge technology for the military. The weapon sight module combines advanced optics, ultra-small displays, and voice-activated AI to provide an upgrade on existing military technology. Kopin’s specialized capabilities have enabled it to become a trusted partner for the military, as evidenced by the new contract.

The news of the contract award is a positive sign for Kopin’s stock price. Such success is expected to continue given the new contract and the company’s long history of innovation. With the military contract secured, Kopin looks set to be a key player in the development of advanced wearable and hearable technologies.

Market Price

On Monday, KOPIN CORPORATION stock opened at $1.0 and closed at $1.0, up by 0.4% from the previous closing price of 1.0. This contract is an important milestone for KOPIN, as it demonstrates that the company’s technology is capable of meeting the rigorous standards required by the military. This contract is also a major step forward for KOPIN as it continues its foray into the military and defense markets.

The company is confident that its Weapon Sight Module technology will provide military personnel with the necessary tools to accurately identify, acquire and engage targets. With this new contract, KOPIN has made a big step in becoming a major player in the defense industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kopin Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 47.4 | -19.33 | -43.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kopin Corporation. More…

| Operations | Investing | Financing |

| -17.69 | -3.31 | 2.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kopin Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.75 | 19.76 | 0.22 |

Key Ratios Snapshot

Some of the financial key ratios for Kopin Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.1% | – | -46.0% |

| FCF Margin | ROE | ROA |

| -39.1% | -49.9% | -31.1% |

Analysis – Kopin Corporation Stock Fair Value

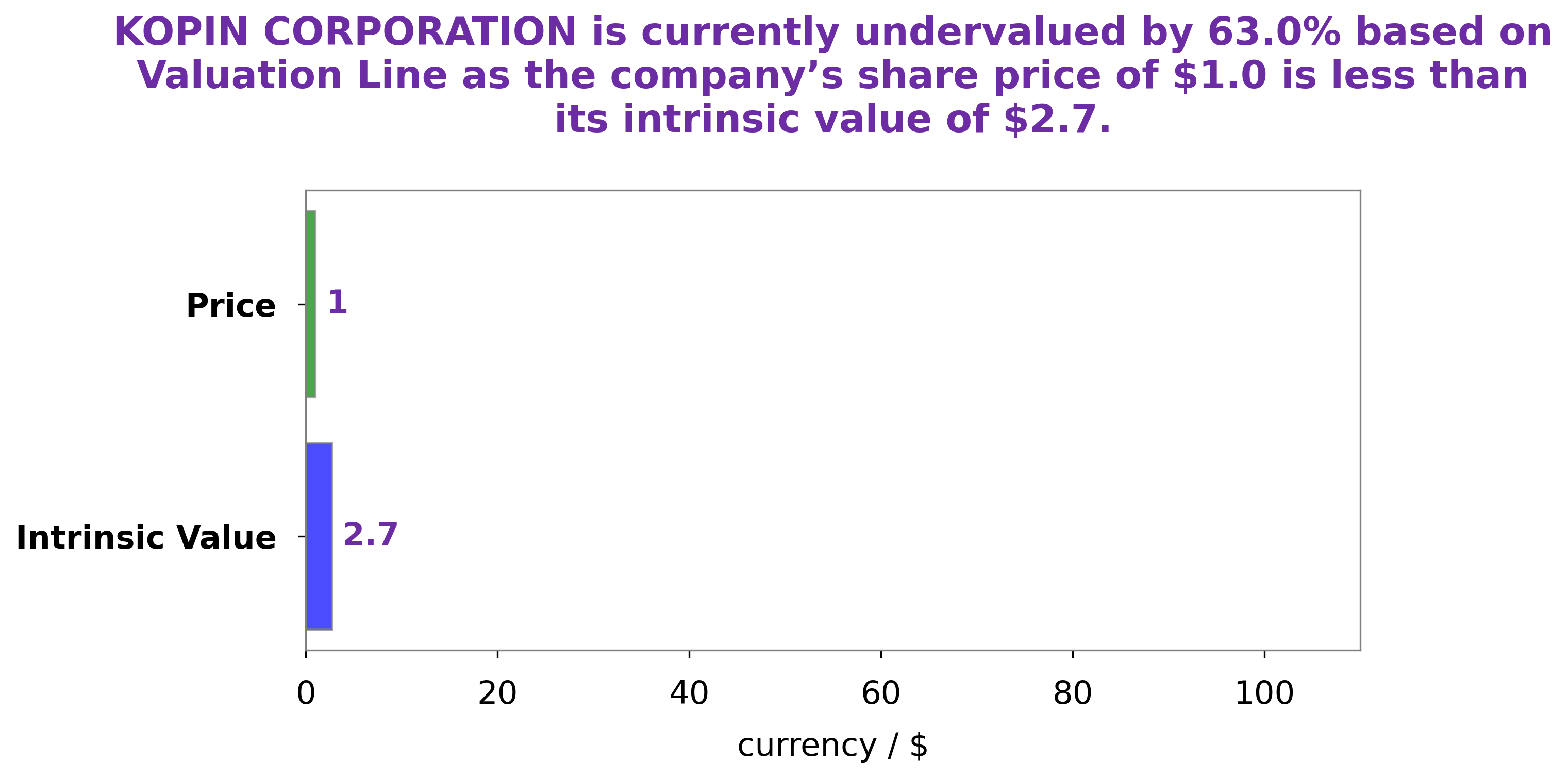

At GoodWhale, we take a look at KOPIN CORPORATION‘s financials to help you make informed investment decisions. Our proprietary Valuation Line tells us that the fair value of KOPIN CORPORATION shares is around $2.7 per share. However, currently KOPIN CORPORATION stock is traded at $1.0, which is undervalued by 63.0%. This gives investors a great opportunity to buy into this company at an advantageous price. Therefore, GoodWhale recommends investors to consider buying KOPIN CORPORATION shares as an investment opportunity. More…

Peers

The company’s products are used in a variety of applications, including video eyewear, head-mounted displays, and medical and military equipment. Kopin’s competitors include Vicor Corp, eMagin Corp, and RiTdisplay Corp.

– Vicor Corp ($NASDAQ:VICR)

Vicor Corporation is a leading provider of power solutions. The company’s products enable the efficient generation, distribution, and utilization of power in industrial, commercial, and military applications. Vicor’s innovative solutions are used in a variety of end markets, including aerospace and defense, data centers, electric vehicles, factory automation, medical equipment, renewable energy, and telecommunications. The company’s products are based on its proprietary Power-on-Package technology, which utilizes silicon-based electrical components to deliver power in a more efficient and compact form factor than traditional power solutions.

Vicor’s market cap as of 2022 is 2.59B. The company has a Return on Equity of 4.77%. Vicor’s products enable the efficient generation, distribution, and utilization of power in industrial, commercial, and military applications. The company’s innovative solutions are used in a variety of end markets, including aerospace and defense, data centers, electric vehicles, factory automation, medical equipment, renewable energy, and telecommunications.

– eMagin Corp ($NYSEAM:EMAN)

eMagin Corporation designs, develops, manufactures, and markets OLED-on-silicon microdisplays and virtual imaging products primarily in North America, Europe, and Asia. The company offers miniature displays that utilize OLED technology for use in near-eye imaging applications, including military, industrial, medical, and consumer products. Its microdisplays provide a high contrast ratio, a wide field of view, a large eyebox, and a low power consumption. The company provides its displays to original equipment manufacturers for incorporation into various virtual imaging systems, including head-mounted displays for military, industrial, and medical applications; augmented reality systems for military, industrial, and medical applications; heads-up displays for military aircraft; night vision goggles; thermal weapon sights; simulation and training systems; and consumer electronic devices, such as video eyewear and head-mounted displays. eMagin Corporation was founded in 1996 and is headquartered in Bellevue, Washington.

– RiTdisplay Corp ($TWSE:8104)

RiTdisplay Corp is a company that manufactures and sells display products. The company has a market cap of 2.52B as of 2022 and a Return on Equity of 4.63%. RiTdisplay Corp’s products include LCDs, OLEDs, and other display technologies. The company’s products are used in a variety of applications, including mobile devices, computers, and television displays.

Summary

KOPIN Corporation is a semiconductor company involved in the development, manufacture, and sale of components and systems for military, consumer and industrial markets. Recent investing analysis shows that the company has been performing well, with a $1.1 million order for its specialized weapon sight module from a major defense contractor. The company’s stock price has also been rising steadily over the past year.

This indicates that the company is generating strong cash flows and financials. Furthermore, KOPIN has signed a number of partnerships and agreements with well-known companies, which is likely to further bolster its financial performance in the future.

Recent Posts