Amphenol Slides Following Credit Suisse Downgrade Citing ‘Weakness’ in Certain Markets

May 20, 2023

Trending News ☀️

Amphenol Corporation ($NYSE:APH), a leading global interconnect manufacturer and supplier, recently experienced a significant slide in its stock following a Credit Suisse downgrade. Credit Suisse downgraded Amphenol from “Outperform” to “Neutral” citing the company’s “weakness” in certain markets. The company is also well known for its innovative products that are used in applications such as automotive, data communication systems, broadband, industrial, mobile devices, and medical. The downgrade of Amphenol’s stock comes as a result of the company’s diminished performance in certain markets due to weakened economic conditions.

While the overall outlook for the company is positive, Credit Suisse believes that any recovery could take some time and hence has downgraded Amphenol’s stock. Despite this, the company remains committed to its long-term goals of driving innovation and creating value for its customers.

Share Price

On Friday, AMPHENOL CORPORATION stock saw a slight dip of 0.4% from its last closing price of 76.1 to 75.8. Whether or not the downgrade will have a long-term impact on Amphenol CORPORATION’s stock price remains to be seen. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amphenol Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 12.65k | 1.92k | 15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amphenol Corporation. More…

| Operations | Investing | Financing |

| 2.36k | -843.6 | -1.31k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amphenol Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.38k | 8k | 12.28 |

Key Ratios Snapshot

Some of the financial key ratios for Amphenol Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.9% | 18.6% | 20.6% |

| FCF Margin | ROE | ROA |

| 15.4% | 22.7% | 10.6% |

Analysis

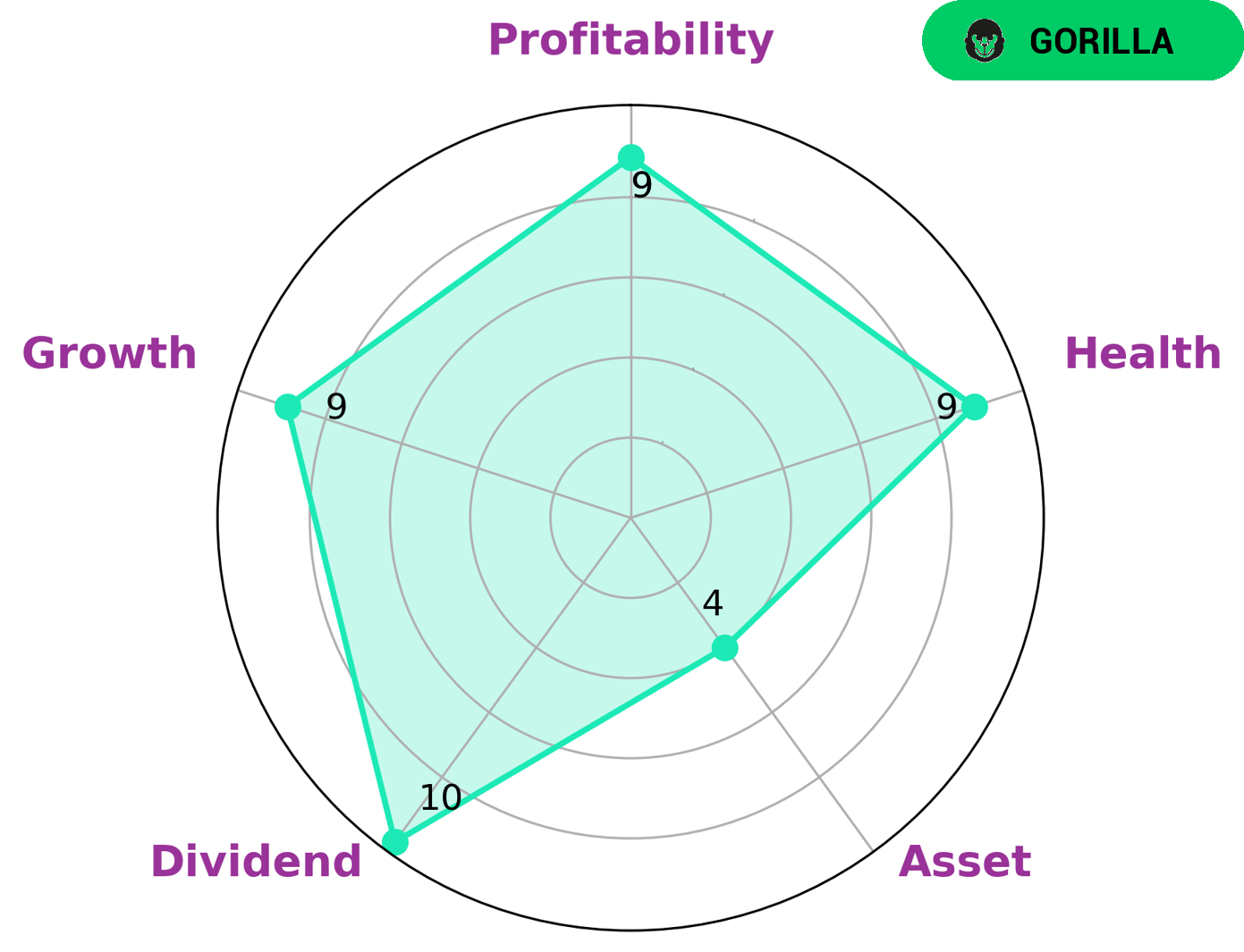

GoodWhale has conducted an analysis of AMPHENOL CORPORATION‘s wellbeing and according to our Star Chart findings, the company is strong in dividend, growth, and profitability with a medium in asset. AMPHENOL CORPORATION also received an impressive health score of 9/10 with regard to its cashflow and debt, making it capable of safely riding out any crisis without the risk of bankruptcy. Building on this information, we also classified AMPHENOL CORPORATION as a ‘gorilla’ company; one that we conclude has achieved stable and high revenue or earnings growth due to a strong competitive advantage. We believe that this type of company may be especially attractive to investors seeking strong and sustained revenue growth and will likely benefit from the potential for future dividends. Additionally, investors who are willing to take on some risk in order to achieve higher returns may view AMPHENOL CORPORATION as a viable long-term investment. More…

Peers

Amphenol Corp is a leading manufacturer of electronic and fiber optic connectors, cables and interconnect systems. The company has a strong competitive position against its competitors CviLux Corp, Harada Industry Co Ltd, and Hirose Electric Co Ltd.

– CviLux Corp ($TWSE:8103)

CviLux Corp is a technology company that designs, manufactures, and sells electronic products. The company has a market cap of 2.34B as of 2022 and a return on equity of 12.83%. CviLux Corp’s products include electronic components, semiconductors, and integrated circuits. The company was founded in 2003 and is headquartered in Taipei, Taiwan.

– Harada Industry Co Ltd ($TSE:6904)

Harada Industry Co Ltd is a Japanese company that manufactures and sells automotive parts and components. The company has a market cap of 17.05 billion as of 2022 and a return on equity of -5.2%. Harada Industry Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Hirose Electric Co Ltd ($TSE:6806)

Hirose Electric Co Ltd has a market cap of 687.03B as of 2022, a Return on Equity of 8.91%. The company designs, manufactures and sells electronic and electrical components and products, including connectors, cables, modules and boards. It also provides engineering services. The company operates in Japan, North America, Europe and Asia.

Summary

Amphenol Corporation is a multi-industry manufacturer of connectors, cable and interconnect systems. Recently, Credit Suisse downgraded the company’s stock due to weakness in certain markets, causing shares to slip.

However, analysts believe that Amphenol’s long-term prospects remain strong. The company continues to experience growth in both emerging and developed markets, and its financial position remains strong with robust cash flow generation. Amphenol’s product portfolio is also diversified, with products ranging from standard connectors to complex systems for broadband networks.

Additionally, the company has been investing in research and development to further strengthen their competitive advantage. Overall, investors may want to keep Amphenol in their sights for potential long-term upside.

Recent Posts