HighTower Advisors LLC Makes New Investment in Fabrinet in 4th Quarter

June 26, 2023

🌥️Trending News

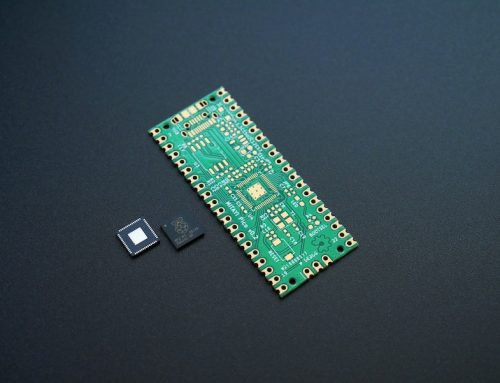

Fabrinet ($NYSE:FN) is a leading provider of advanced optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of complex products. The company serves customers in the aerospace, defense, industrial, medical, telecom, datacom, and consumer markets with high-mix, high-complexity and time-critical manufacturing services. HighTower Advisors LLC, a financial advisory firm, revealed, via its most recent Form 13F filing with the Securities and Exchange Commission, that it had acquired a new stake in Fabrinet in the fourth quarter of the year.

Price History

Following the news, Fabrinet stock opened at $111.5 and closed at $112.1, down by 0.3% from its prior closing price of 112.4. It appears that the new investment made by HighTower Advisors LLC had a negligible impact on Fabrinet’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fabrinet. More…

| Total Revenues | Net Income | Net Margin |

| 2.58k | 243.32 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fabrinet. More…

| Operations | Investing | Financing |

| 158.57 | -122.77 | -73.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fabrinet. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.03k | 587.22 | 37.83 |

Key Ratios Snapshot

Some of the financial key ratios for Fabrinet are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.2% | 27.4% | 9.8% |

| FCF Margin | ROE | ROA |

| 3.9% | 11.2% | 7.8% |

Analysis

At GoodWhale, we recently conducted an analysis of FABRINET‘s well-being. We thoroughly assessed several key factors related to the company’s finances and operations, and based on this our assessment, FABRINET is not a high-risk investment but it is not risk free either. If you are considering investing in FABRINET, we invite you to register with us. We provide comprehensive reports on the business and financial areas with potential risks that you should be aware of. Our team of experts can also provide personalized advice tailored to your specific situation. With our help, you can make an informed decision and ensure that your investments are safe and secure. More…

Peers

The company services a diverse set of markets, including telecommunications, data communications, aerospace and defense, industrial, life sciences, medical devices, and consumer electronics. Fabrinet has a strong competitive position in its markets, with a comprehensive suite of capabilities and a global footprint. The company’s competitors include Castech Inc, TT Electronics PLC, Gooch & Housego PLC, and others.

– Castech Inc ($SZSE:002222)

Castech Inc is a leading manufacturer of semiconductor products and services. The company has a market cap of 6.84B as of 2022 and a return on equity of 12.34%. The company’s products and services are used in a variety of electronic devices and systems, including computers, cell phones, and automotive electronics.

– TT Electronics PLC ($LSE:TTG)

TT Electronics is a provider of advanced electronics solutions for global markets. The company designs and manufactures electronic components, systems and services for applications in the aerospace, defence, rail, oil and gas, marine, medical, power generation and distribution, and industrial markets.

TT Electronics has a market capitalisation of £232.53 million as of March 2022 and a return on equity of 3.65%. The company designs and manufactures electronic components, systems and services for applications in the aerospace, defence, rail, oil and gas, marine, medical, power generation and distribution, and industrial markets.

– Gooch & Housego PLC ($LSE:GHH)

Gooch & Housego PLC is a leading global provider of advanced photonics solutions. They design, manufacture and supply a wide range of optical components, systems and instrumentation to meet the needs of their customers worldwide. Gooch & Housego has a market cap of 118.69M as of 2022 and a return on equity of 3.16%. The company has a strong focus on innovative photonics solutions and providing excellent customer service.

Summary

Fabrinet (NYSE: FN) is an attractive investment opportunity for investors who are looking for diversified exposure to the technology sector. The company is a leading provider of diversified optical packaging and precision electro-mechanical component manufacturing services to original equipment manufacturers. Recently, HighTower Advisors LLC acquired a new stake in Fabrinet, indicating investor confidence in the company’s potential. Fundamentally, Fabrinet is well-positioned to benefit from an increase in demand for its products and services due to increasing demand for electronic components and optical technologies.

The company has a strong balance sheet, a strong competitive position in its industry, and good cash flow. Further, Fabrinet’s share price has remained stable despite market volatility, providing investors with a measure of safety. All factors considered, Fabrinet is a promising investment opportunity for investors seeking diversified exposure to the technology sector.

Recent Posts