Plug Power Intrinsic Value Calculation – Plug Power Secures Trio of Deals in Europe to Supply Electrolyzers

May 23, 2023

Trending News ☀️

Plug Power ($NASDAQ:PLUG), a leading provider of clean, reliable energy solutions, has recently announced the securing of three agreements in Europe to supply electrolyzers. This exciting news further establishes Plug Power’s presence in the growing hydrogen economy, adding to their impressive list of accomplishments in the field. Specializing in hydrogen fuel cells, Plug Power provides hydrogen and fuel cell systems for industrial and consumer applications. These systems are used to power forklifts for industrial purposes, as well as cars, buses, and other modes of transportation. Plug Power has also become a proponent of clean energy and is actively working to reduce carbon emissions through the use of hydrogen fuel cells. These new agreements in Europe will see Plug Power supplying electrolyzers to a variety of clients across multiple countries.

The electrolyzers will be used to create a form of green energy that will significantly reduce the carbon footprint of the companies involved. This is another positive step forward for Plug Power and the hydrogen economy, as it continues to become a viable alternative to traditional methods of energy production. Overall, Plug Power has made great strides in promoting green energy solutions across the globe. With the securing of these three new agreements in Europe, it looks like Plug Power is well on its way to becoming a major player in the future of clean energy.

Share Price

On Monday, Plug Power, a leading producer of hydrogen and fuel cell systems, announced they have secured three deals in Europe to supply electrolyzers. This news caused the PLUG POWER stock to soar by 14.2%, opening at $8.0 and closing at $8.8 from the prior closing price of 7.7. The electrolyzers are intended for use in the production of green hydrogen, and the deals are expected to boost Plug Power’s presence in the European market. This news has investors optimistic about the future of the company and its potential growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plug Power. More…

| Total Revenues | Net Income | Net Margin |

| 770.92 | -774.08 | -95.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plug Power. More…

| Operations | Investing | Financing |

| -895.62 | -857.49 | -52.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plug Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.65k | 1.73k | 6.61 |

Key Ratios Snapshot

Some of the financial key ratios for Plug Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.7% | – | -95.1% |

| FCF Margin | ROE | ROA |

| -188.6% | -11.5% | -8.1% |

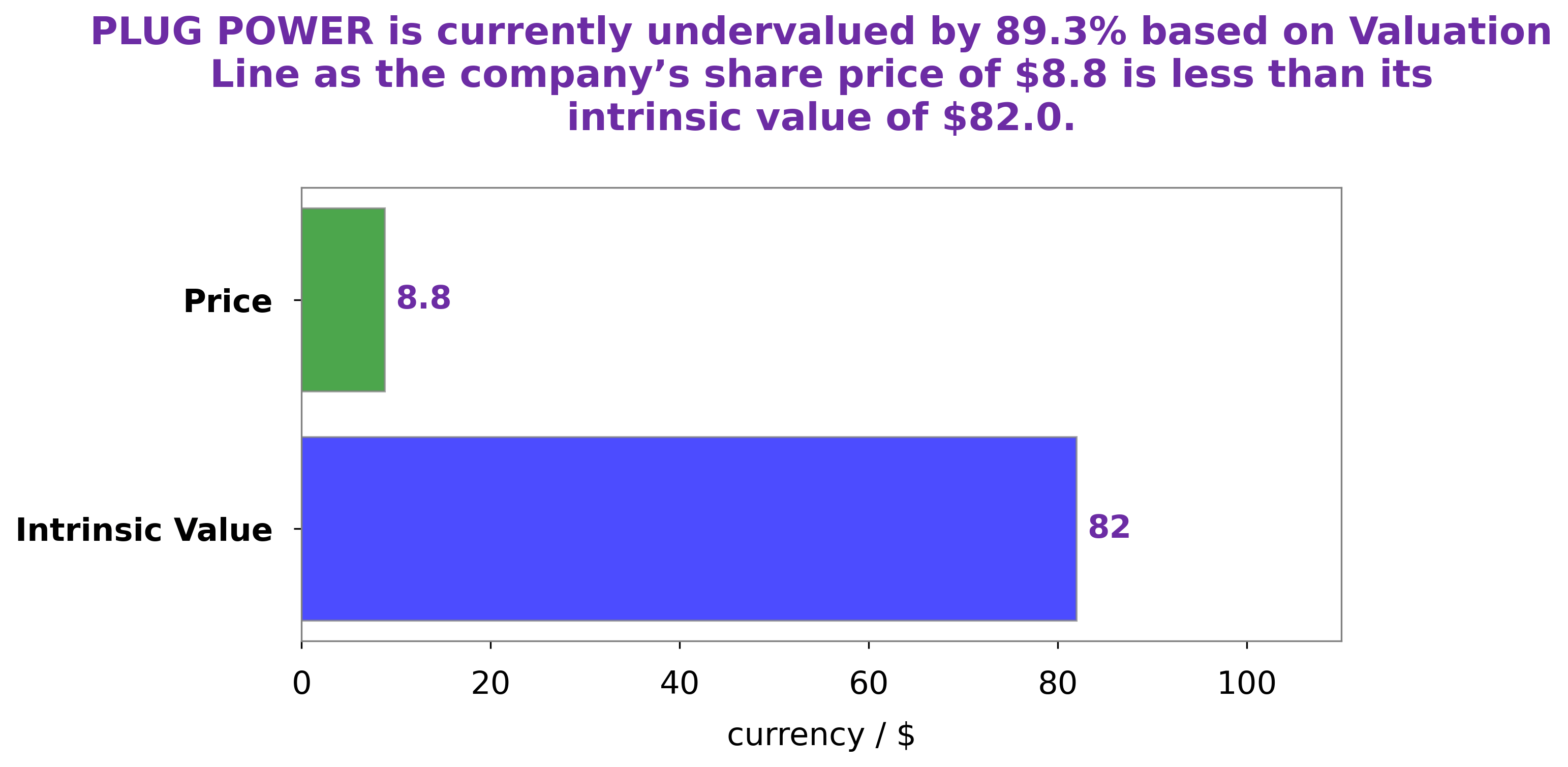

Analysis – Plug Power Intrinsic Value Calculation

At GoodWhale, we have conducted a thorough analysis of PLUG POWER‘s fundamentals to derive the fair value of its stock. After considering the company’s revenue, cash flows, and other relevant metrics, we have determined that the fair value of PLUG POWER’s share is around $82.0. This value was reached using our proprietary Valuation Line algorithm. Currently, PLUG POWER’s stock is trading at $8.8, which means it is undervalued by 89.3%. This presents an excellent opportunity for investors to capitalize on this discrepancy for a potentially substantial return on their investment. More…

Peers

Plug Power Inc. is a leading provider of energy solutions that enable its customers to power their operations with clean, reliable energy. The company’s products and services include fuel cells, hydrogen refueling, and power management systems. Plug Power Inc. competes with Loop Energy Inc, AFC Energy PLC, and Greenchek Technology Inc in the provision of energy solutions.

– Loop Energy Inc ($TSX:LPEN)

As of 2022, Loop Energy Inc has a market cap of 60.66M. The company has a Return on Equity of -31.52%. Loop Energy Inc is a company that provides fuel cells and hydrogen fuel cell electric vehicles. The company’s products are used in a variety of applications, including automotive, transportation, stationary power, and portable power.

– AFC Energy PLC ($LSE:AFC)

AFC Energy PLC is a company that focuses on providing alternative energy solutions. The company has a market capitalization of 143.44 million as of 2022 and a return on equity of -24.64%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate future returns. The company’s focus on alternative energy solutions makes it a unique player in the market and gives it a potential growth opportunity in the future.

– Greenchek Technology Inc ($OTCPK:GCHK)

Greenchek Technology Inc is a publicly traded company that engages in the design, manufacture, and sale of electronic test and measurement equipment. The company has a market cap of 35.51k as of 2022 and a return on equity of 2.93%. Greenchek Technology Inc’s products are used in a variety of industries, including telecommunications, aerospace, defense, and semiconductor. The company’s products are sold worldwide through a network of distributors and resellers.

Summary

Plug Power Inc. (NASDAQ:PLUG) is an American fuel cell technology company that has recently made strides in the European market. As a result of these developments, the stock price of Plug Power moved up the same day. This provides an opportunity for investors to capitalize on the innovative technology the company offers, and benefit from its new business ventures in Europe.

PLUG has established itself as a leader in hydrogen fuel and renewable energy technology and looks to be well-positioned to take advantage of the growing demand for sustainable energy solutions. Investors should continue to monitor Plug Power’s expansion into Europe, as well as its overall progress in developing and improving its existing products and services.

Recent Posts