nVent Electric Reports Steady Performance with Non-GAAP EPS and Revenue Meeting Expectations

April 30, 2023

Trending News 🌥️

NVENT ($NYSE:NVT): nVent Electric, a leading provider of electrical solutions, has reported steady performance with Non-GAAP EPS and Revenue meeting expectations. The company reported Non-GAAP EPS of $0.67 and revenue of $741M, both of which were in-line with the analyst’s expectations. This is a great result for the company, as it continues to maintain its reputation for delivering reliable performance. nVent Electric is a world leader in providing electrical solutions that protect people, processes and the environment. Their broad range of products and services include enclosures, fittings, fastening and grounding products, heat tracing and power systems, ventilation solutions, and more for industrial, hazardous area, commercial, OEM and infrastructure markets.

The company’s commitment to quality and innovation has enabled them to remain competitive in an ever-changing industry. nVent Electric is committed to providing the highest quality products and services to its customers, while simultaneously creating value for its shareholders. The company’s strong financial performance is indicative of its commitment to excellence, and it is no surprise that their non-GAAP EPS and revenue numbers are meeting analyst expectations. This is a great sign for the future of the company, as well as its shareholders.

Stock Price

On Friday, NVT stock opened at $42.0 and closed at $41.9, down by 4.3% from prior closing price of 43.8. Despite the steady performance, investors reacted negatively to the results and sent the stock lower. The company is expected to report second quarter results in late July. Investors will be closely watching the company’s performance over the coming quarters to get a better sense of its prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nvent Electric. More…

| Total Revenues | Net Income | Net Margin |

| 2.91k | 399.8 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nvent Electric. More…

| Operations | Investing | Financing |

| 394.6 | -52.5 | -82.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nvent Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.9k | 2.17k | 16.52 |

Key Ratios Snapshot

Some of the financial key ratios for Nvent Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | 9.8% | 17.3% |

| FCF Margin | ROE | ROA |

| 12.0% | 11.7% | 6.4% |

Analysis

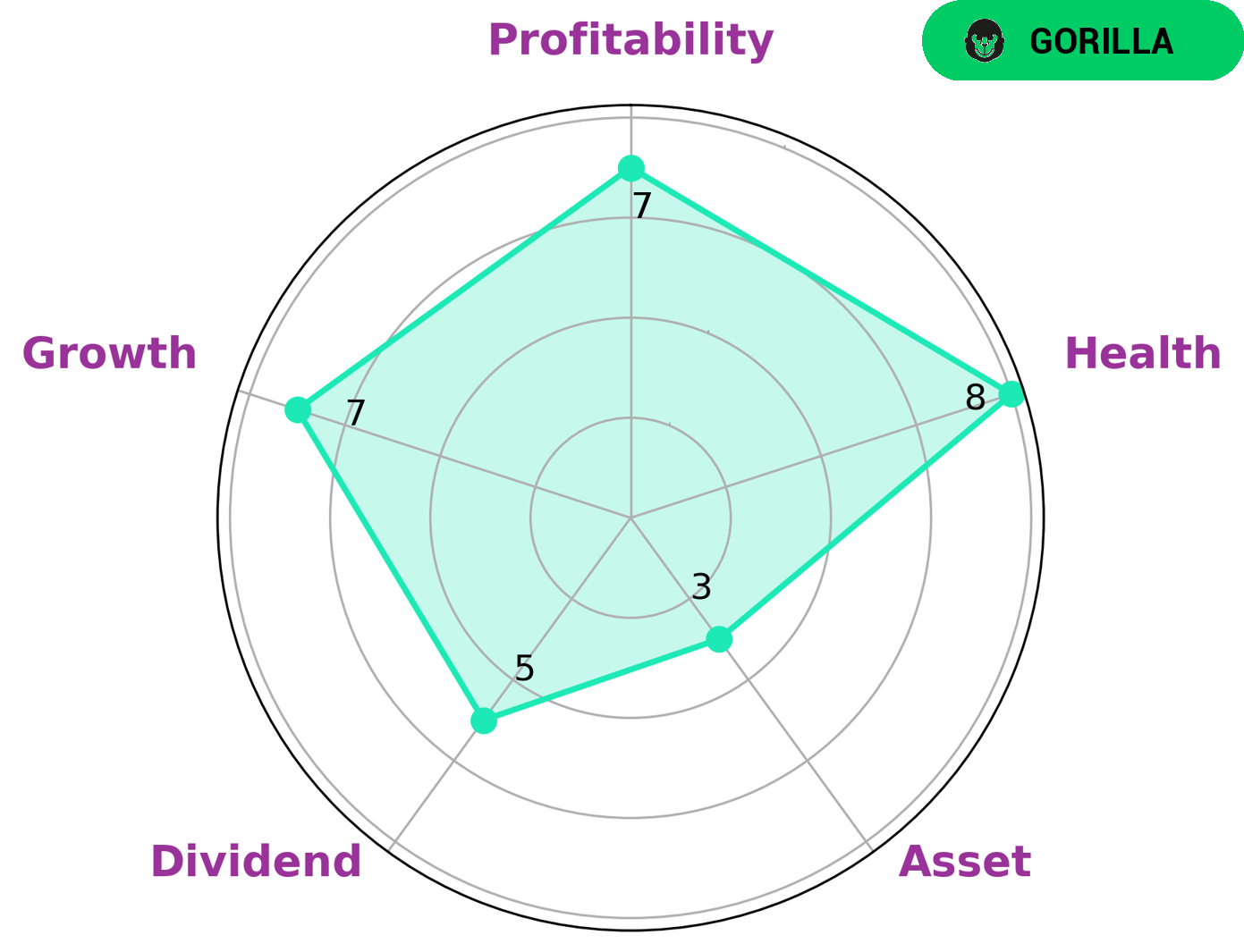

At GoodWhale, we conducted an analysis of NVENT ELECTRIC‘s wellbeing and our results show that the company is classified as a ‘gorilla’ on our Star Chart. This type of company has achieved stable and high revenue or earning growth due to its strong competitive advantage. NVENT ELECTRIC also has a high health score of 8/10 with regard to its cashflows and debt, making it a secure investment option that can safely ride out any crisis without the risk of bankruptcy. The company is strong in growth and profitability, medium in dividend, and weak in assets. This makes NVENT ELECTRIC an attractive option for investors who are looking for a combination of stability and reliable returns. Investors who believe in the company’s competitive advantage and long-term strategy may find this an attractive option for their portfolios. More…

Peers

The company operates in over 40 countries and serves a variety of customers in the commercial, industrial and utility sectors. nVent’s products and solutions include enclosures, connectors, fasteners, thermal management products, circuit breakers and switchgear. The company has a strong presence in Europe and North America, and is expanding its operations in Asia and South America. Shenzhen Genvict Technologies Co Ltd, Easun Reyrolle Ltd, and Global Electrical Technology Corp are among nVent’s major competitors.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd is a Chinese technology company that specializes in Internet of Things (IoT) solutions. The company has a market capitalization of 4.27 billion as of 2022 and a return on equity of -3.9%. The company’s products and services include IoT devices, platforms, and applications.

– Easun Reyrolle Ltd ($BSE:532751)

Easun Reyrolle Ltd is an Indian company that manufactures electrical equipment and provides engineering services. The company has a market cap of 76.99M as of 2022 and a Return on Equity of -1.46%. Easun Reyrolle Ltd is a part of the RPG Group and has its headquarters in Chennai, Tamil Nadu. The company manufactures a range of electrical products such as switchgear, power transformers, and meters. It also provides engineering services in the areas of electrical design, erection, and commissioning.

Summary

NVENT Electric is a global electrical equipment manufacturer, whose shares recently moved down upon the release of their Non-GAAP EPS and revenue results. The figures reported by the company, of $0.67 in Non-GAAP EPS and $741M in revenue, were in line with estimates. However, investors may have been expecting more, resulting in a downward shift in the stock price the same day. Going forward, investors should continue to monitor NVENT Electric’s financial performance, as well as earnings reports, to determine whether the stock price will remain stable or experience further volatility.

Recent Posts