Robbins LLP Investigating Graftech International Ltd. on Behalf of Shareholders

December 3, 2023

🌥️Trending News

Robbins LLP is conducting an investigation into Graftech International ($NYSE:EAF) Ltd. on behalf of EAF investors. The law firm recently announced the investigation and reminded shareholders of their right to pursue a class action lawsuit if they have been negatively affected by the company’s actions. Graftech International Ltd. is a leading manufacturer and innovator of graphite electrodes used in steel production and advanced energy storage solutions. Their products are utilized around the world in a variety of industries such as steelmaking, energy, automotive, and electronics.

Share Price

The investigation focuses on whether the company has violated securities laws and/or breached its filed disclosure obligations. On Friday, Graftech International‘s stock opened at $2.5 and closed at $2.6, a 6.9% increase from its prior closing price of $2.5. As a result, investors are advised to contact Robbins LLP to discuss their legal rights and options concerning this investigation. Robbins LLP invites all shareholders of Graftech International Ltd. to contact the law firm with any questions or concerns about their legal rights and remedies. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Graftech International. More…

| Total Revenues | Net Income | Net Margin |

| 730.87 | 12.49 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Graftech International. More…

| Operations | Investing | Financing |

| 117.29 | -74.92 | 18.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Graftech International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.48k | 1.19k | 1.12 |

Key Ratios Snapshot

Some of the financial key ratios for Graftech International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.5% | -55.5% | 9.2% |

| FCF Margin | ROE | ROA |

| 5.8% | 13.7% | 2.8% |

Analysis

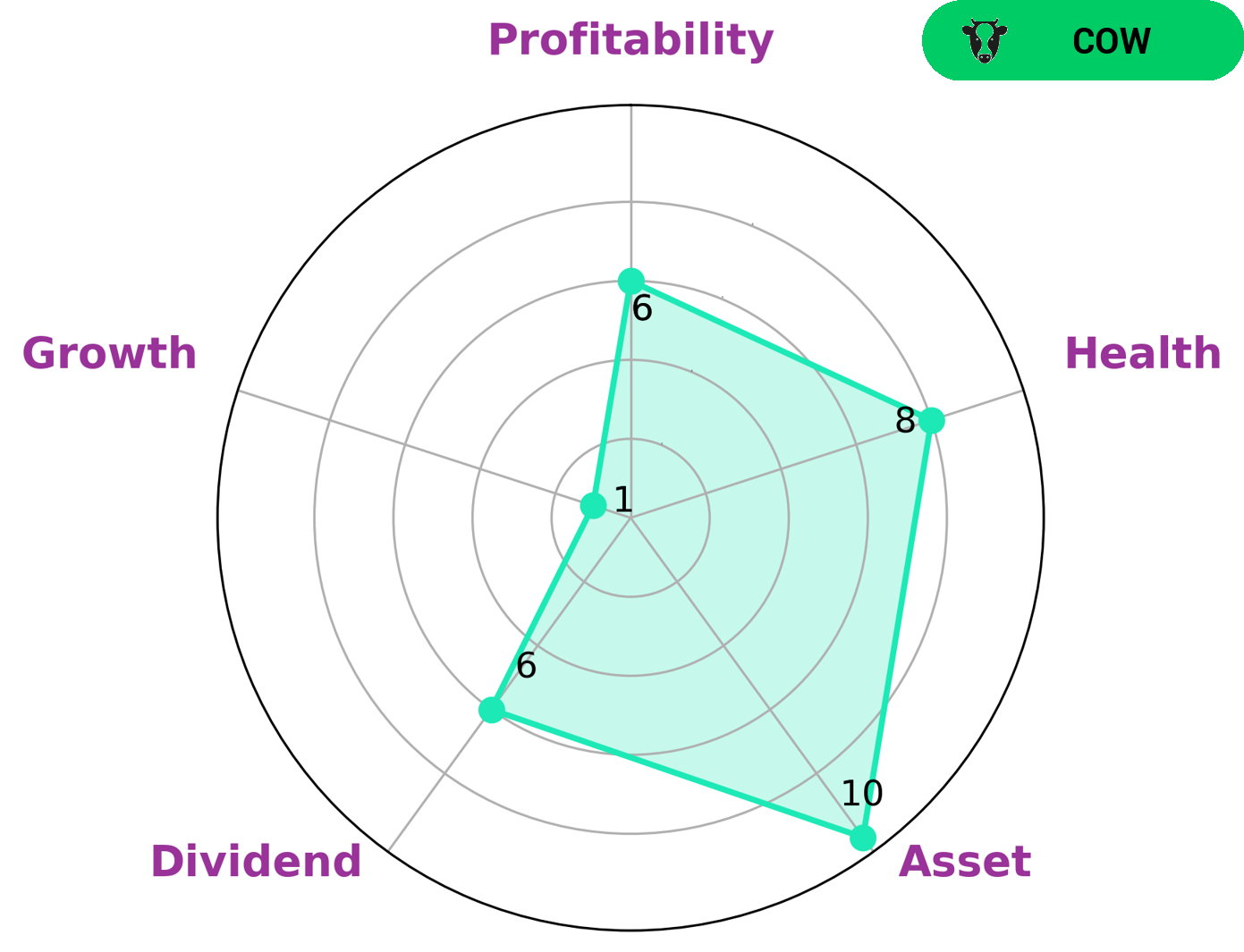

GoodWhale conducted an analysis of GRAFTECH INTERNATIONAL‘s wellbeing. Based on our Star Chart, GRAFTECH INTERNATIONAL has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. In terms of its performance, GRAFTECH INTERNATIONAL is strong in asset, medium in dividend, profitability and weak in growth. From our analysis, we classified GRAFTECH INTERNATIONAL as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Therefore, GRAFTECH INTERNATIONAL is likely to be attractive to long-term dividend-seeking investors. More…

Peers

GrafTech International Ltd is one of the world’s largest manufacturers of graphite electrodes, which are used in electric arc furnaces to make steel. The company has a market share of about 17 percent. Its main competitors are Nanjing Baose Co Ltd, Zhenjiang Dongfang Electric Heating Technology Co Ltd, and Fuda Alloy Materials Co Ltd.

– Nanjing Baose Co Ltd ($SZSE:300402)

Nanjing Baose Co Ltd is a Chinese company with a market cap of 4.12B as of 2022. The company has a Return on Equity of 7.34%. Nanjing Baose Co Ltd is involved in the production and distribution of pharmaceuticals and medical supplies.

– Zhenjiang Dongfang Electric Heating Technology Co Ltd ($SZSE:300217)

Zhenjiang Dongfang Electric Heating Technology Co Ltd is a leading manufacturer of electric heating products in China. The company has a market cap of 10.34B as of 2022 and a return on equity of 7.75%. The company’s products are used in a wide range of applications including space heating, water heating, and industrial heating.

– Fuda Alloy Materials Co Ltd ($SHSE:603045)

Fuda Alloy Materials Co Ltd is a Chinese company that produces aluminum alloy products. Its market cap as of 2022 was $2.25 billion, and its return on equity was 6.16%. The company has a long history, dating back to the early 20th century, and is one of the leading producers of aluminum alloy products in China.

Summary

Graftech International Ltd. Investors should be aware that the stock price of Graftech moved up the same day that Robbins LLP released this announcement. As the investigation continues, investors should look for any news regarding the outcome, and consider the potential risk or potential reward of investing in Graftech. Furthermore, investors should do their own research and analysis to gain a better understanding of the company in order to make more informed decisions when it comes to investing in Graftech International Ltd.

Recent Posts