Amphenol Corporation Posts Stellar Results with Record-Breaking Earnings and Revenue

April 27, 2023

Trending News 🌥️

The company posted a Non-GAAP EPS of $0.69 per share, exceeding expectations by $0.02.

In addition, the company’s revenue of $2.97 billion was also higher than the estimates by $60 million. Amphenol Corporation ($NYSE:APH) is an advanced technology company that designs, manufactures and markets electrical, electronic and fiber optic connectors, interconnect systems, antennas, sensors and sensor-based products. The company serves a wide variety of markets such as industrial, automotive, mobile devices, telecom, data communications, and military. These results are a testament to Amphenol’s ability to manage through difficult times and come out stronger than ever. With the increasing demand for its products and services, the company is well-positioned to continue delivering strong results in the future.

Stock Price

On Wednesday, Amphenol Corporation posted stellar results with record-breaking earnings and revenue. The company’s stock opened at $73.8 and closed at $73.9, a decrease of 1.3% from the previous closing price of 74.9. The increase in earnings was driven by strong demand for the company’s products and services. The revenue also increased significantly compared to the same period last year, indicating that the company is well-positioned to capitalize on new opportunities.

Additionally, the company’s balance sheet remains strong, with no significant liabilities on its books. Overall, these results suggest that Amphenol Corporation is well-positioned for continued growth and success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amphenol Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 12.62k | 1.9k | 15.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amphenol Corporation. More…

| Operations | Investing | Financing |

| 2.17k | -731.1 | -1.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amphenol Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.33k | 8.23k | 11.04 |

Key Ratios Snapshot

Some of the financial key ratios for Amphenol Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 16.6% | 20.6% |

| FCF Margin | ROE | ROA |

| 14.2% | 23.9% | 10.6% |

Analysis

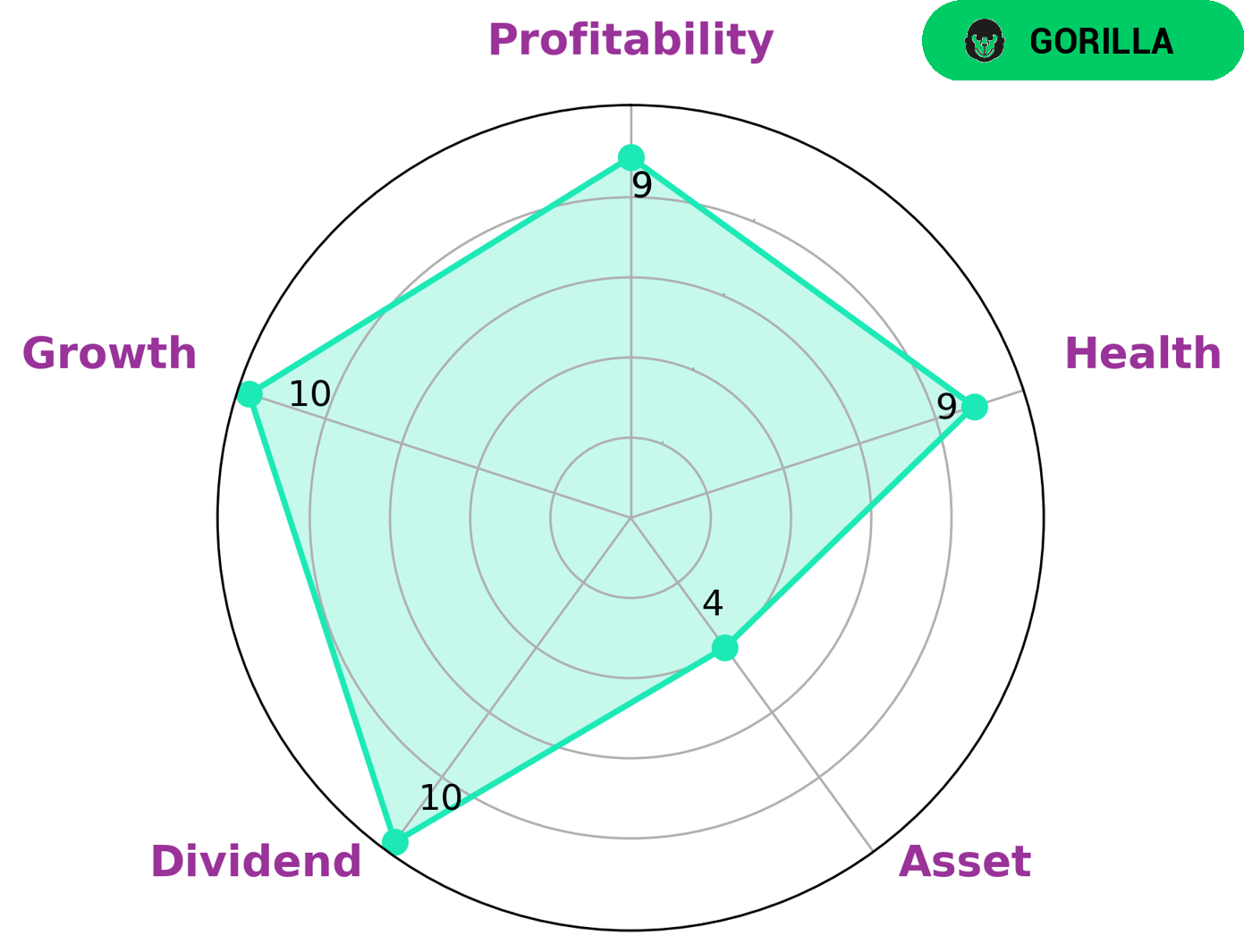

GoodWhale conducted an analysis of AMPHENOL CORPORATION‘s wellbeing. According to our Star Chart, AMPHENOL CORPORATION has a high health score of 9/10, indicating that its cashflows and debt are in good condition and it’s capable of safely riding out any potential crisis without the risk of bankruptcy. In addition, we observed that AMPHENOL CORPORATION is strong in dividend, growth, and profitability and medium in asset. Based on our findings, we classified AMPHENOL CORPORATION as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for companies with long-term stability and high returns may be interested in AMPHENOL CORPORATION. This company is likely to be able to withstand economic downturns due to its strong financial position and has the potential to generate high returns for its shareholders. More…

Peers

Amphenol Corp is a leading manufacturer of electronic and fiber optic connectors, cables and interconnect systems. The company has a strong competitive position against its competitors CviLux Corp, Harada Industry Co Ltd, and Hirose Electric Co Ltd.

– CviLux Corp ($TWSE:8103)

CviLux Corp is a technology company that designs, manufactures, and sells electronic products. The company has a market cap of 2.34B as of 2022 and a return on equity of 12.83%. CviLux Corp’s products include electronic components, semiconductors, and integrated circuits. The company was founded in 2003 and is headquartered in Taipei, Taiwan.

– Harada Industry Co Ltd ($TSE:6904)

Harada Industry Co Ltd is a Japanese company that manufactures and sells automotive parts and components. The company has a market cap of 17.05 billion as of 2022 and a return on equity of -5.2%. Harada Industry Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Hirose Electric Co Ltd ($TSE:6806)

Hirose Electric Co Ltd has a market cap of 687.03B as of 2022, a Return on Equity of 8.91%. The company designs, manufactures and sells electronic and electrical components and products, including connectors, cables, modules and boards. It also provides engineering services. The company operates in Japan, North America, Europe and Asia.

Summary

Amphenol’s share price is currently reflecting a bullish sentiment as investors remain optimistic about the company’s future prospects.

Recent Posts