Jabil Inc Intrinsic Value – Is Jabil Inc a Good Investment in the Electronic Components Industry?

November 16, 2023

☀️Trending News

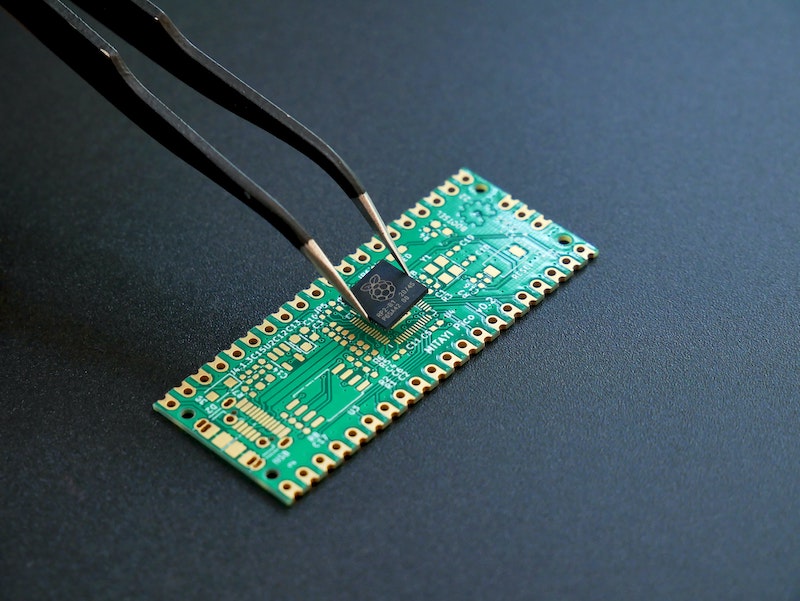

Investing in Jabil Inc ($NYSE:JBL) is an attractive option in the electronic components industry. The company offers end-to-end solutions across a variety of industries through its electronic design, manufacturing, supply chain and aftermarket services. The company’s expertise covers a wide range of electronic components, from printed circuit boards to servers. The company’s stock has been on a steady rise since the turn of the century, and the market for electronic components is expected to remain robust in the coming years as the world continues to shift more to digital technology. Jabil Inc has established itself as a leader in the industry, earning strong reviews from analysts and investors alike for its consistent performance and innovation. Jabil Inc offers investors a unique opportunity to invest in a well-established electronics component company with a strong track record of success.

With its diversified portfolio of products, services, and partnerships, Jabil Inc has positioned itself to capitalize on trends in the industry. The stock also benefits from its strong financials, which have allowed the company to make strategic acquisitions and investments that have bolstered its competitive edge. The company has established itself as a leader in the industry with its strong track record of success and performance, and is well-positioned to capitalize on trends in the industry. With its diversified portfolio of products, services, and partnerships, Jabil Inc is an attractive investment for investors looking for long-term growth potential.

Stock Price

On Wednesday, the stock opened at $132.2 and closed at $132.7, representing a 0.6% increase from its previous closing price of $131.9. This rise in stock price is indicative of Jabil’s strong financial position as well as its continued success and growth in the industry. Jabil Inc has a strong portfolio of services and products that make them competitive and successful in the market. With an impressive array of clients, they have a proven track record for delivering cost-effective and innovative solutions across multiple industries.

Additionally, they have a wide geographic reach and numerous locations, which allows them access to a variety of resources and customers. Overall, Jabil Inc presents an excellent opportunity for investors looking to capitalize on the electronic components industry. The company’s impressive portfolio and financial position are sure to attract investors looking for a reliable return on their investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jabil Inc. More…

| Total Revenues | Net Income | Net Margin |

| 34.7k | 818 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jabil Inc. More…

| Operations | Investing | Financing |

| 1.73k | -723 | -680 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jabil Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.42k | 16.56k | 21.9 |

Key Ratios Snapshot

Some of the financial key ratios for Jabil Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | 34.4% | 4.6% |

| FCF Margin | ROE | ROA |

| 2.0% | 35.6% | 5.1% |

Analysis – Jabil Inc Intrinsic Value

At GoodWhale, we have been analyzing the fundamentals of JABIL INC in order to better understand its true value. Our analysis has led us to the conclusion that the intrinsic value of a JABIL INC share to be around $78.5, which was calculated through our proprietary Valuation Line. Currently, JABIL INC stock is being traded at $132.7, representing an overvaluation of 69.1%. We believe this is an opportunity for investors to take advantage of the situation and buy JABIL INC shares at a bargain price. More…

Peers

It is headquartered in St. Petersburg, Florida, and it has been in business since 1966. The company has more than 100,000 employees, and its revenue was $17.9 billion in 2017. Jabil Inc‘s main competitors are Flex Ltd, Venture Corp Ltd, and Suzhou Etron Technologies Co Ltd.

– Flex Ltd ($NASDAQ:FLEX)

Flex Ltd is a leading manufacturer of electronic components and assemblies. The company has a market capitalization of 7.97 billion as of 2022 and a return on equity of 18.46%. Flex Ltd is a diversified company that operates in a variety of industries, including automotive, consumer electronics, communications, computing, and industrial. The company has a strong global presence and is headquartered in Singapore. Flex Ltd is a publicly traded company on the Singapore Stock Exchange.

– Venture Corp Ltd ($SGX:V03)

Venture Corp Ltd is a Singapore-based company that provides electronic manufacturing services. The company has a market cap of 4.64B as of 2022 and a Return on Equity of 12.65%. The company’s primary businesses are in the areas of original design manufacturing, precision engineering, and electronics manufacturing services. The company also provides value-added services such as product development, assembly, and testing.

– Suzhou Etron Technologies Co Ltd ($SHSE:603380)

As of 2022, Suzhou Etron Technologies Co Ltd has a market cap of 4.81B and a Return on Equity of 13.48%. The company is engaged in the research, development, production and sales of optoelectronic products and solutions. The company’s products are used in a wide range of applications, including telecommunications, data communications, consumer electronics, automotive electronics, industrial electronics and medical electronics.

Summary

An investment in Jabil Inc (JBL) has the potential to be a profitable venture. All these factors weigh in favor of investing in JBL, and may indicate that it is a good choice for investors looking for an established company with reliable returns.

Recent Posts