Plug Power Plummets to New Multi-Year Lows Amid Cautious Outlook and Execution Struggles

May 16, 2023

Trending News 🌧️

Plug Power ($NASDAQ:PLUG), a leading hydrogen and fuel cell technology provider, has been struggling in the market recently. The company has plummeted to new multi-year lows due to a combination of cautious outlook and execution struggles. This has cast doubt on the company’s ability to continue driving growth and innovation in the industry. The company’s cautious outlook has been based on rising costs and the uncertain global economy. With a lack of visibility on their end-market demand, the company has been unable to accurately assess its potential growth in the coming months. This has resulted in a significant drop in their share price.

On top of this, Plug Power has also been facing difficulties with execution. Their ambitious plans have failed to produce the intended results, leading to missed targets and frustrated investors. This has further weighed down on their stock price as investors become increasingly uncertain about the company’s prospects. Although the company is attempting to address these issues, it is unclear if they will be able to turn things around in the near future.

Market Price

On Monday, PLUG POWER stock opened at $7.5 and closed at $7.8, up by 4.9% from the previous closing price of $7.5. The company has recently reported a disappointing quarter, as it missed consensus expectations on both revenue and earnings per share. This has caused investors to remain cautious about the company’s prospects going forward.

Additionally, there are concerns about the company’s ability to execute on its initiatives. While the company has achieved positive financial results in the past, its recent struggles have caused its share price to drop significantly. As a result, PLUG POWER’s stock is now trading at new multi-year lows. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plug Power. More…

| Total Revenues | Net Income | Net Margin |

| 770.92 | -774.08 | -95.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plug Power. More…

| Operations | Investing | Financing |

| -895.62 | -857.49 | -52.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plug Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.65k | 1.73k | 6.61 |

Key Ratios Snapshot

Some of the financial key ratios for Plug Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.7% | – | -95.1% |

| FCF Margin | ROE | ROA |

| -188.6% | -11.5% | -8.1% |

Analysis

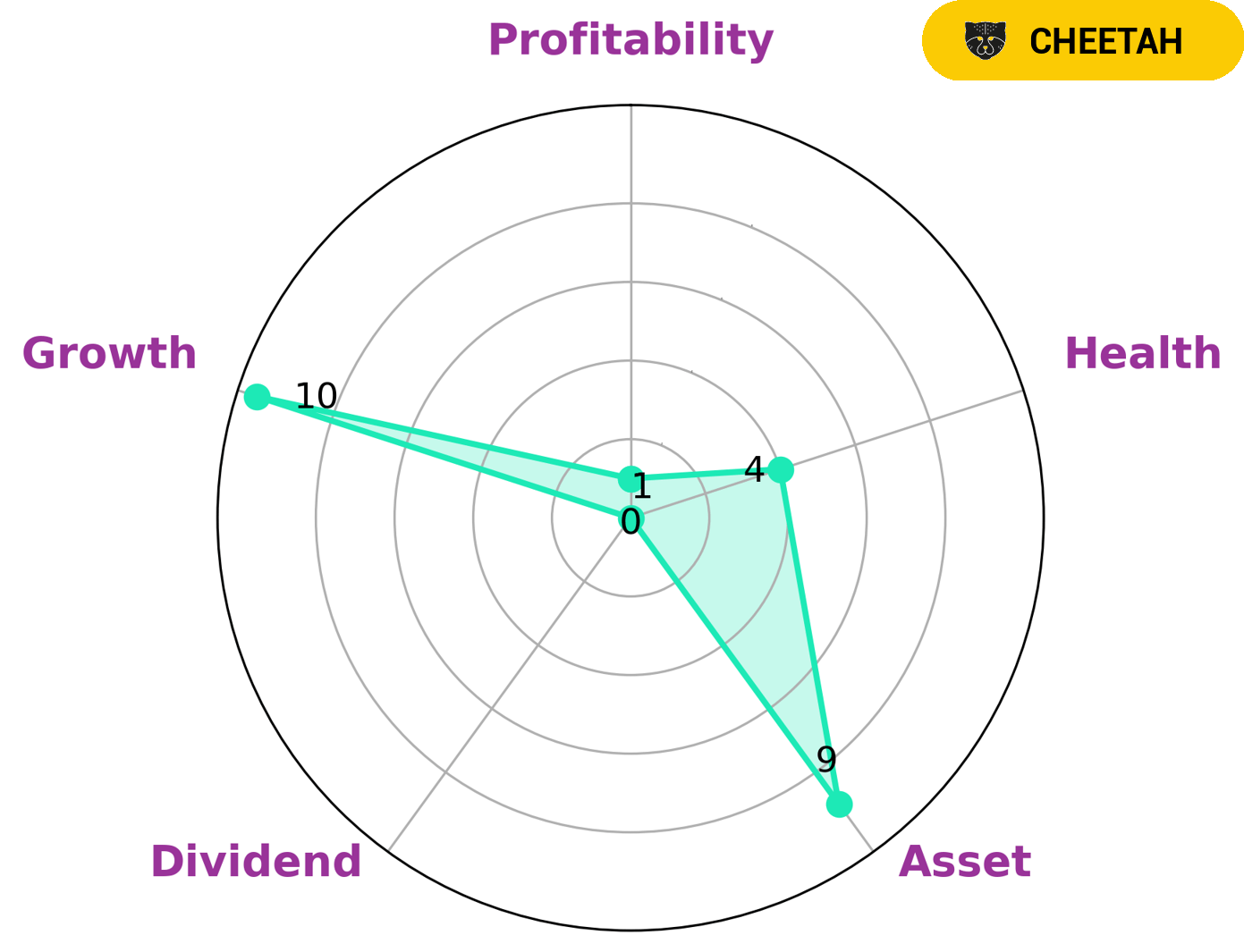

At GoodWhale, we have conducted an analysis of PLUG POWER‘s fundamentals. According to our Star Chart, PLUG POWER has an intermediate health score of 4/10 with regard to its cashflows and debt, meaning it may be able to sustain future operations in times of crisis. We classify PLUG POWER as a ‘cheetah’ company, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Looking at its scorecard, we can see that PLUG POWER is strong in asset and growth, but weak in dividend and profitability. Given this analysis, we believe that investors who are looking for companies with high growth potential but that also present some risks may be interested in investing in PLUG POWER. Such investors should conduct further research before making any decisions. More…

Peers

Plug Power Inc. is a leading provider of energy solutions that enable its customers to power their operations with clean, reliable energy. The company’s products and services include fuel cells, hydrogen refueling, and power management systems. Plug Power Inc. competes with Loop Energy Inc, AFC Energy PLC, and Greenchek Technology Inc in the provision of energy solutions.

– Loop Energy Inc ($TSX:LPEN)

As of 2022, Loop Energy Inc has a market cap of 60.66M. The company has a Return on Equity of -31.52%. Loop Energy Inc is a company that provides fuel cells and hydrogen fuel cell electric vehicles. The company’s products are used in a variety of applications, including automotive, transportation, stationary power, and portable power.

– AFC Energy PLC ($LSE:AFC)

AFC Energy PLC is a company that focuses on providing alternative energy solutions. The company has a market capitalization of 143.44 million as of 2022 and a return on equity of -24.64%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate future returns. The company’s focus on alternative energy solutions makes it a unique player in the market and gives it a potential growth opportunity in the future.

– Greenchek Technology Inc ($OTCPK:GCHK)

Greenchek Technology Inc is a publicly traded company that engages in the design, manufacture, and sale of electronic test and measurement equipment. The company has a market cap of 35.51k as of 2022 and a return on equity of 2.93%. Greenchek Technology Inc’s products are used in a variety of industries, including telecommunications, aerospace, defense, and semiconductor. The company’s products are sold worldwide through a network of distributors and resellers.

Summary

Plug Power is a leading provider of hydrogen and fuel cell technology, but their recent outlook has been less than optimistic. The stock price dropped to multi-year lows following their cautious outlook and reports of ongoing execution issues. Despite this, the stock price moved up slightly the same day, possibly in response to the company’s commitment to improving operations. Investors should consider the company’s financials, competitive landscape, and other risks before investing in Plug Power.

Additionally, it is important to remember that stock prices can fluctuate drastically and investment decisions should never be taken lightly.

Recent Posts