SHENZHEN INC: Shanghai Allied Industrial Receives Regulatory Approval to Launch IPO

January 18, 2023

Trending News ☀️

SHENZHEN INC ($SZSE:300713) is excited to announce that the Regulatory Board has given Shanghai Allied Industrial the green light to proceed with its Initial Public Offering (IPO) in Shenzhen. The IPO is expected to raise close to $1 billion in funds for the company, which will be used for expansion and diversification of its product line. SHENZHEN INC will use the money to invest in research and development, expand into new markets, and develop new technologies for its products and services. The company has been expanding rapidly in recent years and is now one of the largest companies in its sector. The IPO will provide it with an additional source of capital to fuel its growth and further strengthen its position as a leader in the industry.

SHENZHEN INC has a strong commitment to sustainability and environmental responsibility, and it is committed to creating a better future through innovation and technology. It is also dedicated to providing its customers with quality products and services while making a positive impact on the communities it serves. With its IPO, SHENZHEN INC will have access to greater resources and will be able to continue its efforts to expand and diversify its product line, while also creating more jobs in the region. This news is an exciting milestone for the company, and investors are sure to benefit from this new opportunity.

Stock Price

SHENZHEN INC, the Shanghai Allied Industrial, has recently received regulatory approval to launch an Initial Public Offering (IPO). This has been met with a mostly positive reaction from the media, and the company is now poised to take advantage of the public markets. On Tuesday, SHENZHEN INC opened up trading at CNY13.7 and closed at CNY13.5, representing a decrease of 0.7% from its previous closing price of CNY13.6. This is a sign that the stock, despite its recent approval and positive media coverage, has not yet been able to generate enough investor interest to push its share price higher. The company is now looking to capitalize on the opportunity of going public by expanding its operations and increasing its presence in the market.

It is expected that the IPO will provide SHENZHEN INC with a much needed financial boost, allowing them to take on more projects and further develop their business. The future success of SHENZHEN INC largely depends on how it will be able to make use of the capital generated from the IPO. If the company can effectively use this money to expand their operations and bring in new customers, then it could be well on its way to becoming a major player in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shenzhen Inc. More…

| Total Revenues | Net Income | Net Margin |

| 313.67 | -17.23 | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shenzhen Inc. More…

| Operations | Investing | Financing |

| 13.46 | -7.35 | 4.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shenzhen Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.02k | 295.85 | 4.58 |

Key Ratios Snapshot

Some of the financial key ratios for Shenzhen Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | -93.9% | 1.9% |

| FCF Margin | ROE | ROA |

| -24.7% | -2.4% | -1.7% |

VI Analysis

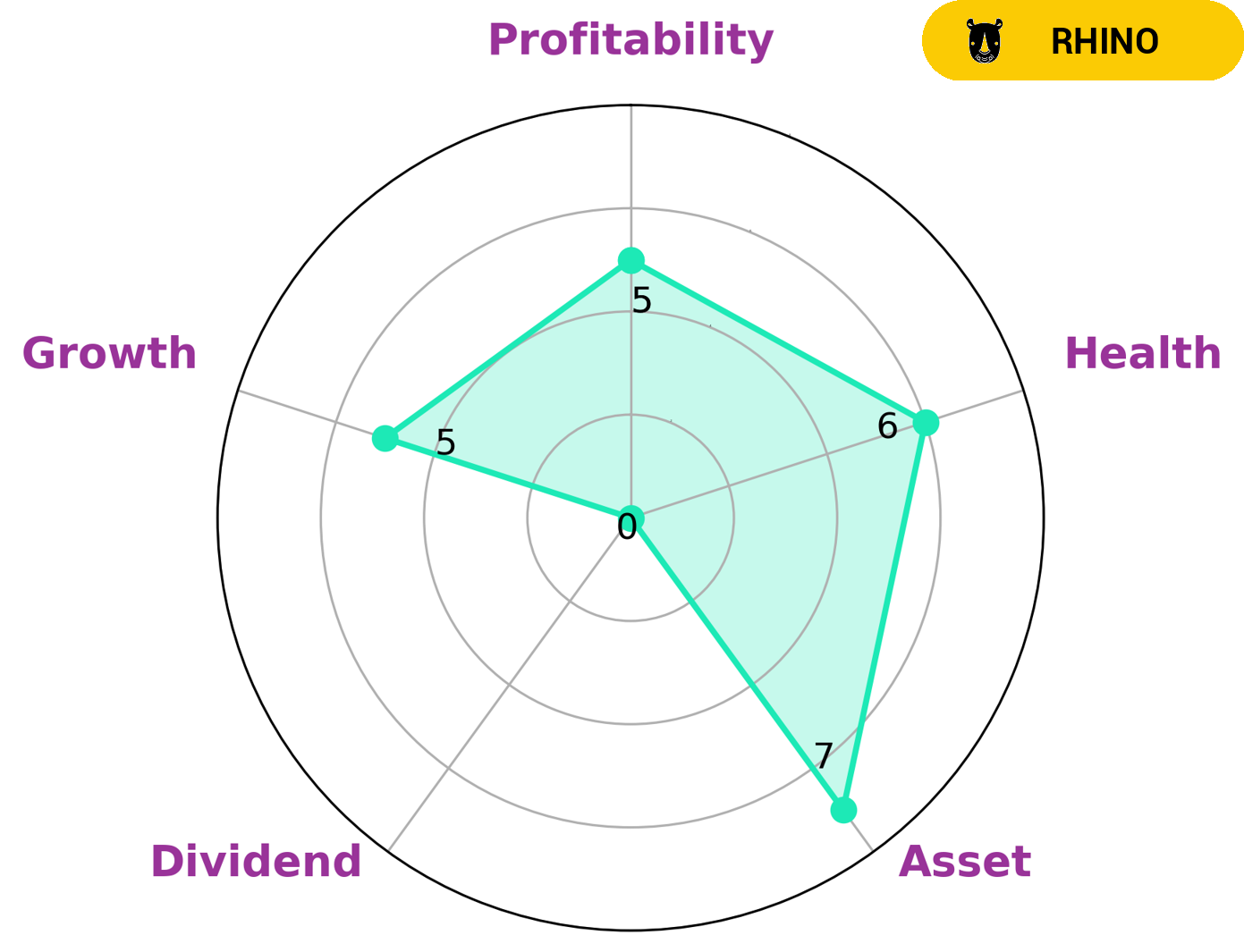

Investors who are looking for a company with long term potential should pay close attention to the fundamentals of Shenzhen Inc. VI app provides an easy way to get the big picture of the company’s financial health in the form of a Star Chart. The chart shows that the company has an intermediate health score of 6/10. This suggests that the company has sufficient cashflows and debt to sustain its operations in times of crisis. The asset strength of Shenzhen Inc is high, while its growth, profitability, and dividend are rated as medium. It is classified as a ‘rhino’, which means that it has achieved moderate revenue or earnings growth. This type of company is attractive to investors who are looking for companies with good fundamentals, but are not expecting extraordinary growth. Investors who are looking for a reliable, long-term investment should consider Shenzhen Inc. Its asset strength and moderate growth make it an attractive option for those seeking stability. Furthermore, its intermediate health score suggests that it is well-positioned to weather any economic downturns in the future. More…

VI Peers

The company has a strong presence in the market and is well established, with strong competition from Shijiazhuang Tonhe Electronics Technologies Co Ltd, Phihong Technology Co Ltd, and Sichuan Injet Electric Co Ltd. These companies are all well established and offer competitive products and services to their customers.

– Shijiazhuang Tonhe Electronics Technologies Co Ltd ($SZSE:300491)

Shijiazhuang Tonhe Electronics Technologies Co Ltd is a Chinese company that specializes in the production and sale of electronic products and services. With a market cap of 2.56B as of 2023, the company is a major player in the electronics industry. It has also seen an impressive return on equity of 3.34%, suggesting that its financial performance is strong. This indicates that the company is well-positioned to take advantage of growth opportunities and capitalize on emerging markets.

– Phihong Technology Co Ltd ($TWSE:2457)

Phihong Technology Co Ltd is a leading supplier of electronic products and solutions. Founded in 1975, the company has grown to become a globally recognized provider of products and services for the consumer electronics, communications, and industrial markets. As of 2023, the company has a market capitalization of 14.26 billion, reflecting the strength of its business and brand. Additionally, its Return on Equity (ROE) is 1.17%, an indication of the company’s financial performance. Phihong Technology has a diversified product portfolio, with offerings including power adapters, power supplies, and LED lighting solutions. The company is well-known in the industry for its commitment to quality and customer service.

– Sichuan Injet Electric Co Ltd ($SZSE:300820)

Sichuan Injet Electric Co Ltd is a Chinese manufacturer of electrical equipment with a market cap of 10.7B as of 2023. The company is renowned for its high Return on Equity (ROE) of 13.25%, indicating that the company is highly profitable and efficiently manages its capital. The company specializes in the production of power and industrial electronic switches, circuit breakers, relays, and other electrical equipment. With its strong balance sheet and innovative technology, Sichuan Injet Electric Co Ltd is well positioned to continue to thrive in the electrical equipment industry.

Summary

SHENZHEN INC. has recently been granted regulatory approval to launch its initial public offering (IPO). This has been met with positive media coverage, indicating that the market is optimistic about the company’s potential. Analysts suggest that investors should weigh the company’s fundamentals and their expectations for future performance before making any investment decisions. They point to SHENZHEN INC.’s successful track record in the industry, its financial strength, and its strong management team as key factors that could make it a solid long-term investment.

Furthermore, analysts note that the IPO pricing could provide a good entry point for investors, allowing them to benefit from SHENZHEN INC.’s potential upside. In conclusion, investors should conduct their own due diligence to assess whether SHENZHEN INC. is a suitable investment for them.

Recent Posts